NASDAQ futures are coming into Tuesday with a gap down after an overnight session featuring extreme range and volume. Price was balanced overnight until about 5:30am New York when sellers stepped in and probed down below Monday low. Since then price has reclaimed Monday range and as we approach cash open price is hovering in the lower quadrant of Monday range.

On the economic calendar today we have a 52-week T-bill auction at 11:30am.

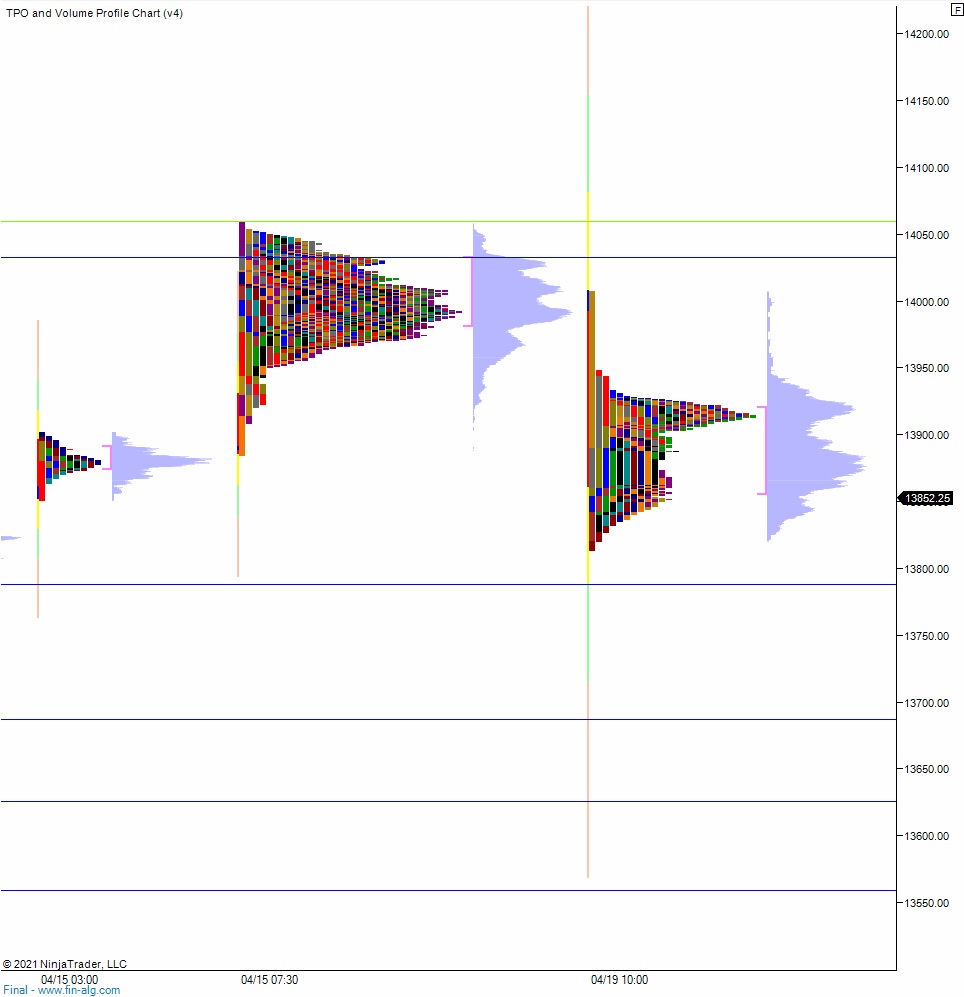

Yesterday we printed a double distribution trend down. The day began with a gap down in range that buyers drove into off the open. Said buyers could not close the overnight gap before being met by strong responsive sellers who drove down below last Thursday/Friday low. After a bit of congestion along last Wednesday’s naked VPOC sellers held the mid and pressed a new daily low, effectively closing the Wednesday gap before discovering a responsive bid. The rest of the day was spent chopping before a late day ramp saw price nearing the bottom-side of the mid.

Heading into today my primary expectation is for sellers to press down through overnight low 13814 setting up a tag of 18,000. Look for buyers down at 13,788 and for two way trade to ensue.

Hypo 2 buyers work into overnight inventory and close the gap up to 13,896.75 then tag 13,900 before two way trade ensues.

Hypo 3 stronger buyers trade up to 14,000 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: