Gonna see a bit less of your old pal Raul out there on the interwebs in the upcoming week. I have several civic duties to attend to, and it would be a selfish distraction to fritter the precious moments of the upcoming six days away on the Twitter. The city needs me.

The old crew is assembling from across the country right here in the spooky capital of america—Detroit. I have been called upon to officiate a pagan handfasting ritual. This must be done in such a way to please to gods and solidify the commitment of these two wonderful people.

I am bringing in an additional axeman to help me keep several large fires burning during the week. These will serve to cleanse the grime off the travelers and extinguish the notion of summer from our minds.

Then it is off to a most hedonistic and demonic masquerade to indulge in any and every pleasure and vice.

Perhaps I shall come out the other end of the festivities with some clarity and more kindness. Lately my only looping thought has been to make to kill. That needs to go away if I am to profitably engage these auctions.

That is my intention. To seek clarity from kindness and to integrate a polished lens into my work and hustle.

Until then, I bid thee adieu.

Raul Santos, October 9th 2022

And now the 404th Strategy Session.

Stocklabs Strategy Session: 10/10/22 – 10/14/22

I. Executive Summary

Raul’s bias score 2.50, medium bear. A little continuation selling early Monday before buyers make another push to start the week. Then look for the markets to digest FOMC minutes Wednesday afternoon, Taiwan Semiconductor earnings and CPI data Thursday morning and eventually for the market to take direction into the weekend.

II. RECAP OF THE ACTION

Solid rally through Tuesday. Some selling pressure during globex Tuesday night and into Wednesday morning. Another solid rally Wednesday. Choppy Thursday before heavy selling post non farm payroll data and into the weekend.

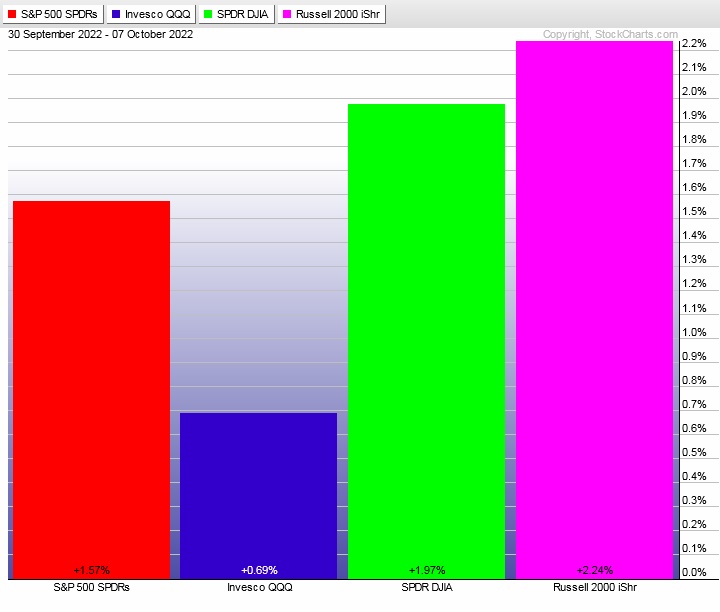

The last week performance of each major index is shown below:

Rotational Report:

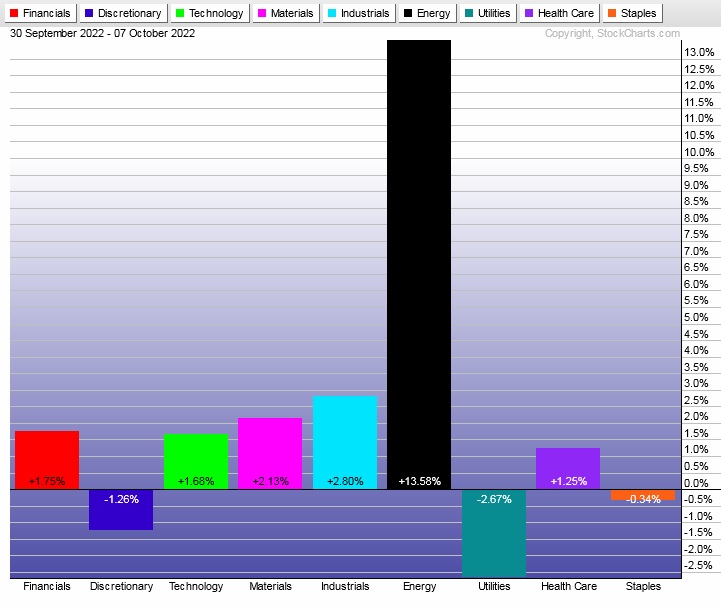

Energy trading in its own word, printing a strong week. Utilities see another week of selling while everything else sort of treads water.

neutral

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Money flows managed to skew to the buy side for the first time in several weeks, mostly driven by oil industries and materials.

neutral

Here are this week’s results:

III. Stocklabs ACADEMY

In touch with the news, out of touch with the auction

Something I’ve noticed in my own behavior during open market hours. I have become increasingly obsessed with the news flow — I could talk about any and every bit of current events from celebrity gossip to the Slavic war to who is saying what at the Federal Reserve to the latest White House actions to Elon’s every corporate action to which NFTs are holding community meetings. You name it.

Yet I couldn’t tell you where the nearby value zones are for the NASDAQ 100 or whether the Russell is demonstrating relative strength or how the internals are looking on the NYSE.

I’ve managed to allow my attention to become obsessed with the wrong information. Going to really dial back my screen time, especially on the mobile device, this week.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for buyers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

A little continuation selling early Monday before buyers make another push to start the week. Then look for the markets to digest FOMC minutes Wednesday afternoon, Taiwan Semiconductor earnings and CPI data Thursday morning and eventually for the market to take direction into the weekend.

Bias Book:

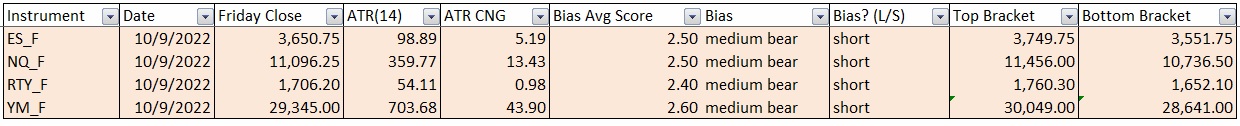

Here are the bias trades and price levels for this week:

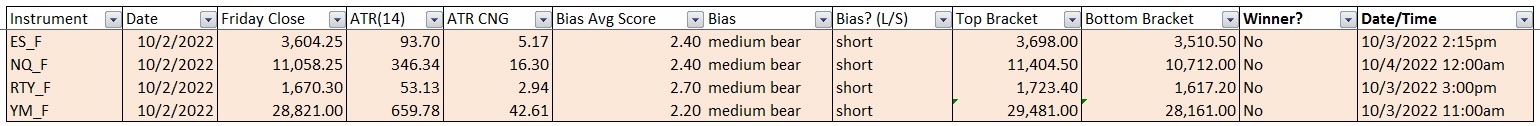

Here are last week’s bias trade results:

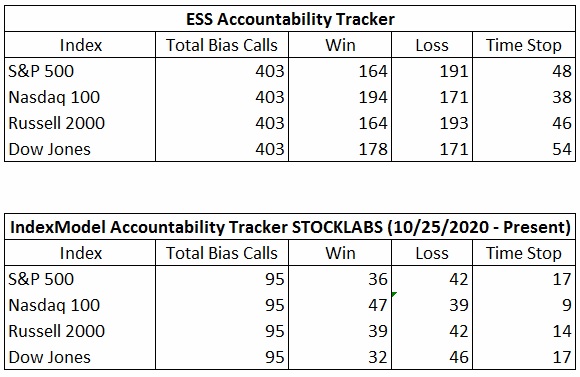

Bias Book Performance [11/17/2014-Present]:

Ether steady the others weak

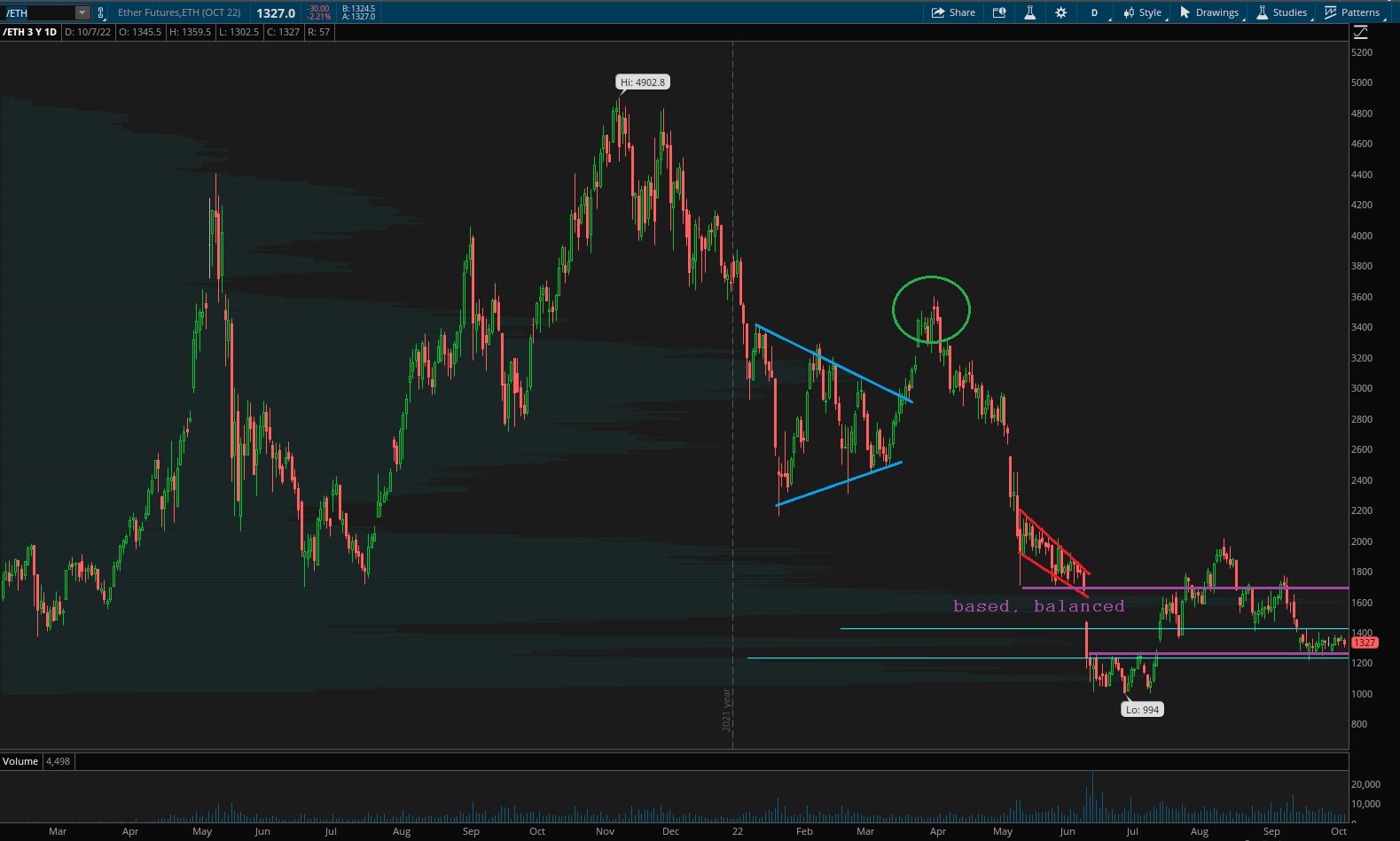

Readers are encouraged to apply these techniques to all markets. Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum

Transports started to build another weak low last week. Maybe it will hold for the short term, but it certainly is not the type of low we want to move away from for any substantial amount of time.

See below:

Semiconductors look to be discovery down for a second week. The $TSM earnings due out Wednesday could stabilize this otherwise downward descending index.

Ether balancing out and holding steady, decoupling a bit from equities.

V. INDEX MODEL

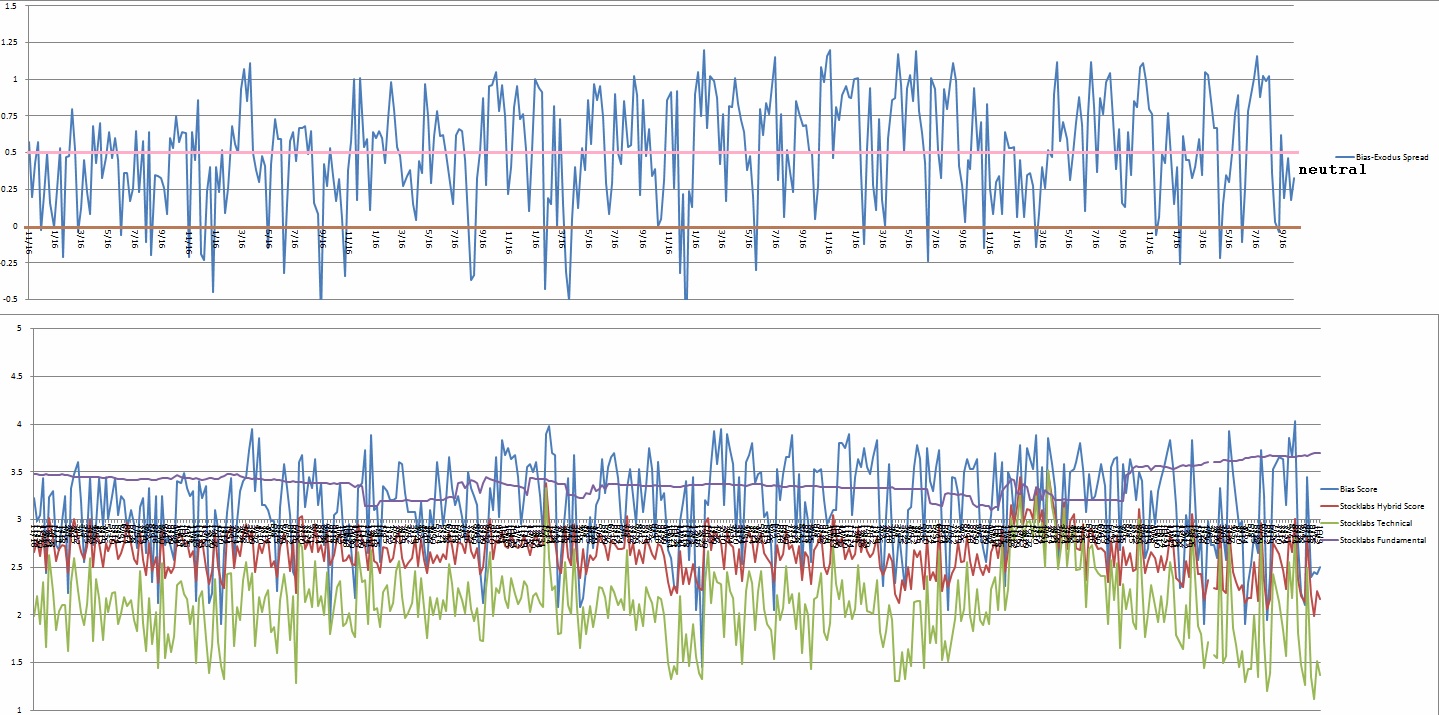

Bias model is neutral heading into the first week of the fourth quarter. The fourth consecutive neutral reading. No bias.

There were five Bunker Busters in recent history — five weeks ago, fourteen weeks back, twenty-one weeks ago, thirty-four reports back and thirty six reports back.

Here is the current spread:

VI. 12 month hybrid oversold

On Friday, September 23rd Stocklabs went hybrid oversold on the 12 month algo. This is a bullish cycle that runs through October 7th, end of day. Here is the final performance of each major index. Interesting how the Russell outperformed during this cycle:

VII. QUOTE OF THE WEEK:

“When life seems hard, the courageous do not lie down and accept defeat; instead they are all the more determined to struggle for a better future.” – Queen Elizabeth II

Trade simple, keep going

If you enjoy the content at iBankCoin, please follow us on Twitter