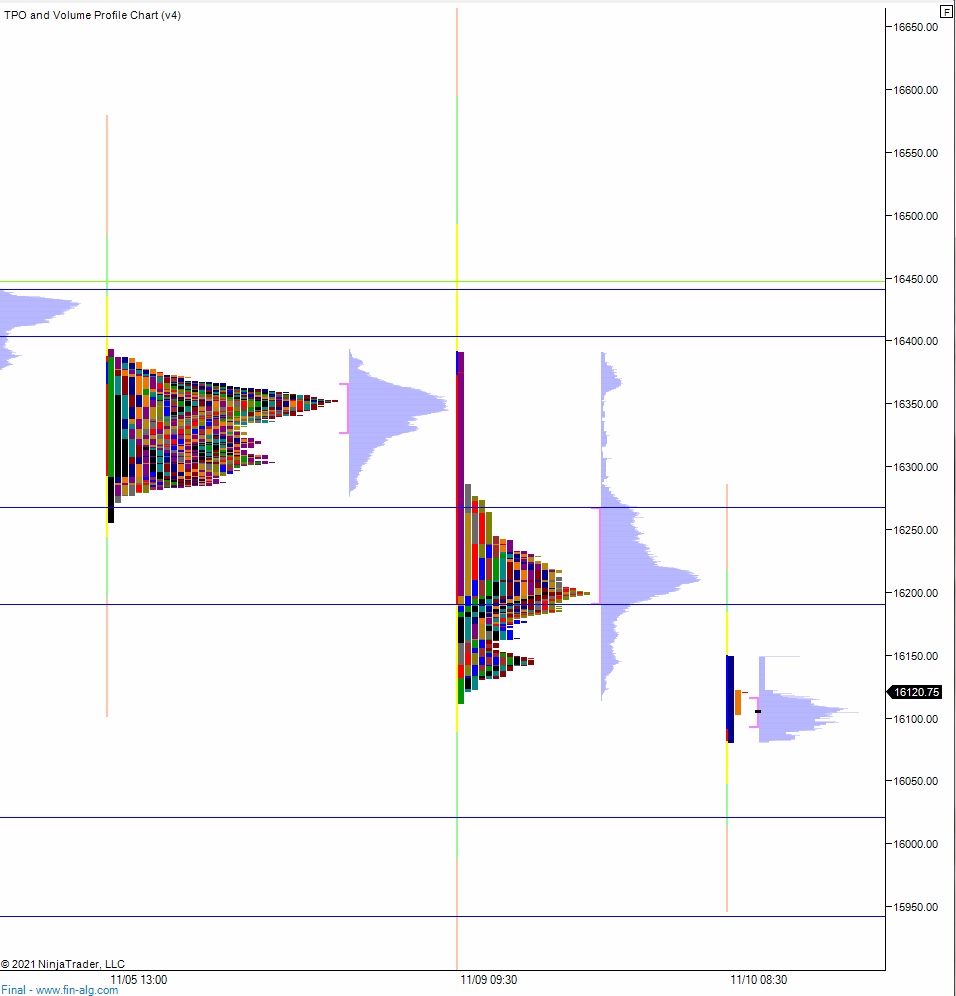

NASDAQ futures are coming into Wednesday down a quick -100 after an overnight session featuring extreme range and volume. Price was choppy but balanced overnight. Around 9pm we took out the overnight low before making a sharp rotation higher, then lower. At 8:30am CPI data came out higher than expected, as did jobless claims. This introduced some sellers to the tape, and as we approach cash open price is hovering in the upper quadrant of last Wednesday’s range.

Also on the economic calendar today we have crude oil inventories at 10:30am followed by 4- and 8-week T-bill auctions at 11:30am. There is a 30-year bond auction at 1pm followed by a Treasury statement at 2pm.

Yesterday we printed a normal variation down. The day began with a gap up in range. After a brief open two way auction sellers stepped in and drove lower, driving down into the gap fill and continuing to drive down through the Monday low. Buyers stepped in ahead of the Friday low and nearly worked price back up to the daily midpoint. Sellers defended the mid, twice eventually setting up a new daily low. Sellers could not take out the Friday low however, and we spent the end of the session chopping along the low.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 16,203.75 before two way trade ensues.

Hypo 2 stronger buyers trade up to 16,267.50 before two way trade ensues.

Hypo 3 sellers press down to 16,200 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: