NASDAQ futures are coming into the second week of March down about -100 after an overnight session featuring extreme range and volume. Price first went gap up Sunday evening when Globex opened for trade. Then, after trading up near last Thursday’s range sellers stepped in and took control of the tape, steadily rotating price lower via three pushes lower that eventually worked price a bit down through the Friday midpoint. Around 4:30am bidders reversed the auction, and as we approach cash open price is hovering in the upper quadrant of Friday’s range.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

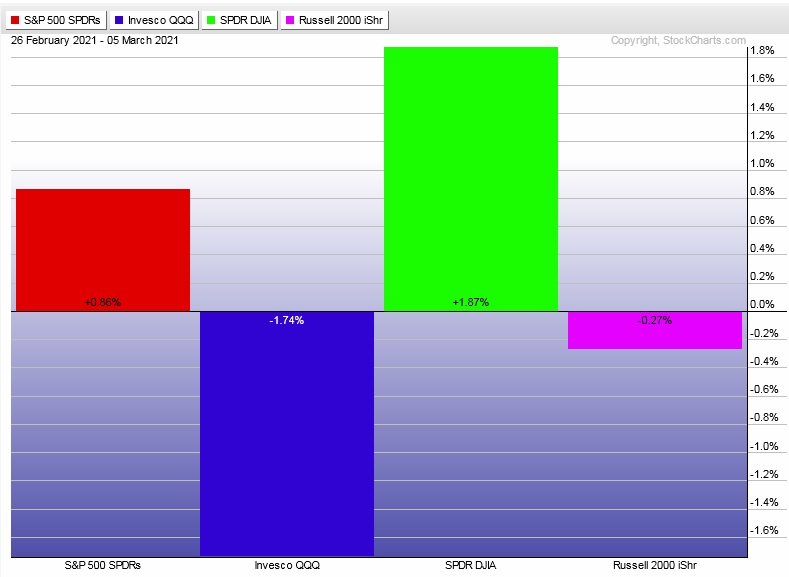

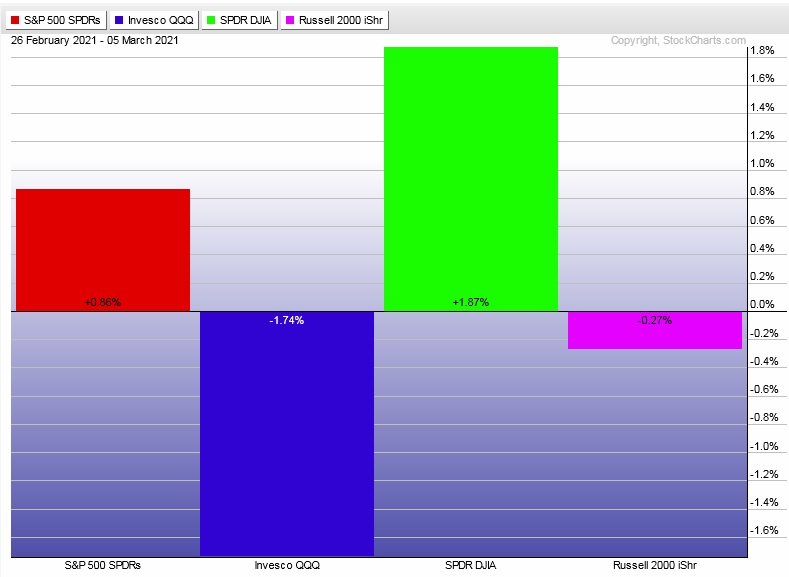

Last week had a third sigma NYSE TICK on the open Monday, kicking the month off with a full day of conviction buying. Tuesday erased much of the Monday gains then aggressive sellers formed a sharp trend lower through to mid-Friday. Markets turned around late Friday and rallied into the close. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a neutral extreme up. The day began with a gap up beyond the Thursday midpoint. Sellers quickly resolved the overnight gap and continued lower, trading down through the Thursday low shortly after the first hour of trade, pushing the market into an early range extension down, briefly trading down into price levels unseen since November 30th. Here a strong responsive bid stepped in and price shot up through the daily midpoint and later in the afternoon pushed neutral and eventually closed along the highs.

Neutral extreme up.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 12,656.50. Look for sellers up at 12,679.75 and for two way trade to ensue.

Hypo 2 stronger buyers trade up to 12,765.75 before two way trade ensues.

Hypo 3 sellers press down to 12,420 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: