Good evening lads,

I took a break from installing the kitchen from hell, jackin’ off and all the other deviant things I do to update the weekend research and here we are. There was a bunker buster last week. Yup. Sure was. There is something to be said about being prepared for a price acceleration…so I shall. In the past I’ve taken to the futures market during a bunker buster week and I would start out only working the short side of the tape, then eventually I would switch and only work the long side. The challenge was often times the bunker can bust right off the get go Monday morning.

In fact, I thought that might have been the case last week. Right on the open Monday the NYSE TICK went third sigma up. Thems are ‘go with’ ticks. I had to resist with every fiber the base impulse to sit down and start ripping long /nq trades. Instead, I stayed in my nightmare kitchen, brooding about the next time I could jack off, and from my mobile phone I placed buy orders for GOOGL and TACO and something else. I dunno exactly which tickers. It doesn’t really matter. Wednesday I did it again TWTR and TACO and something else, and Friday a third time COST and TACO and AMZN.

Expecting selling, I was patient and had my little shopping list like I was going to Costco to stock up on supplies for the old jack shack and I just checked the names off the list then walked past the dollar fifty hot dogs and went back to the empty box that once was a kitchen.

I eat from one bowl, no matter what the food and I use the grey water from my laundry to worsh it rinsed. I drink municipal water from a mason jar I fill from the sink next to the toilet. This is also where I shit and make coffee.

In summary, I have reduced Mothership to Cruise America RV living conditions and morale is sort of…idk…off.

In any event, physically I am strong as an ox. I can literally rip cabinets off the walls with my bear (bare?) hands. Performance wise, doing okay. Next week? We don’t know. One bite at a time.

Raul Santos, March 7th, 2021

And now the 328th edition of Strategy Session. Enjoy:

Stocklabs Strategy Session: 03/08/21 – 03/12/21

I. Executive Summary

Raul’s bias score 2.95, neutral. Sellers assert some pressure on prices early in the week before a choppy second half of the week.

II. RECAP OF THE ACTION

Third sigma NYSE TICK on the open Monday, kicking the month off with a full day of conviction buying. Tuesday erases much of the Monday gains then a sharp trend lower through to mid-Friday. Markets turn around late Friday and rally into the close.

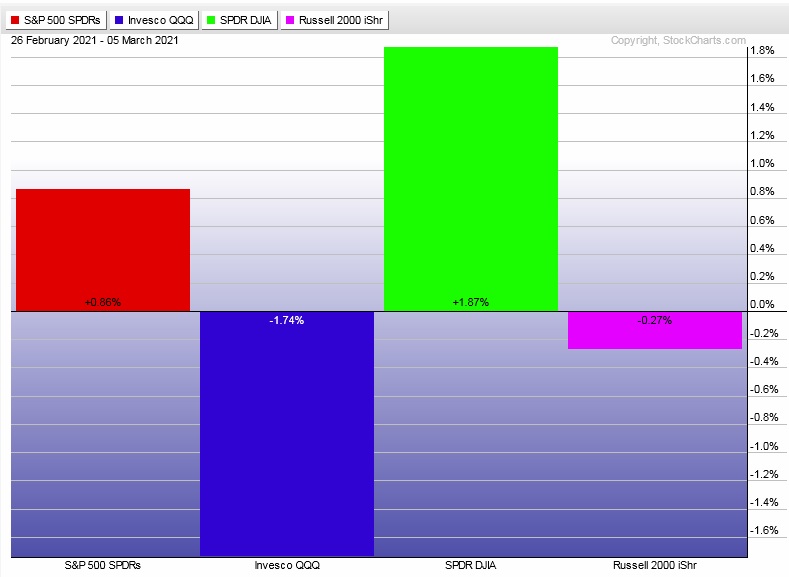

The last week performance of each major index is shown below:

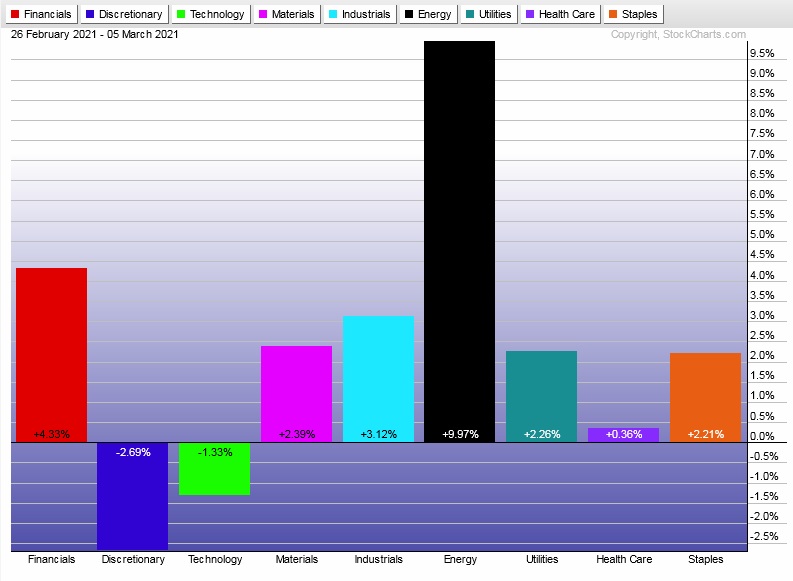

Rotational Report:

Rotations mostly higher. Energy continues to trade on its own planet. Concerning divergent weakness from key Tech and Discretionary sectors.

neutral

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

Industry flows slightly skewed to the sell side of the ledger, but not by much. Volume delta well over +5% suggests buyers were more aggressive with their orders. Median return a bit below +0.5%.

neutral

Here are this week’s results:

III. Stocklabs ACADEMY

The week after a Bunker Buster

So the Bunker Buster managed to forecast the selling. The IndexModel does a decent job of providing a good explanation “why” the market does what it does. We look at raw data generated by the net interactions of all market participants. No headlines. No gurus. Not the moon. Just orders.

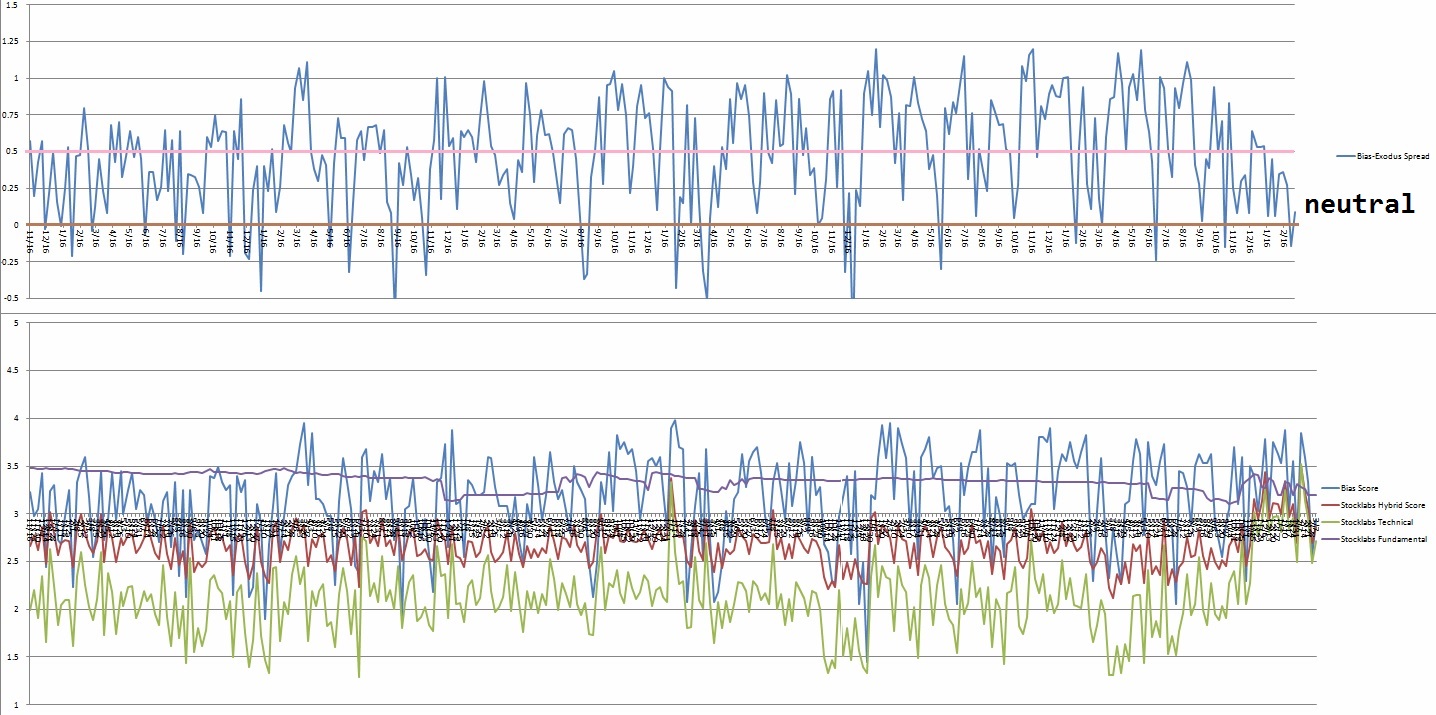

The tendency after the model successfully forecasts behavior is to become aggressive. Well, heading into this week we have no IndexModel to work with. The model is neutral. Stocklabs is neutral. There is nothing to work with.

Hopefully we used last week’s selling to accumulate larger positions in our favorite long term investments. If we executed that part of our strategy well then this upcoming week is the time to do nothing.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Sellers assert some pressure on prices early in the week before a choppy second half of the week.

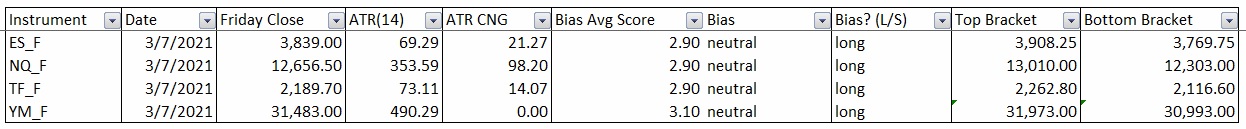

Bias Book:

Here are the bias trades and price levels for this week:

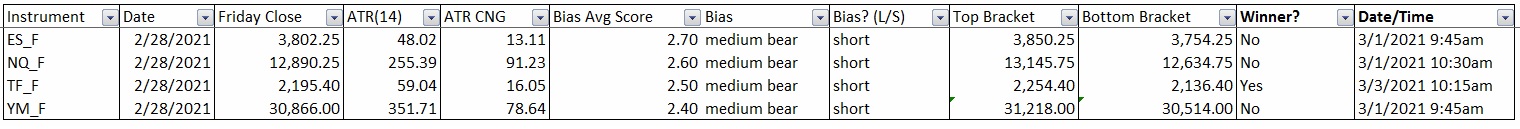

Here are last week’s bias trade results:

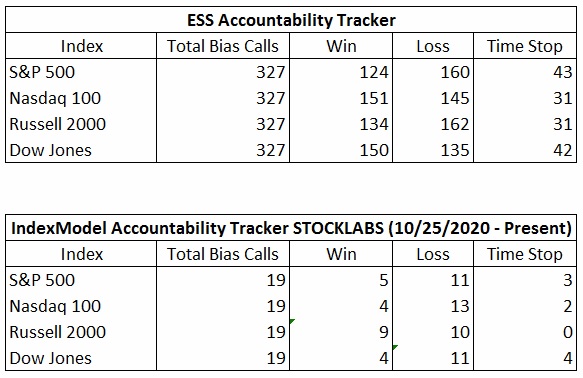

Bias Book Performance [11/17/2014-Present]:

Possible signs of balance

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports saw buyers form a sharp excess low. This could be the early set-up for a new balance.

See below:

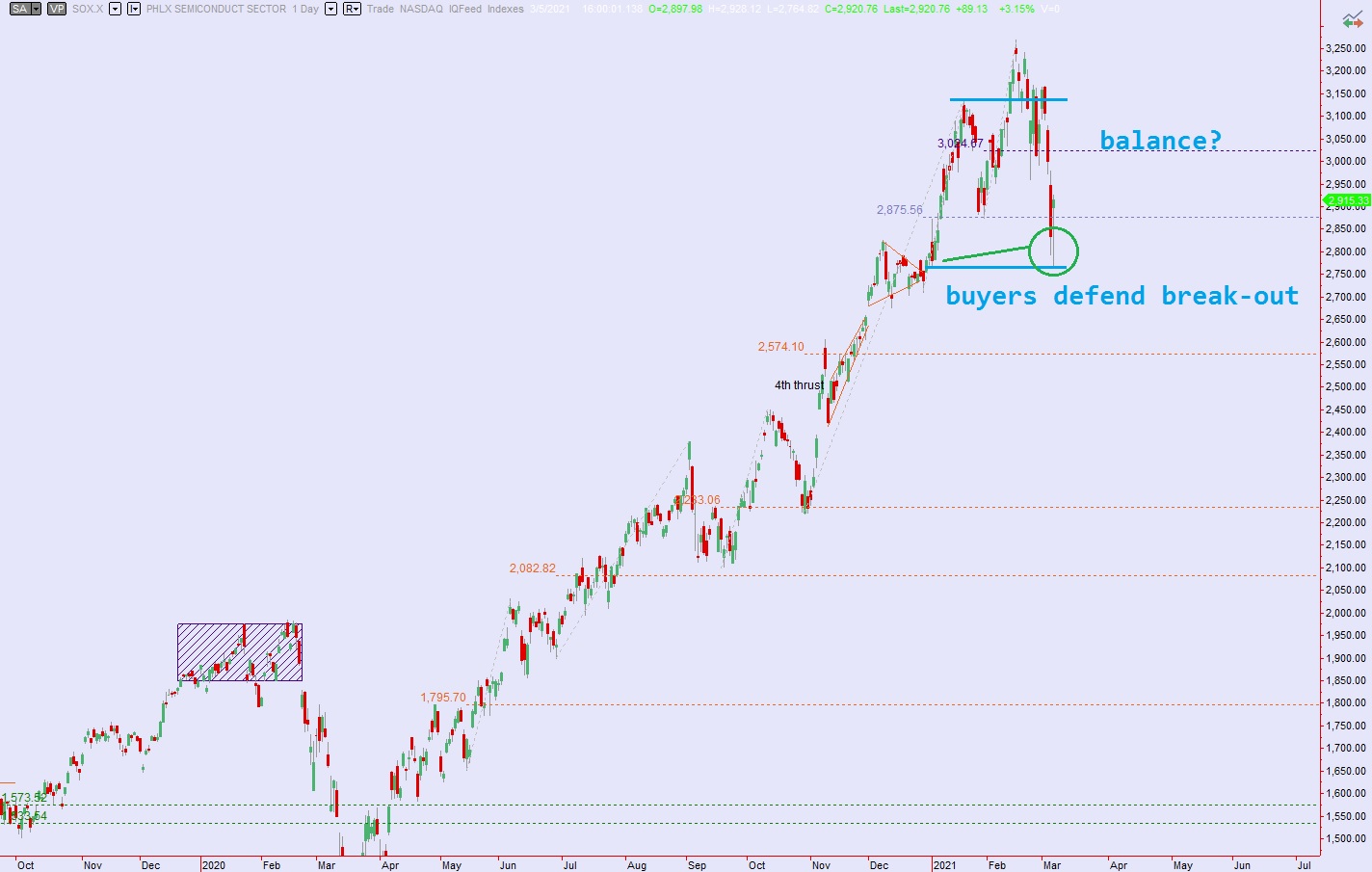

Semiconductors also formed an excess low, right around the breakout zone from a prior consolidation. Primary expectation is for a new range to take hold.

See below:

V. INDEX MODEL

Bias model is neutral after signaling Bunker Buster last week and being neutral for the thirteen weeks prior. No bias heading into next week. Here is the current spread:

VI. QUOTE OF THE WEEK:

“A journey of a thousand miles begins with a single step.” – Lao Tzu

Trade simple, this trade now, then the next

If you enjoy the content at iBankCoin, please follow us on Twitter