NASDAQ futures are coming into Wednesday with a slight gap up after an overnight session featuring elevated range on extreme volume. Price was balanced overnight, balancing along the lower half of Tuesday’s range. Major NASDAQ components Microsoft and Alphabet are +2% and -0.5% respectively in premarket trade after reporting earnings Tuesday night. At 8:30am durable goods orders came out in-line with expectations, and as we approach cash open price is hovering about -35 points below the Tuesday midpoint.

There are no other high importance organizations reporting earnings today.

Also on the economic calendar today we have crude oil inventories at 10:30am followed by a 2-year note auction at 11:30am and a 5-year note auction at 1pm.

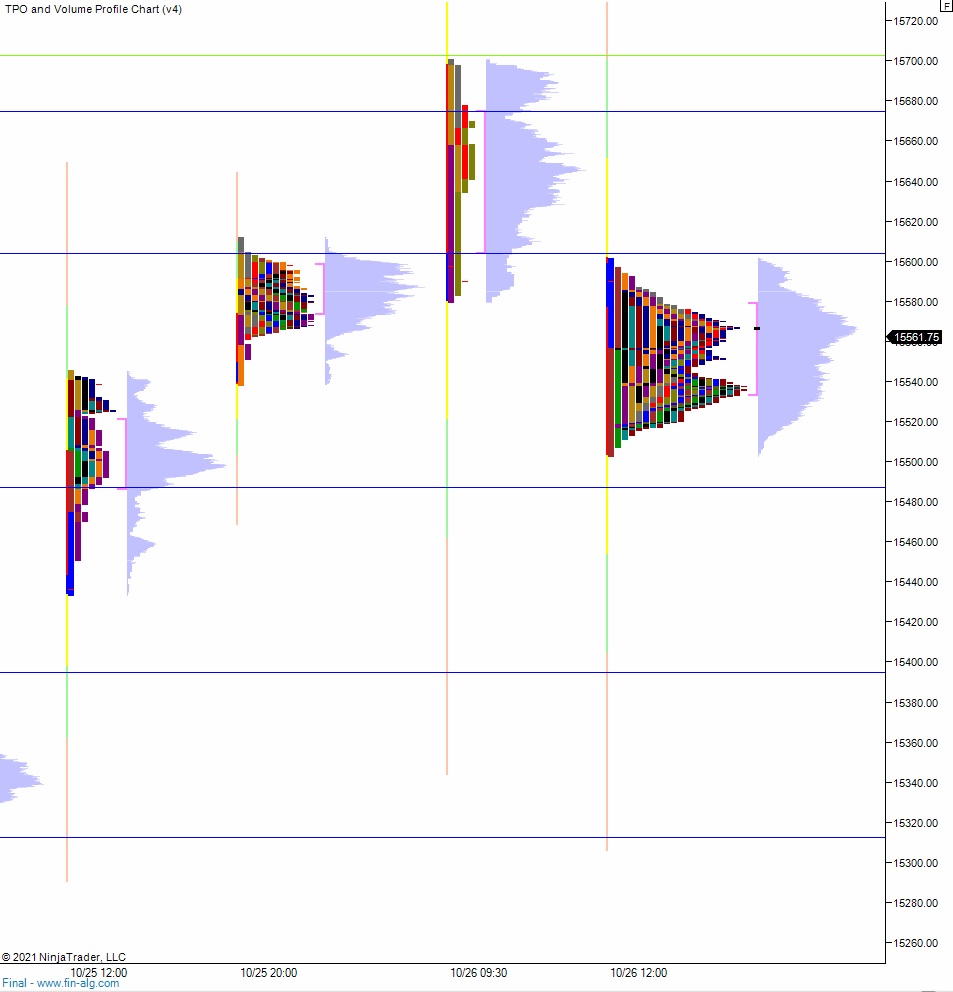

Yesterday we printed a normal variation down. The day began with a pro gap up. Buyers drove into the gap up, working price nearly to all-time high within the first hour of trade. Price stalled 0.50 points away from taking out the high and before the market could go range extension up sellers stepped in. They reclaimed the mid and they closed the overnight gap. We spent the rest of the session chopping in the lower quadrant of range, sort of in the gap zone.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 15,541.50. Sellers continue lower, down through overnight low 15,507.25 before two way trade ensues.

Hypo 2 buyers press up through overnight high 15,592.75 and tag 15,603.75.

Hypo 3 stronger buyers rally price up to 15,674.25.

Levels:

Volume profiles, gaps and measured moves: