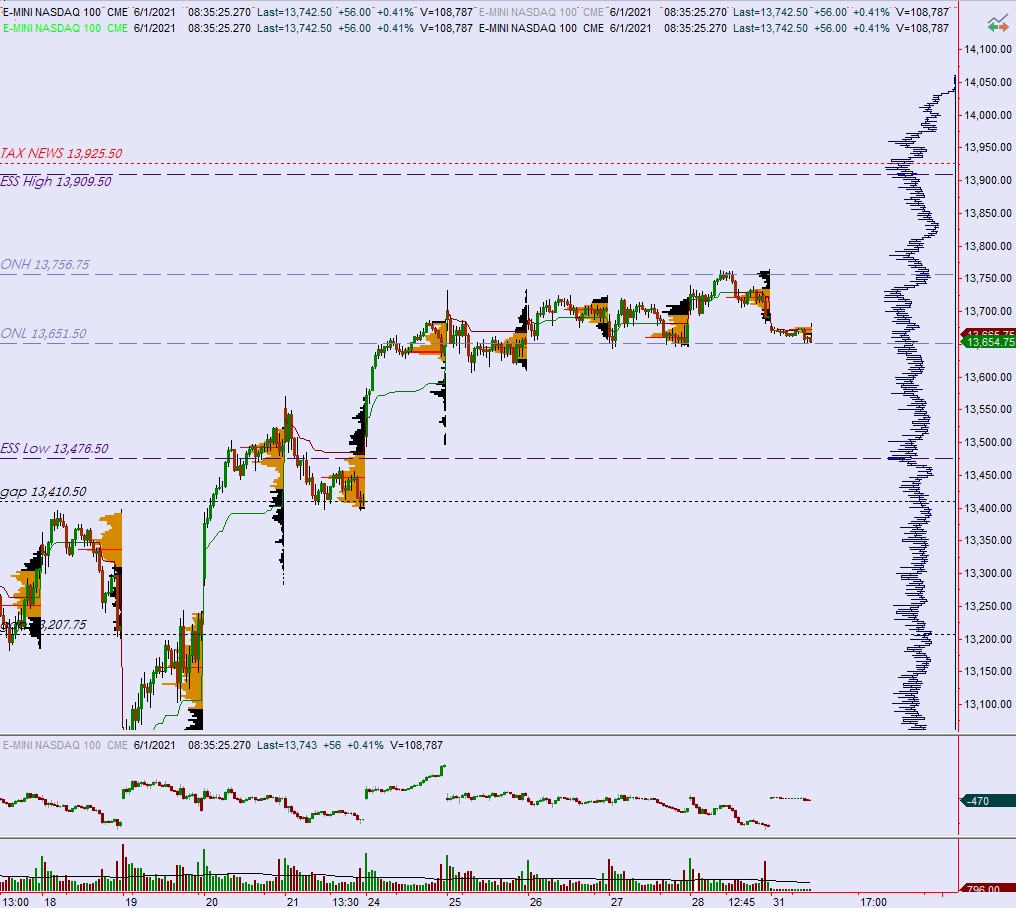

NASDAQ futures were balanced overnight and are heading into the final month of the second quarter gap up after an overnight session featuring extreme range and volume. As we approach cash open in this holiday shortened week price is hovering near last week’s high.

On the economic calendar today we have ISM manufacturing index and construction spending at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

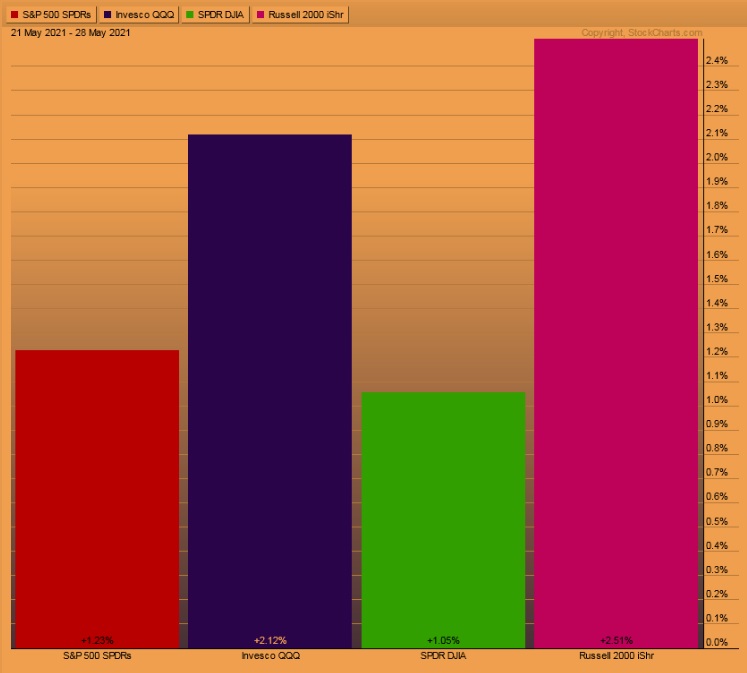

Last week we saw a strong rally Monday then a slow and steady upward drift for the rest of the week. Russell 2000 outperformed suggesting risk tolerance remains elevated.

The last week performance of each major index is shown below:

On Friday the NASDAQ printed a neutral extreme down. The day began with a gap up in range and after an open-two-way auction price sort of chopped the mid for an hour and a half before rallying to a new qweekly high. Price held the highs for about an hour before falling back down through the mid. Then, sellers held the mid and pushed into a late-day neutral print, closing on the lows.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the Friday gap down at 13,693 before two way trade ensues.

Hypo 2 buyers gap and go up to 13,800 before two way trade ensues.

Hypo 3 stronger buyers tag 13,833 before two way trade ensues.

Levels:

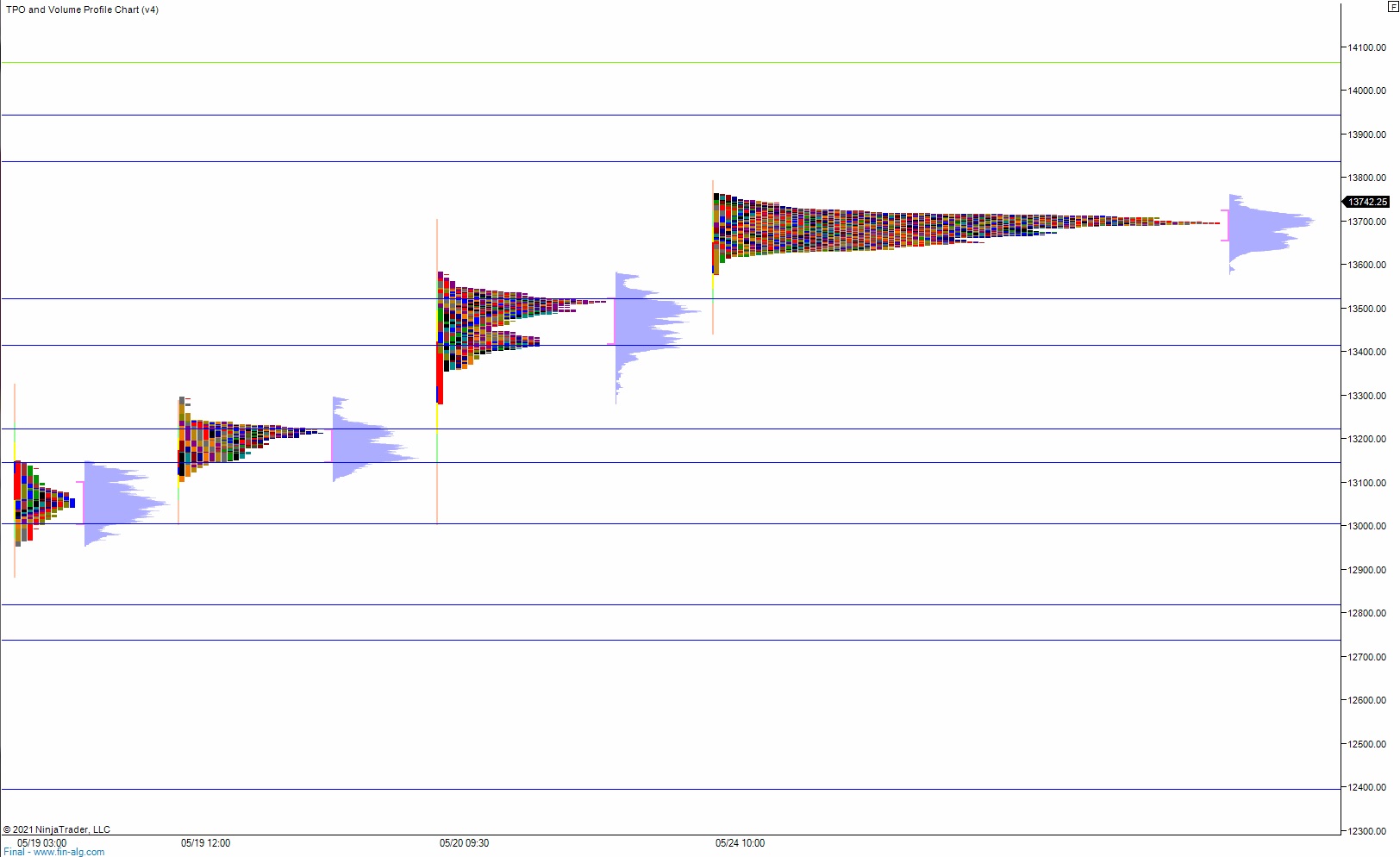

Volume profiles, gaps and measured moves: