Not sure what to say. I’ve been having a heck of a time keeping my impulses in check. There are bunnies everywhere and pregnant mommas looking all delicious. I need to focus.

Last week I flipped bullish too soon and took some heat.

Elon joining the board at Twitter is good news for humanity. The top dog at New York Times telling his wordcels to limit their Twitter use is like kicking the tide. Won’t change a thing.

The days of centralized information are iffy. As are fiat currencies. As is life, if I may be so boldt.

But there is hope. There are giant giga factories pumping out fancy cars everyone wants.

There are signs of life from the frozen soils up here in the murder mitten.

It looks like we might just make it.

But first we have to wade through bank earnings next week.

Then comes the big miracle and who knows, maybe the goblins will go back in their caves and the futurists will regain control.

It seems like we’re right on the brink of busting through the fear and uncertainty.

Don’t fight the fed. Sure. But there are fine equities out there that anyone with a decent grasp of what is to come will want to own.

GOOGLE. TESLA. TWITTER. And so on.

Bearish into Monday. Then CPI. Then we don’t know.

Okay for now,

Raul Santos, April 10th 2022

And now the 381st edition of Strategy Session. Enjoy.

Stocklabs Strategy Session: 04/11/22 – 04/15/22

I. Executive Summary

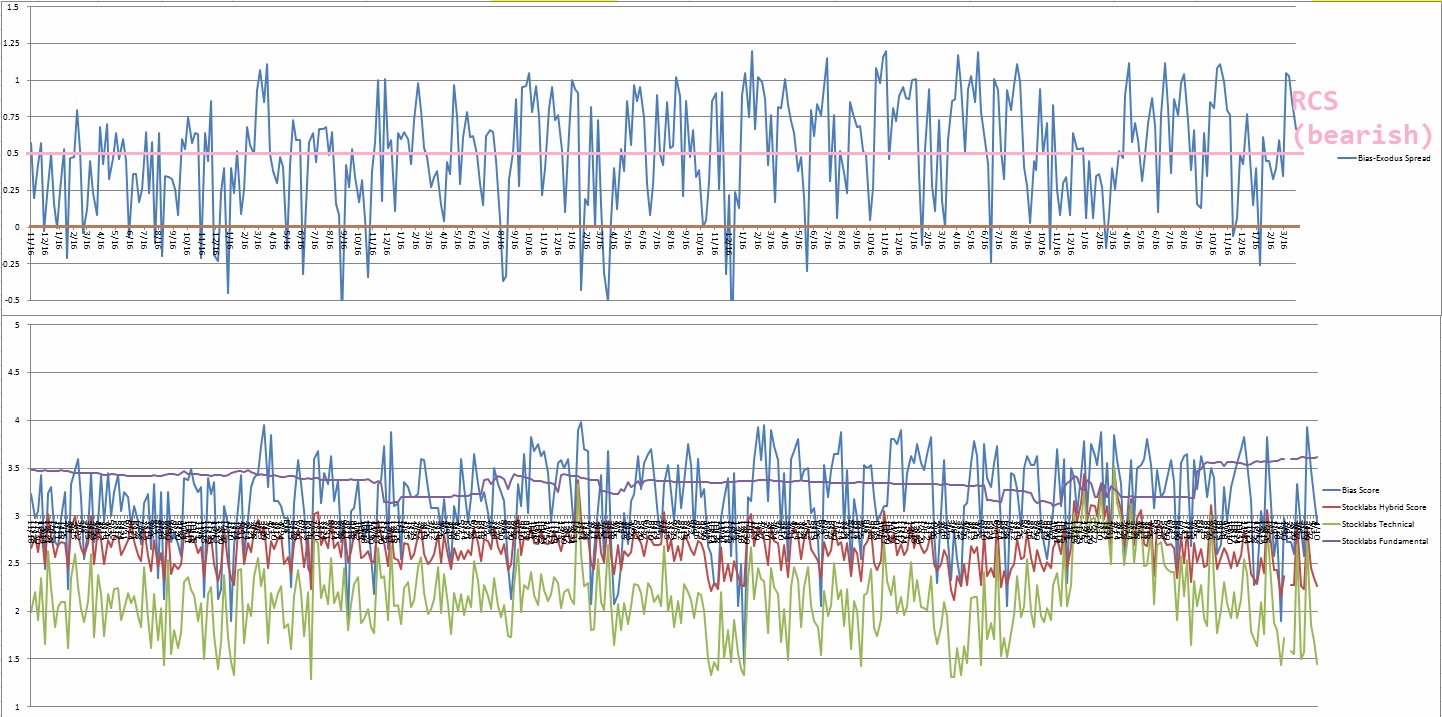

Raul’s bias score 2.93, neutral*. Sellers continue to pressure the tape lower Monday. Then watch for CPI data out Tuesday morning to either accelerate the selling or reverse the tape higher. Thursday morning several major banks along with Taiwan semiconductors are set to report earnings and could increase volatility.

U.S. markets are closed Friday in observation of Good Friday.

*Rose Colored Sunglasses [RCS] bearish bias triggered, see Section V.

II. RECAP OF THE ACTION

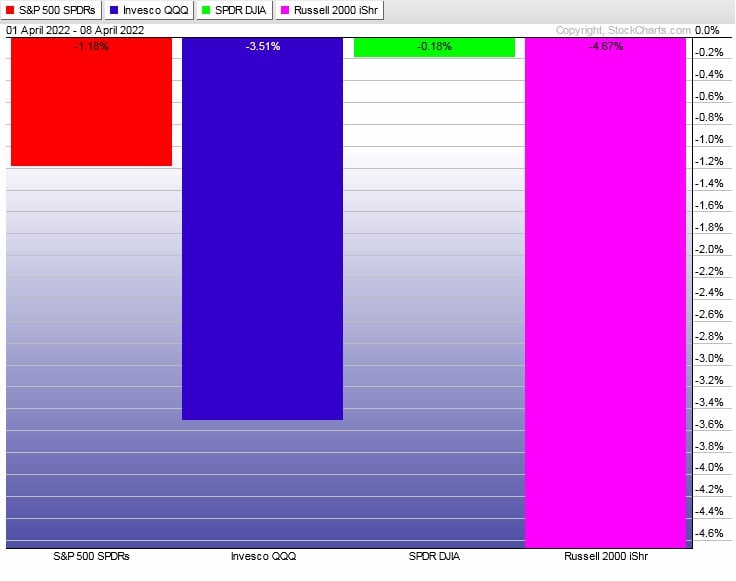

Rally Monday. Erased Tuesday. Strong continuation selling Wednesday followed by chop into the weekend. Tech-heavy NASDAQ divergent weakness into the weekly close.

The last week performance of each major index is shown below:

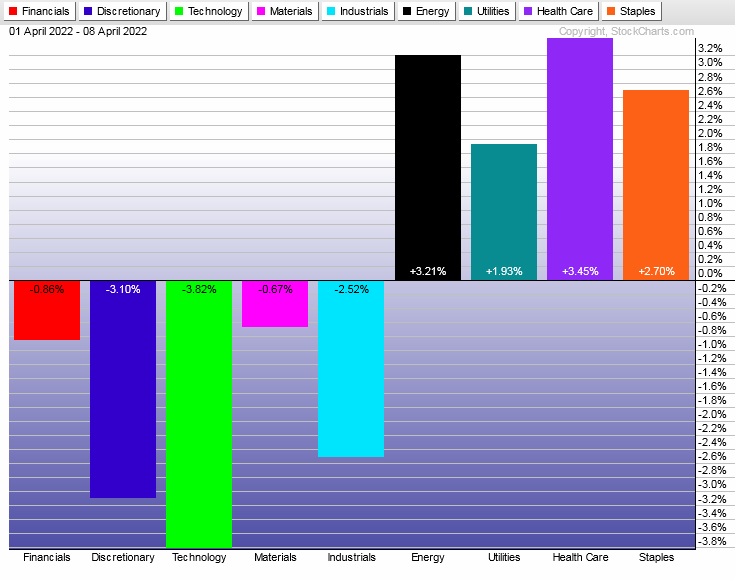

Rotational Report:

Third consecutive week of bleak rotations. Utilities and Staples strong suggests investors remain risk averse. Energy and Healthcare did okay.

After three weeks in a row of bearish rotations one begins to wonder if a strong set of rotations is lurking on the horizon.

slightly bearish

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Bulls took back control of money flows four weeks back after sixteen weeks dominated by sellers, dating back to mid-November.

But last week sellers negated that control. Bulls need to produce something major in the holiday-shortened week, otherwise this indicator is back to being bearish.

bearish

Here are this week’s results:

III. Stocklabs ACADEMY

Pressing any bets in this market is risky

While most signals point bearish heading into next week. Bears have already covered decent ground. Markets do not seem to be rewarding pressing bets in either direction. With lots of economic data and earnings on the slate for next week, and the upcoming holiday, while indicators are pinned bearish I am hesitant to press shorts much longer. Perhaps through Monday afternoon at most.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for buyers

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Sellers continue to pressure the tape lower Monday. Then watch for CPI data out Tuesday morning to either accelerate the selling or reverse the tape higher. Thursday morning several major banks along with Taiwan semiconductors are set to report earnings and could increase volatility.

Bias Book:

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

Bias Book Performance [11/17/2014-Present]:

Transports on the verge of breakdown

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum. Readers are encouraged to apply these techniques to all markets.

Transports appear to be down below their well-established range. Often times just when these balances seem poised to break, price snaps back in the other direction. It is a challenging spot to have much conviction. However, the behavior of this contextual chart ought to give us some clarity on what we see next week in the major indices.

See below:

Semiconductors lost the pivot and accelerated lower, but still appear to be in balance.

Ether still appears to be in a small discovery up phase within a higher time frame balance.

V. INDEX MODEL

Bias model is rose colored sunglasses bearish for a second consecutive week after two consecutive weeks of extreme RCS bullishness. This is a bearish signal that expects sellers to control the tape for much of the week.

We were Bunker Buster eleven reports back. This is the second Bunker Buster in recent history, with the previous one being nineteen reports back. The Bunker Buster before these recent two was fifty-seven weeks ago.

Rose Colored Sunglasses calls sellers to pressure the tape lower throughout much of the week.

Here is the current spread:

VI. QUOTE OF THE WEEK:

“You can’t really be strong until you see a funny side to things.” – Ken Kesey

Trade simple, enjoy the process

If you enjoy the content at iBankCoin, please follow us on Twitter