I think we can all agree the entire notion of a nation having power over the global economy is being rapidly forgotten by the collective consciousness of western minds.

There are edge cases. Rural outcasts mostly. People who will lose a fortune long DWAC as it craters into the single digits. Folks who desperately cling to an archaic ethos long after the music has stopped. But prevailing sentiment and thus the hearts and minds of our children and grand childeren recognize these to be the true leaders of Earth:

Things have certainly become more fragmented. Decentralized, if you will. Uniting the people under the banner of one fairy tale worked for hundreds of year after the Romans lost their grip on Europe. That formula even held up into the New World for a few hundred years thanks to fake history.

But then the internet came along. Pandora’s box was opened. The gatekeepers of information were rendered obsolete and now pirates and profiteers reign supreme in the high seas of the interwebs.

Or metaverse, if you prefer.

Lads I was here for all of it. The serendipitous birthright of anyone who hit the jackpot and was born into the mid 1980s. After all the bleak crack stuff and crony corporatism gutted our inner cities but before the cellular telephone or even caller ID. I took a front seat to the greatest enlightenment period humankind has ever experienced. An enlightenment that is still happening now.

Thanks to brave lads like Steve Jobs (RIP). Trail blazers who said FUCK YOU RONALD REGAN, we’re taking LSD and building time machines. Thanks to these code-typing rebels the mold was broken. Lines on a map man. The borders are in your mind.

Not mine.

I swear allegiance to no nation or its leaders. The only political leader worthy of any reverence is Treasury Secretary Yellen. And even hers is more-and-more digressing into something more ceremonial. Like Buckingham Palace.

What is happening now. Today. At this very moment. There are no more days off. In this very moment thousands of protocols are vying for power. Who is going to win?

We don’t know.

Okay for now.

Raul Santos, October 24th 2021

And now the 361st strategy session. Enjoy:

Stocklabs Strategy Session: 10/25/21 – 10/29/21

I. Executive Summary

Raul’s bias score 3.55, medium bull*. Choppy Monday. Then look for price rally all week long, fueled by earnings from Big Tech.

Facebook Monday. Microsoft, Alphabet (Google) and Twitter Tuesday. Apple and Amazon Thursday. All reports due out after the bell.

*extreme Rose Colored Sunglasses bullish bias triggered, see Section V.

II. RECAP OF THE ACTION

Trend up Monday. Continuation Tuesday. Choppy for the rest of the week.

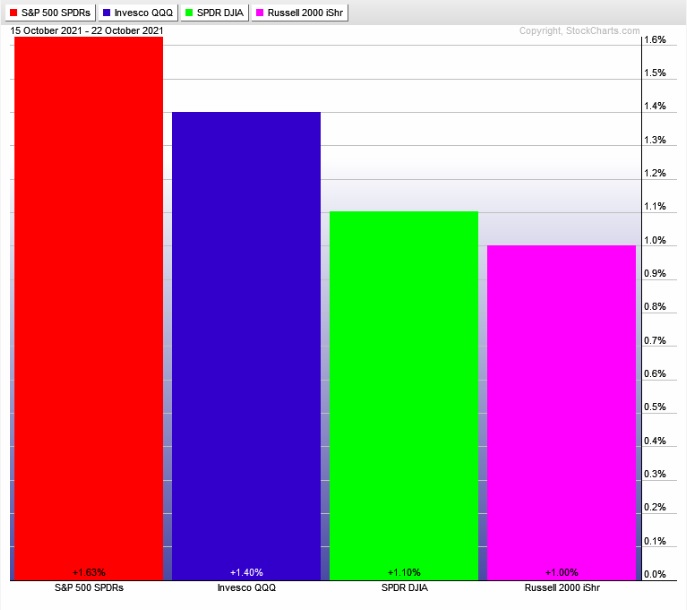

The last week performance of each major index is shown below:

Rotational Report:

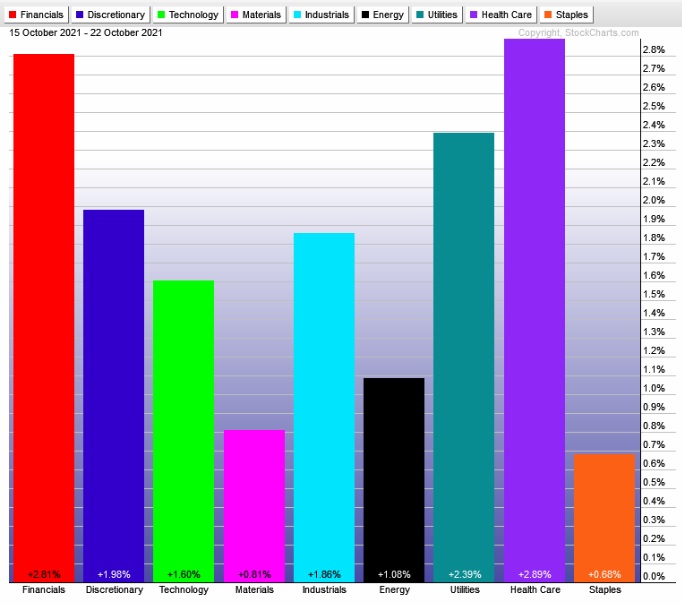

Super low quality leadership last week. Perhaps Tech will assume leadership in the coming week.

neutral

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Eight weeks back we had a major bullish skew that was never negated. Then last week we had another major bullish skew.

bullish

Here are this week’s results:

III. Stocklabs ACADEMY

Indexmodel might need to go in for maintenance

I was eyeballing recent data. Via the oscillator I keep on a spreadsheet. And it seems like the thresholds may need a tweaking.

I do not like ‘moving the goal posts’ on an algorithm/model. There is a risk of curve fitting the system to past performance when these types of tweaks are made. That is why I do not react quickly to oddities in the data.

Part of me expected to see a Bunker Buster signal during the September/October dip. That never happened. Which is fine.

But these RCS bearish signals. That may need to be addressed. They pose a risk to my performance.

I shall ponder making these tweaks into year-end. For now the model remains unchanged.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for buyers

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Choppy Monday. Then look for price rally all week long, fueled by earnings from Big Tech.

Bias Book:

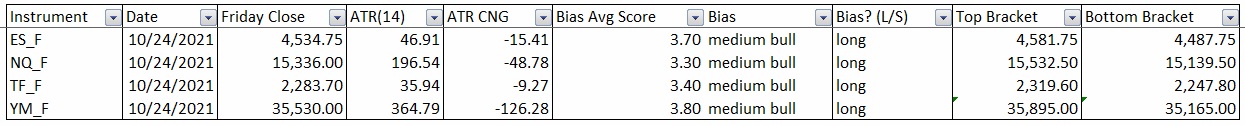

Here are the bias trades and price levels for this week:

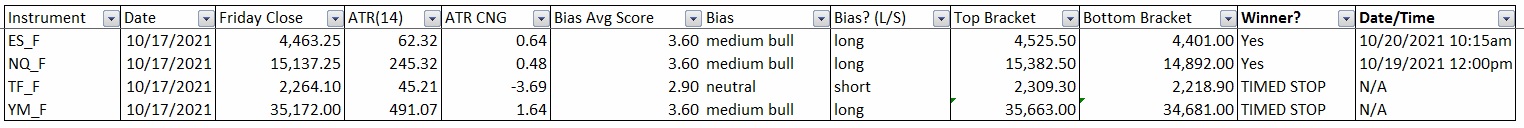

Here are last week’s bias trade results:

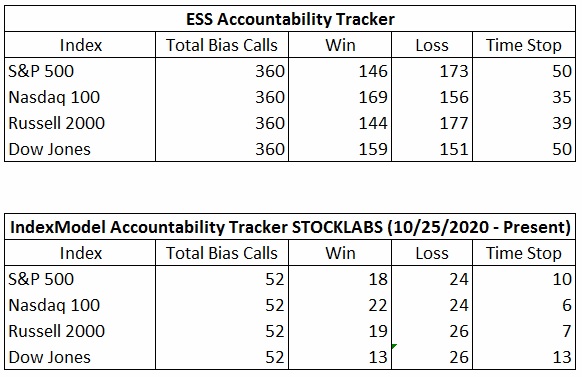

Bias Book Performance [11/17/2014-Present]:

Overplay for the underlay

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports are in a steep discovery up. I expect buyers to continue to explore higher prices in the coming week.

See below:

Semiconductors more-and-more appear to be setting up the ‘overplay for the underlay’. What this set-up essentially equates to is a super-obvious chart setup (rising wedge) breaks lower. All of the technical analysis textbooks say this is a bearish set up. So it breaks lower. Some buyers liquidate their longs. Some short sellers position for further downside.

Then price rips up beyond the wedge and explores higher prices.

My primary expectation is that the PHLX semiconductor index is set up for an overplay for the underlay.

V. INDEX MODEL

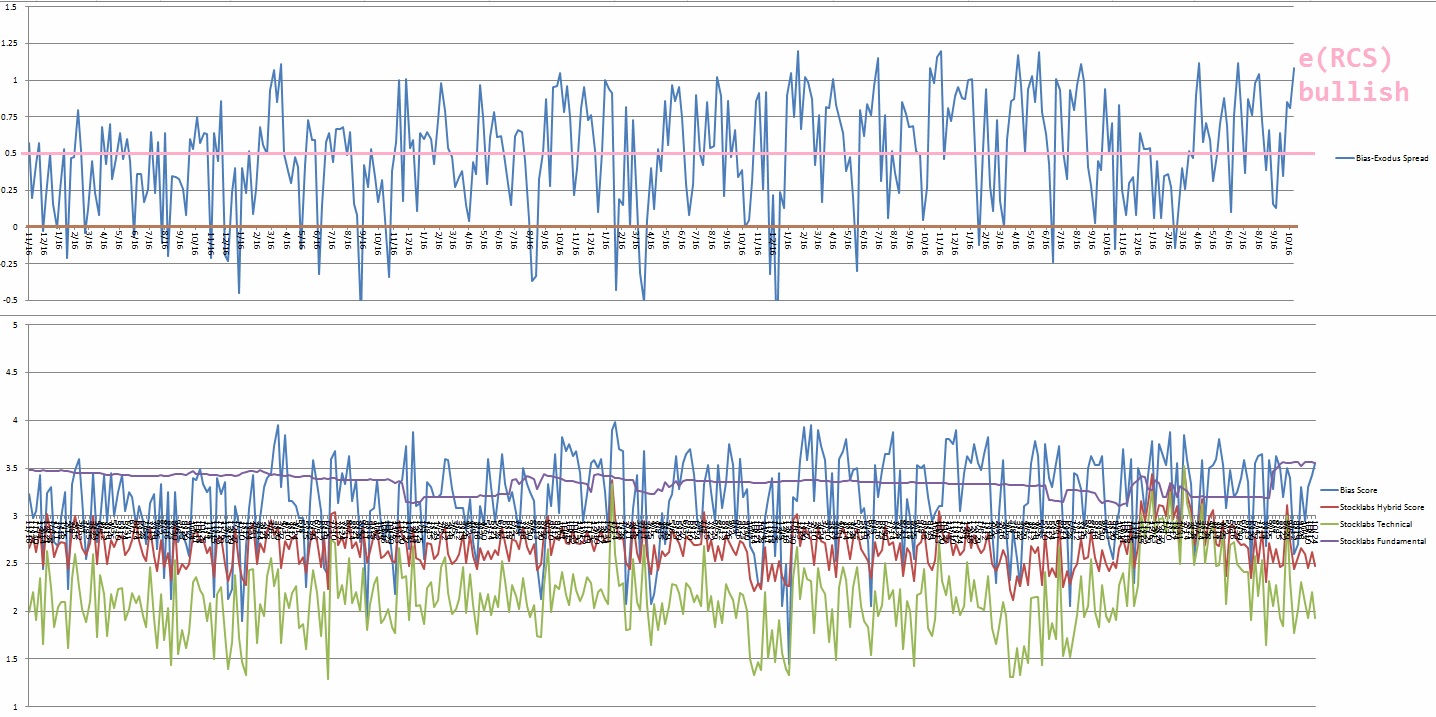

Bias model is extreme Rose Colored Sunglasses [RCS] bullish after being bearish RCS for two consecutive weeks. Bias model was neutral three reports back after signaling Rose Colored Sunglasses [RCS] bearish four weeks ago. It was neutral the prior two weeks after being Rose Colored Sunglasses [RCS] bearish seven weeks back after being neutral eight reports back and Rose Colored Sunglasses bearish for the two consecutive weeks prior to that.

We had a Bunker Buster thirty four weeks ago.

Extreme Rose Colored sunglasses calls for a sideways drift, perhaps with a slight upward bias.

Here is the current spread:

VI. QUOTE OF THE WEEK:

“Make every detail perfect and limit the number of details to perfect.” – Jack Dorsey

Trade simple, simplify everything

If you enjoy the content at iBankCoin, please follow us on Twitter