NASDAQ futures are coming into the second-to-last day in November up a quick +180 after an overnight session featuring extreme range and volume. Price drove higher Sunday evening and then balanced for several hours, balancing along the upper quadrant of Friday’s range. As we approach cash open price is hovering along the overnight high.

On the economic calendar today we have pending home sales at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

Last week we saw an early Monday rally to record highs faded aggressively the rest of the day. Then continuation selling Tuesday. Relief rally Wednesday (into Thanksgiving). Covid-variant news hits tape very early Friday morning and price trended lower into the weekend.

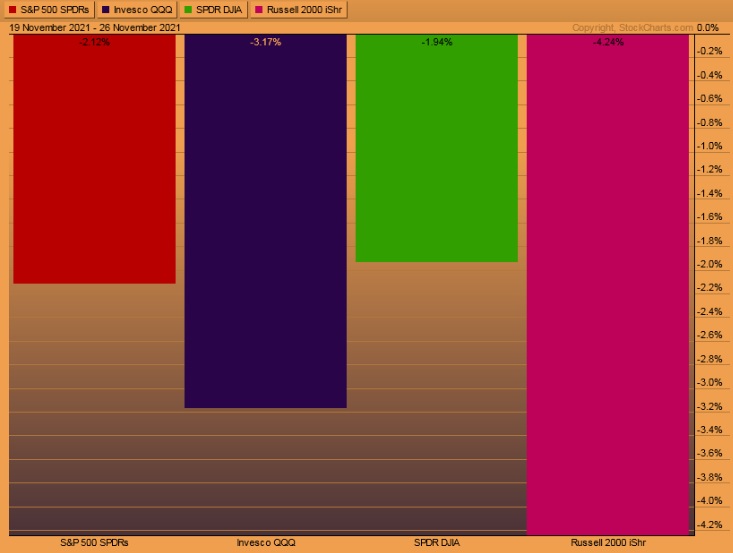

The last week performance of each major index is shown below:

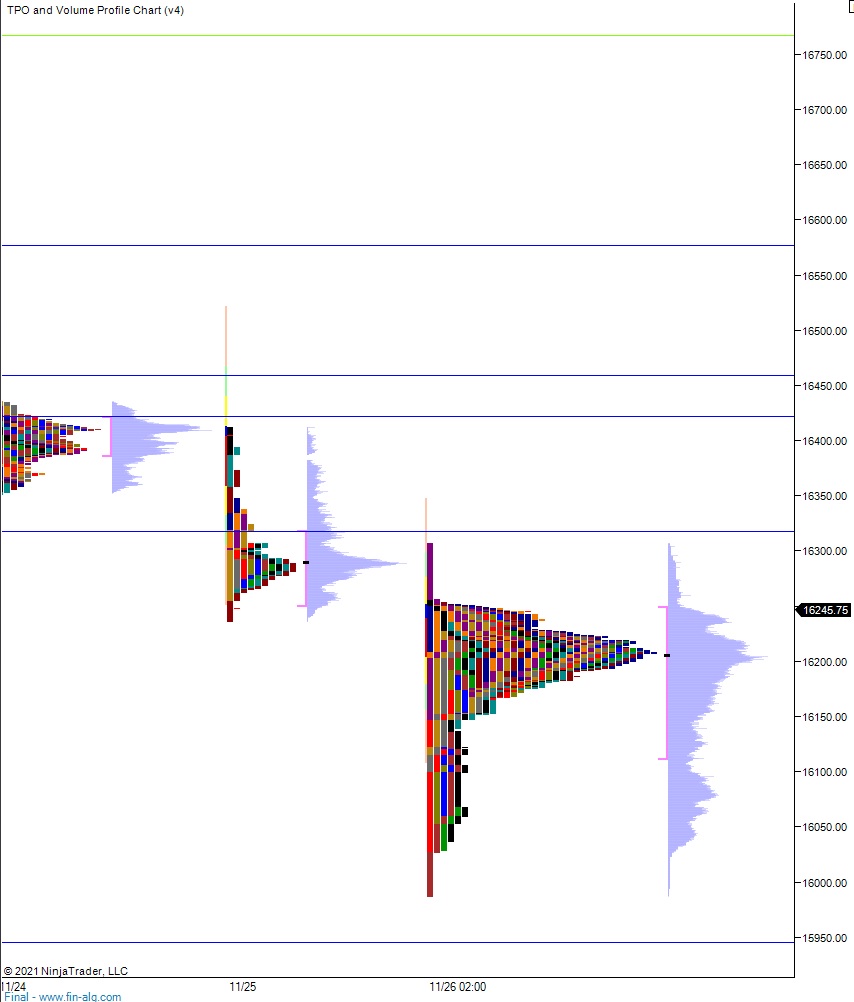

On Friday the NASDAQ printed a trend down. The day began with a gap down into the Wednesday midpoint. After a test higher failed to close the overnight gap sellers stepped in and began driving lower, effectively taking out the weekly lows by about 11am. Then there was a brief bounce before sellers continued pressing the tape lower, effectively closing us on the lows during the shortened holiday session.

Heading into today my primary expectation is for buyers to gap-and-go higher, tagging the omicron gap up at 16,358.50 before two way trade ensues.

Hypo 2 buyers stall out around 16,300 and two way trade ensues.

Hypo 3 sellers press down to 16,100 before two way trade ensues.

Levels:

Volume profiles, gaps and measures moves: