Not going to sugar coat it lads, things are looking pretty bleak in the old equity complex.

I went over last week’s data to see if any minor adjustments that may have occurred from having quality raw data instead of k-mart data would have signaled the short last Sunday. It doesn’t seem likely to model would have caught the down move.

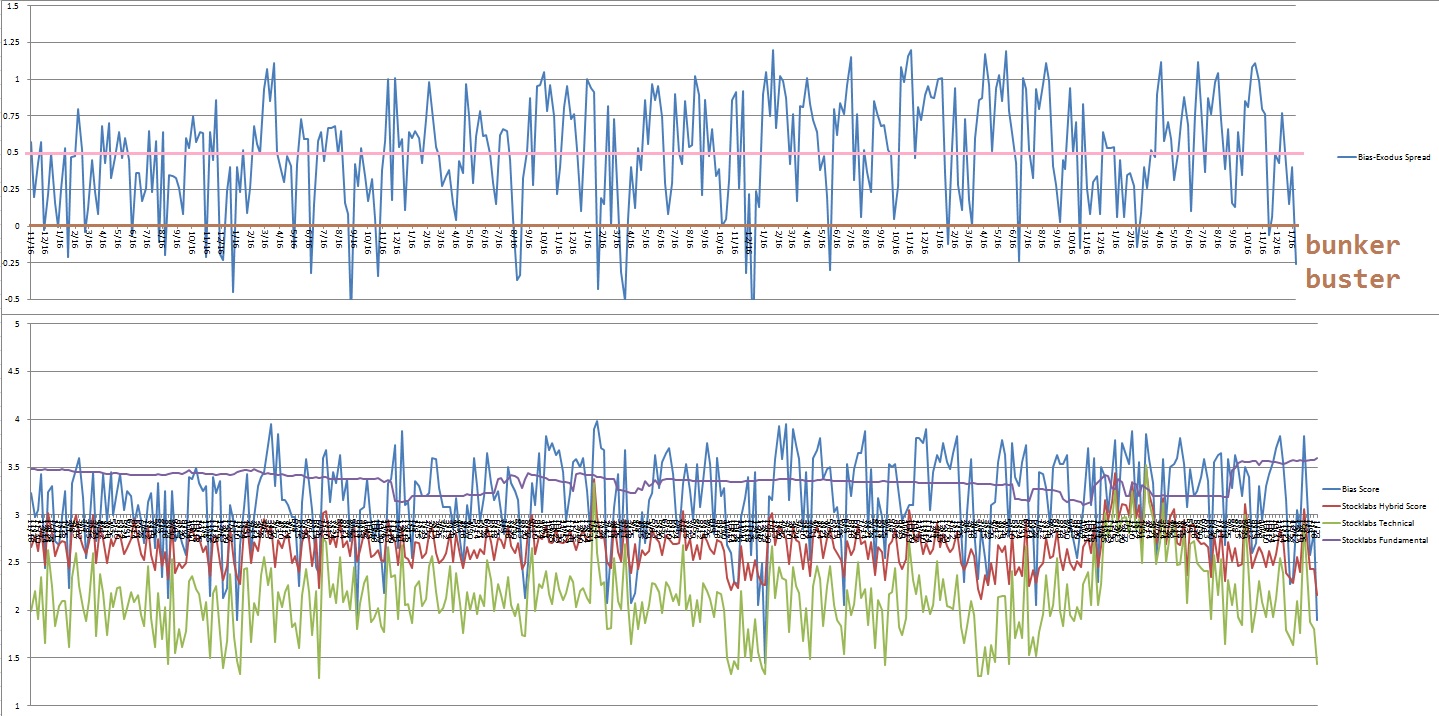

The model is signalling Bunker Buster again. If you recall, we had one of these eight weeks ago. When they happen in close proximity of each-other like this that is a bit of a red flag.

There are other technical red flags but we won’t get into them here. Read the Strategy Session if you want to see everything I am looking at.

The real red flag is my emotional state. I am thriving right now. Winter has finally made its way into the north and it is doing wonders for my bones. I am toiling and doing gymnastics and going to the bath houses and disco raves. I’ve been doing my business in the woods like a bear and drinking hootch. It just seems like if we were really close to a bottom I would be feeling a bit more despair.

Michigan is an interesting place. We have these radical political polar opposites. Speaking with commoners of these lands yields a common thread — civil war is imminent. The lefties think it as much as the righties. I blame cable news. I don’t ever let that toxic bull shit enter my perceptual lens.

The truth is, I’ve already made it. On a fluke I bought a modest single family home in 2010 pretty close to the generational bottom in housing. Then I retired from corporate finance and found my footing as a full-time speculator. After that I learned how to grow a decent amount of my food. I know how to make beer (but I don’t right now — too busy). I have farms. Plurl. Elder Raul has a cabin in the woods I can bug out to if the city goes haywire.

I am building a complex in the city that ten trucks full of bugaloo butt clowns couldn’t breach with a full detail of assaulting rifles and rpgs. So I make my way through the world carefree and easy. On top of all of this, I am terribly good looking and folks just heckin’ like me.

Like I can disarm most situations with the power of word. And when I can’t daddy-o I can run a 4.6 second 40 yard dash and parkour my way to safety.

I can dig a hole as strongly as anyone.

At some point one has to choose freedom. This country offers it. This is the best country in the world man don’t let those fear mongering doche bags twist your mind up.

With that freedom comes responsibility. For the common man. Does that mean dying on a hill because you’re suddenly an observer of some 20-something-year old losers acting a fool? Maybe chivalry is needed. Most of the time it isn’t.

Choose your battles.

Or chose not to battle. Just build compounds and if the bandits manage to breach your fortifications, let them take the compound and go live under a bridge somewhere near a national forest.

It really is that simple lads.

But yes, markets are looking dicey. I’ll look to add some long exposure during the week but the fucking Matterhorn is not on my buy list. I am buying quality. Microsoft. Google. Tesla. COSTCO. Berkshire. WALLED MART.

Have you ever played Monopoly? Only one person wins.

Okay for now,

Raul Santos, January 23rd 2022

And now the 373rd edition of Strategy Session.

Stocklabs Strategy Session: 01/24/22 – 01/28/22

I. Executive Summary

Raul’s bias score 1.83, STRONG BEAR*. Sellers continue to pressure the tape. Watch for a strong buyer response at some point during the week. This could mark a tradable low into the next few weeks. Possible catalysts for a reversal — Big Tech earnings Tuesday-Thursday (MSFT, TSLA, AAPL) or Fed rate decision/press conference Wednesday.

*Index Model signaled Bunker Buster, see Section V.

II. RECAP OF THE ACTION

Gap down Tuesday into the holiday-shortened week. Sellers defended the gap zone through Thursday then accelerated to the downside Thursday afternoon. Reflexive rally early Friday was overrun by sellers who continued to pressure the tape into the weekend.

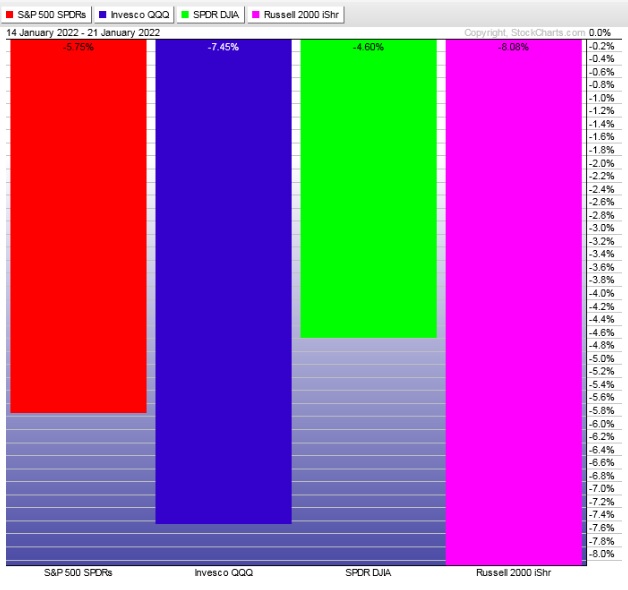

The last week performance of each major index is shown below:

Rotational Report:

Full-on risk off rotation out of the equity complex.

Bearish (but also nearing extremes that could be considered bullish)

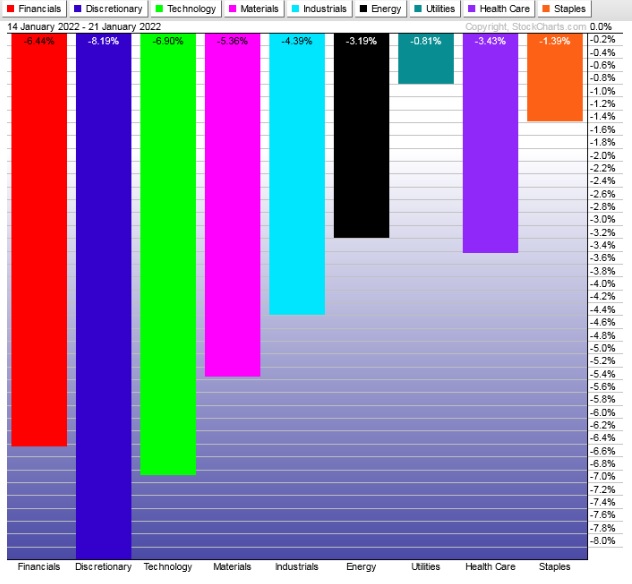

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

The selling skews over the last ten weeks have been dominated by sellers. Sellers logged another massive ledger print. Bull need to do something major to turn these tides.

bearish

Here are this week’s results:

III. Stocklabs ACADEMY

Holiday pivot LOWER

Well we seemed to have pivoted off the holiday to the downside. Perhaps this is the start (middle?) of capitulation we need to see to form a low. The selling prior to last week had been methodical, under the surface, and only hitting certain sectors.

For now sellers are in control.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for buyers

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Sellers continue to pressure the tape. Watch for a strong buyer response at some point during the week. This could mark a tradable low into the next few weeks. Possible catalysts for a reversal — Big Tech earnings Tuesday-Thursday (MSFT, TSLA, AAPL) or Fed rate decision/press conference Wednesday.

Bias Book:

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

Bias Book Performance [11/17/2014-Present]:

PHLX confirms the failed auction

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break in balance, the more order flow energy to push the discovery phase.

Market are most often in balance.

Every week this newsletter uses auction theory to monitor three instruments, the Nasdaq Transportation Index, PHLX Semiconductor Index and ethereum. Readers are encouraged to apply these techniques to all markets.

Transports broke compression to the downside. Now this chart appears to be in discovery down. Perhaps we find a new, wider range sometime in the future.

See below:

Semiconductors confirmed the failed auction when we made a hard move away from the failure wick last week. This is a troubling set up as semiconductors are been the driver of our entire secular bull market for the last few years. A failure here could set up many quarters of bearishness. As always, we’ll take it one week at a time.

Ether still has the discovery down look.

V. INDEX MODEL

Bias model is Bunker Buster heading into month-end. This is the second Bunker Buster in recent history, with the previous one being eight reports back. The Bunker Buster before these recent two was forty six weeks ago.

Bunker Buster calls for an acceleration to the downside and an eventual formation of a tradable low.

Here is the current spread:

VI. 3 month Hybrid Oversold

On Thursday, January 13th Stocklabs went hybrid oversold on the 3-month algo. This is a bullish cycle that ends Friday, January 28th end-of-day. Here is the performance of each major index so far:

VII. QUOTE OF THE WEEK:

“A person who thinks all the time has nothing to think about except thoughts, so he loses touch with reality and lives in a world of illusions.” – Alan Watts

Trade simple, think slow, move fast

If you enjoy the content at iBankCoin, please follow us on Twitter

Good Thoughts!