I read a beautiful tweet this morning:

Did shrooms

With my wife

Saw a vision

Came up with a billion dollar idea

Manifesting under a full moon

I love my life— No 🔑 No 🧀 (@bitcoinzay) February 28, 2021

And whether or not this nice man came up with a billion dollar idea, we don’t know. It doesn’t matter. I know well the feeling behind the message and that he was brave enough and has a strong enough relationship with his wife to take psychedelics together is a wonderful thing.

Set and setting are so very important when you take these chemicals. Self-awareness skyrockets when we introduce these compounds to our body. The mushrooms show you what you need to see. Most of us have some goblins hiding out in our psyche, wrong doings, whatever, which is fine, however confronting those spooky things around the wrong people and/or in the wrong place is a recipe for a bad time.

You know, running down the street naked, rolling around in gutter puddles, stuff like that. No bueno.

I spend a good deal of my time building places I feel safe going on a trip. You would not believe how difficult it is to create total outdoor privacy. Pure, garden of eden style, nudity without the risk of offense, writhing around on the ground asking the gods why, why, WHYYYY? outdoor privacy. Ask me how I know.

There are a few ways. The first and least labor intensive is go to a national forest and hike at least a half day into the wild then venture off any beaten path. You will find, however, that it is extremely difficult to get away from humans. They. Are. Everywhere. Again. Ask me how I know.

Next you can build privacy. But don’t assume a six foot wooden fence will do it. It won’t. Don’t assume 20 acres of land will do it. It won’t. Some fucker always has the higher ground. I work hard in this department.

You need to become one hell of a gardener. In the north, emerald green arborvitaes are your friend. They need lots of space though, more then you might give them if you’re impatient and want privacy NOW. I recommend planting two rows of them in a checkerboard formation. So with a six foot wooden fence and about $5,000 fiat american dollar’s worth of arborvitae stock you are well on your way to creating total visual privacy. Guess what? You still need to create audible privacy.

You would not believe how fucking god damned nosy people can be when you start howling like a wolf. You’re going to need to build some fountains. Big ones. You really need lots of white noise if you’re a moaner.

Okay now the third way: obtain the high ground. This works well especially in the city where there is all sorts of other noises. Climb or otherwise gain access to the tallest building in sight. Bring a couple snacks, some forty ounce bottles of malt liquor and the psychedelic of choice. Make sure you have the mental fortitude not to lose your head up at those heights. I recommend a faithful companion.

The fourth way is a totally different set of circumstances and will result in a totally different experience. Which is fine. And can be wonderful — go to a massive gathering of freaks (rave, masquerade, festival) and sort of just go with the flow. Blend in with the wookies. Experience the deep interconnection to your fellow humans. Beware though. They may gross you out at some point—what with all their gluttony and pores….their pores…and their stimulant impulses.

So yeah man there you go. Those are a few ways to set up for a nice trip.

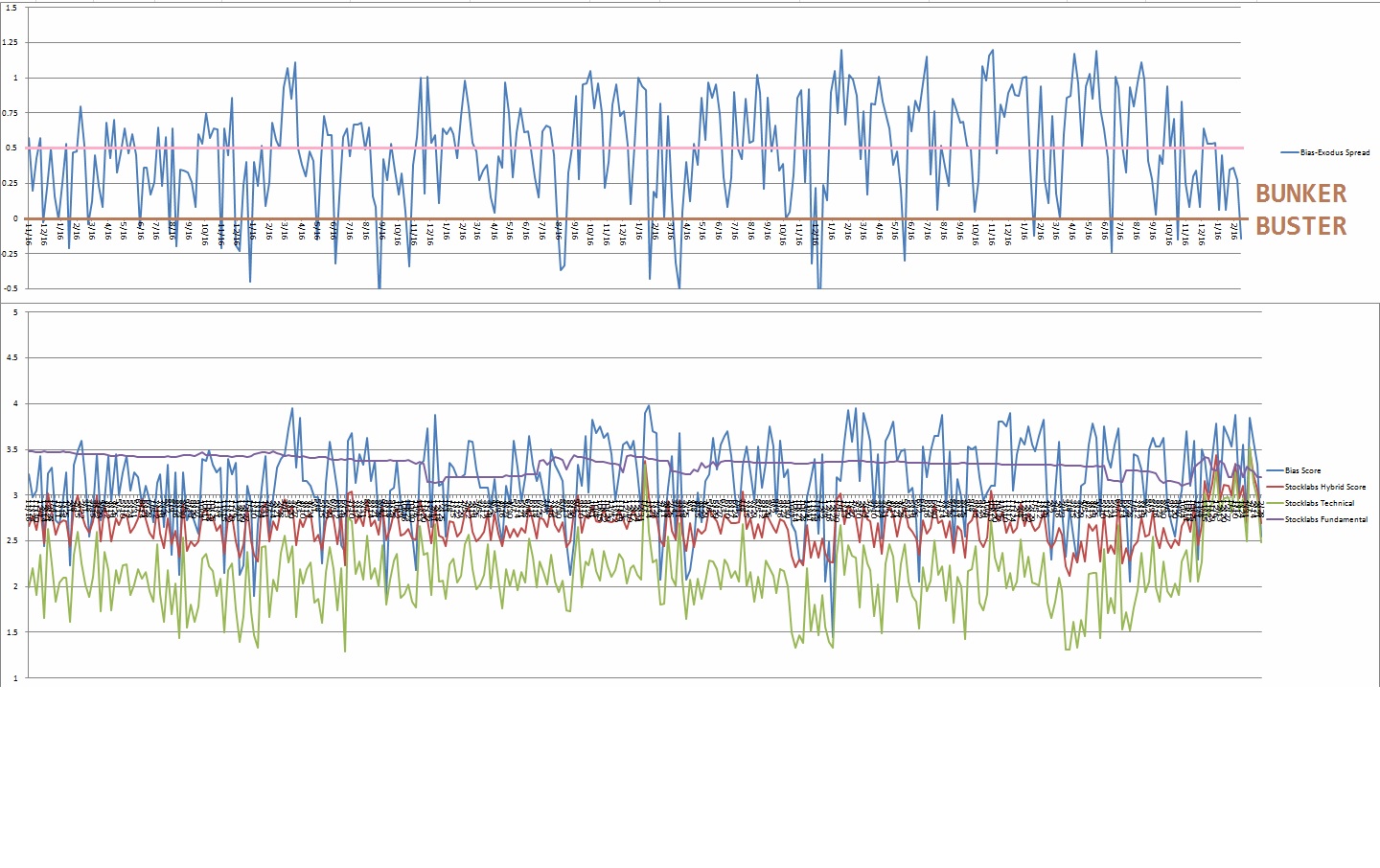

BACK TO MARKETS: We have a signal to work with from the IndexModel. The first one in thirteen weeks. Hallelujah. Bunker Buster. This is a wild signal. It calls for an acceleration to the downside which eventually leads to a low that can last for weeks. Months even.

And we’re heading into March. And the moon is big. And last week we had all that spooky numerology guff going on (3.33 on 02/21/21).

I do not day trade during Bunker Buster signals. But I do accumulate/add to long term investments. Therefore I will use the week to buy more TACO, TWTR, TSLA, FAMI, GOOGL and so on.

I will likely put out morning reports still. Or just tweet out my levels. Either way thank you for stopping by and just know I am looking for fast selling to buy into.

Okay for now.

Raul Santos, February 28th 2021

And now the 327th edition of Strategy Session. Enjoy:

Stocklabs Strategy Session: 03/01/21 – 03/05/21

I. Executive Summary

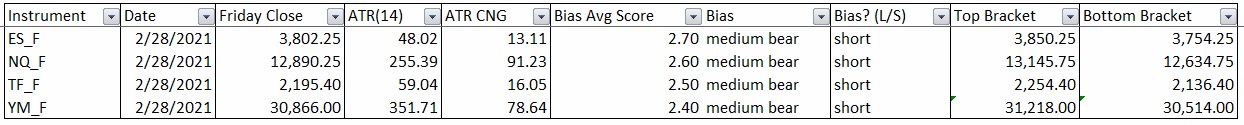

Raul’s bias score 2.55, medium bear*. Selling velocity increases to the downside, ultimately forming a sharp, excess low that holds for the rest of the week. Third reaction to Non-farm payroll data Friday morning sets direction heading into the end of the week.

*Bunker Buster signal triggered, see Sections III and IV.

II. RECAP OF THE ACTION

Pro gap down into the week. Sellers control the tape through early Tuesday. Buyers strong Tuesday and erase Wednesday’s down gap. Strong selling Thursday. Choppy Friday, chopping along the weekly lows.

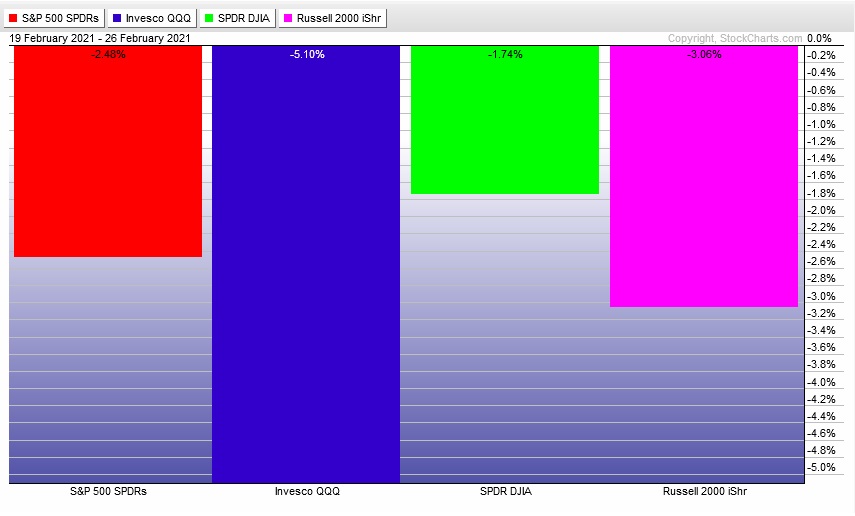

The last week performance of each major index is shown below:

Rotational Report:

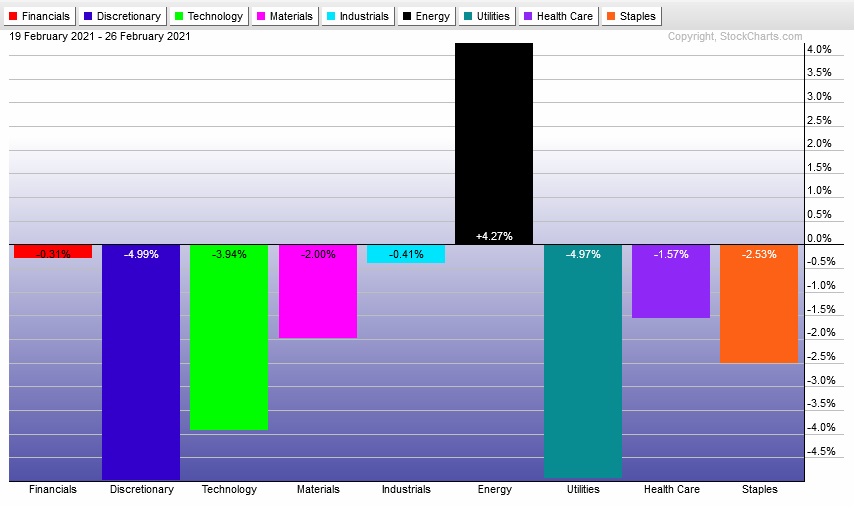

Rotations uniformly lower except for energy which continues to trade independent of other sectors.

slightly bearish

For the week, the performance of each sector can be seen below:

Concentrated Money Flows:

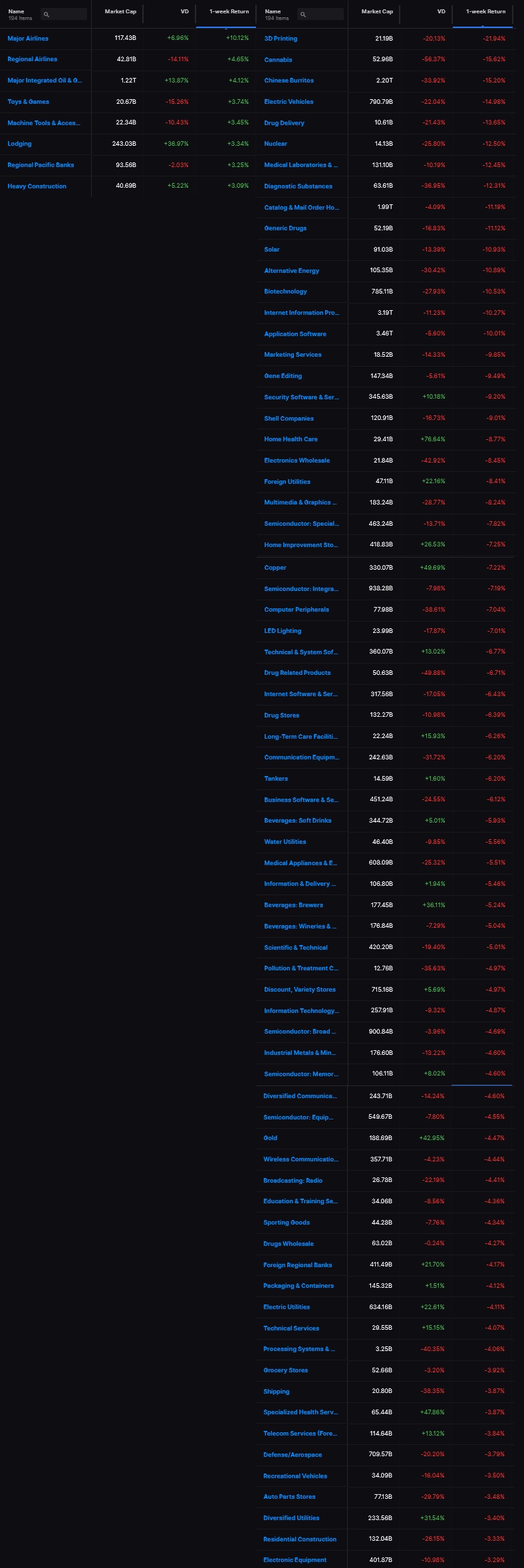

Industry flows skewed heavily to the downside last week. Median return nearly -2% but not quite. The median 30-day volume delta remains negative suggesting a continued outflow of capital from the equity complex.

bearish

Here are this week’s results:

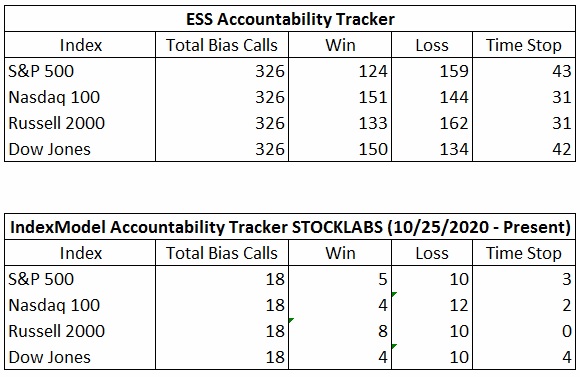

III. Stocklabs ACADEMY

Bunker Buster

This is the first bunker buster signal of 2021. There were four bunker busters in 2020 (2/2, 3/22, 6/28, 11/1). This signal is bullish, in a sense, but has been hard for me to use to my advantage in my day trading. I have however found it to be a useful time to accumulate additional long-term investments.

Therefore I will use the upcoming week to add to my favorite investments of 2021, especially into any fast selling. The key is to wait for responsive buyers to emerge. This will look like a sharp, fast bounce off the lows. It could come as soon as Monday morning.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for buyers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Pro gap down into the week. Sellers control the tape through early Tuesday. Buyers strong Tuesday and erase Wednesday’s down gap. Strong selling Thursday. Choppy Friday, chopping along the weekly lows.

Bias Book:

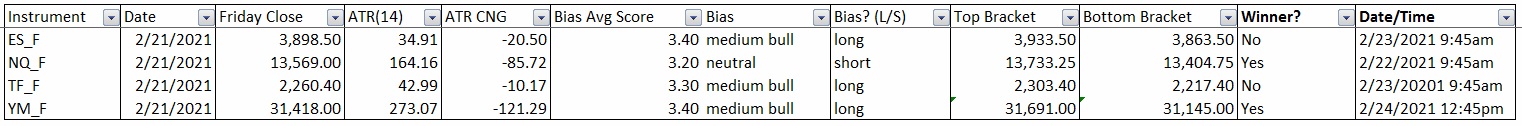

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

Bias Book Performance [11/17/2014-Present]:

Semiconductors wearing out support zone

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports still look to be in discovery up. Primary expectation is for a continued up phase.

bullish

See below:

Semiconductors have pressed into their local support level hard three times. The more times a support level is tested, the weaker it becomes. This could lead to a fresh leg lower. This general drawn box envisions where a new balance may form along the highs.

Or we could switch right into discovery down.

Or the support holds and discover up continues.

All this to say the key semiconductor index is looking uncertain heading into March.

neutral

See below:

V. INDEX MODEL

Bias model is signaling bunker buster after thirteen consecutive weeks of neutral readings. This signal calls for an acceleration to the downside that ultimately discovers a tradable low.

VI. Stocklabs Hybrid Overbought.

On Friday, February 5th Exodus flagged hybrid (and technical) overbought on the 12-month algo. This is a bullish cycle that ran through Monday, February 22nd end-of-day. Here is the final performance:

VII. QUOTE OF THE WEEK:

“Three things cannot be long hidden: the sun, the moon, and the truth.” – Buddha

Trade simple, be patient

If you enjoy the content at iBankCoin, please follow us on Twitter