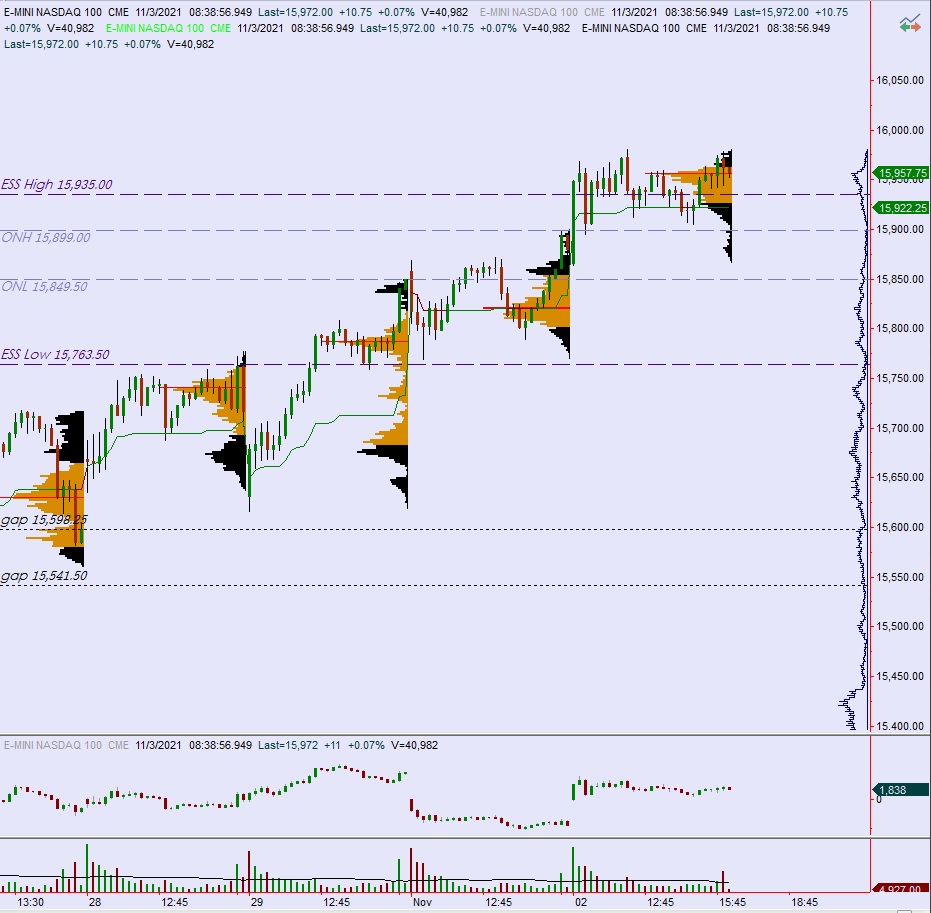

NASDAQ futures are coming into Wednesday with a slight gap up after an overnight session featuring normal range and volume. Price was balanced overnight, balancing along the upper half of Tuesday’s range. At 8:15am ADP employment data came out slightly better than expected, and as we approach cash open price is hovering up near the Tuesday high.

Also on the economic calendar today we have factory orders and ISM service index at 10am, crude oil inventories at 10:30am and the fomc announcement at 2pm followed by the 2:30pm Fed presser.

Yesterday we printed a normal variation up. The day began with a slight gap down in range. Buyers resolved the gap with a drive up. Said drive took price to a new all-time high. Sellers then worked price back to the midpoint, which aligned with the Monday high. Buyers defended here and we slowly worked to a range extension up around lunchtime. Price bounced along the mid for a few hours before ramping back to the highs during the close.

Heading into today my primary expectation is for sellers to gap fill down to 15,957.75 and then for tight chop between 15,950 and 16,000. Then look for the third reaction to the fomc announcement to dictate direction into the second half of the day.

Hypo 2 buyers gap-and-go, sustaining trade above 16,000 to set up a run to 16,050. Then look for the third reaction to the fomc announcement to dictate direction into the second half of the day.

Hypo 3 sellers press down through overnight low 15,937.75 setting up a tag of 15,900. Then look for the third reaction to the fomc announcement to dictate direction into the second half of the day.

Levels:

Volume profiles, gaps and measured moves: