Started my research late. Then went for a winter walk. Then ate good soup. Came back and finished the Weekly Strategy Session.

Now I am tiredt. I shall light a fire and brood next to it until morning time.

Know this — the fate of the entire market lies in NVIDIA’s hands.

Raul Santos, February 21st, 2021

Here is strategy session I make for to enjoy and trade well maybe you love it.

Stocklabs Strategy Session: 02/22/21 – 02/26/21

I. Executive Summary

Raul’s bias score 3.33, medium bull. Rally through end of Monday then choppy. Then look for third reaction to NVIDIA earnings Wednesday after the bell to dictate direction into the second half of the week.

II. RECAP OF THE ACTION

Markets closed Monday for President’s Day. Holiday shortened week kicked off with a gap up to new highs. Sellers pressed into and erased the gap then continued lower through Wednesday morning. Big chop for the rest of the week with sellers pressuring the tape into Friday’s close.

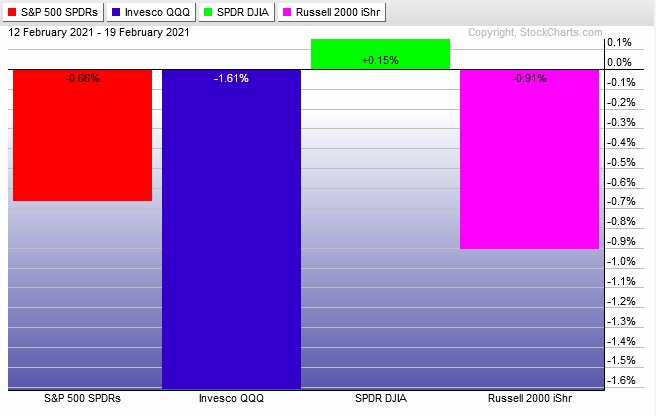

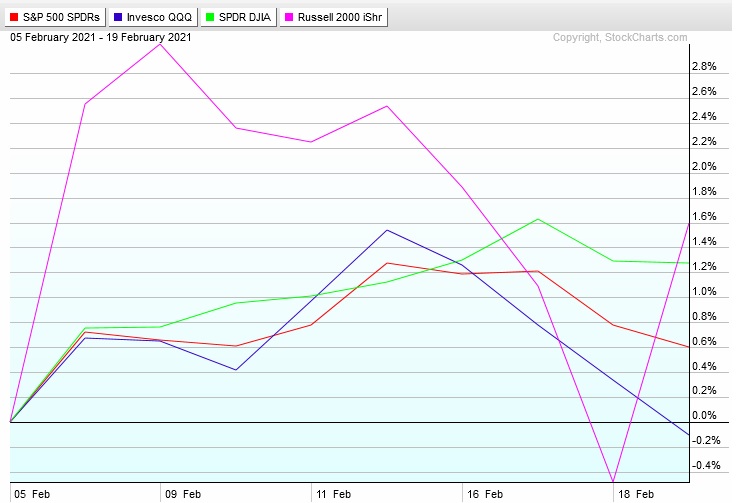

The last week performance of each major index is shown below:

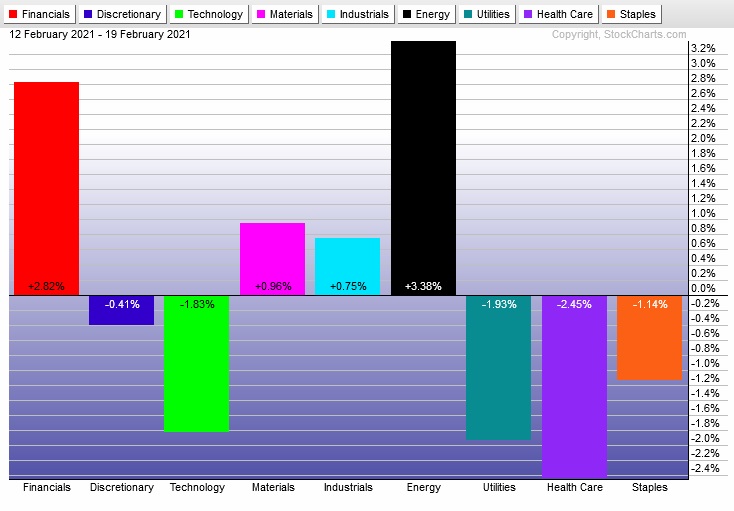

Rotational Report:

Rotations a bit mixed but key sectors like Tech and Discretionary were lower.

slightly bearish

For the week, the performance of each sector can be seen below:

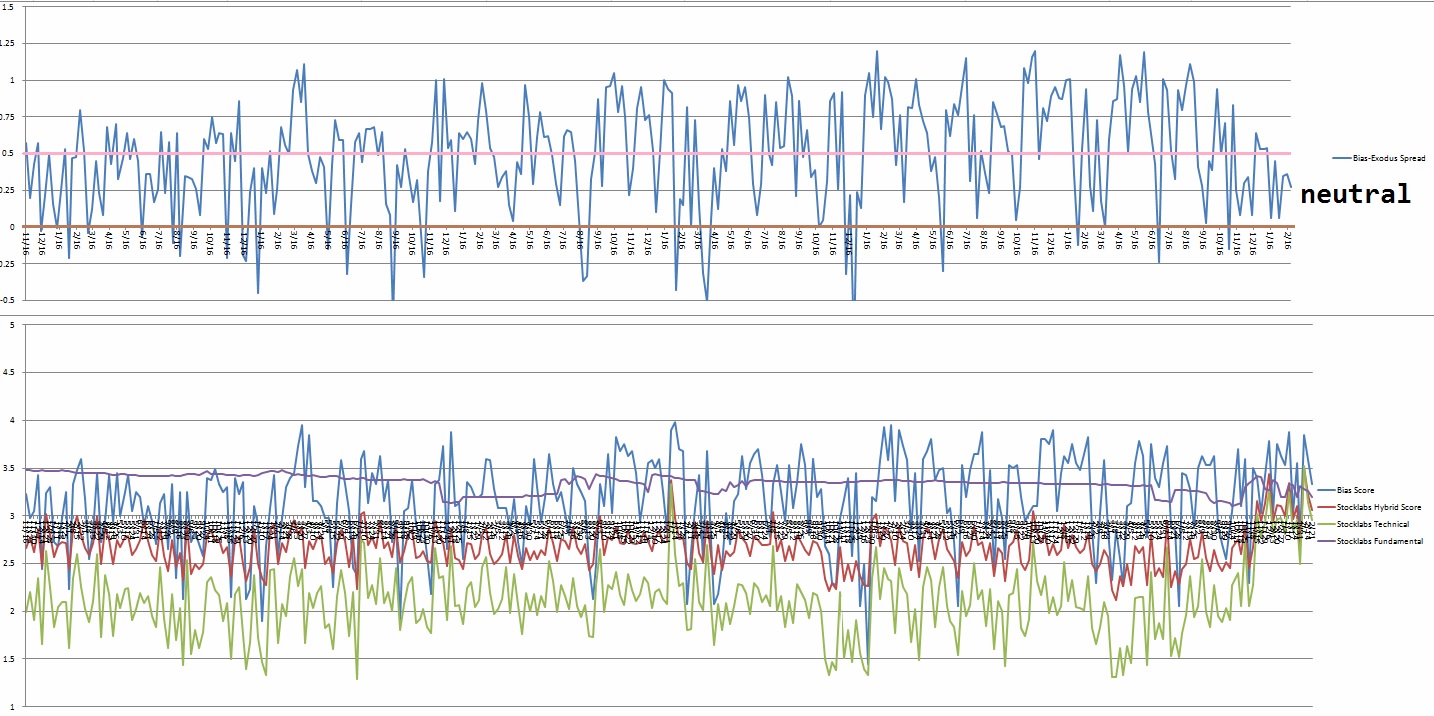

Concentrated Money Flows:

Industry flows show a balanced ledger last week. Median return reflects this, just slightly negative on the week. Quality industry groups on the positive side the ledger. The median 30-day volume delta remains negative suggesting a subtle outflow of capital from the equity complex.

neutral

Here are this week’s results:

III. Stocklabs ACADEMY

Holidays don’t count

When working through an overbought or oversold 10-day cycle it is important to remember market holidays do not count. This can throw off when we think a cycle is ending. The current overbought cycle triggered on the 12-month algo has been incorrectly noted these last two weeks to end last Friday, the 19th when actually it ends tomorrow, Monday the 22nd at end-of-day.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for buyers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Rally through end of Monday then choppy. Then look for third reaction to NVIDIA earnings Wednesday after the bell to dictate direction into the second half of the week.

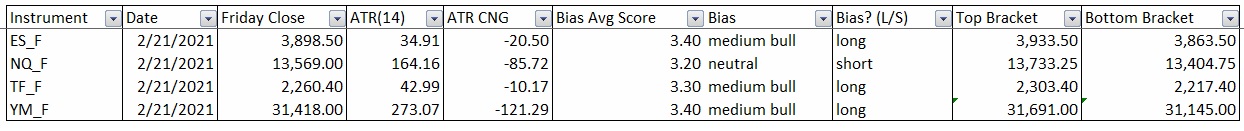

Bias Book:

Here are the bias trades and price levels for this week:

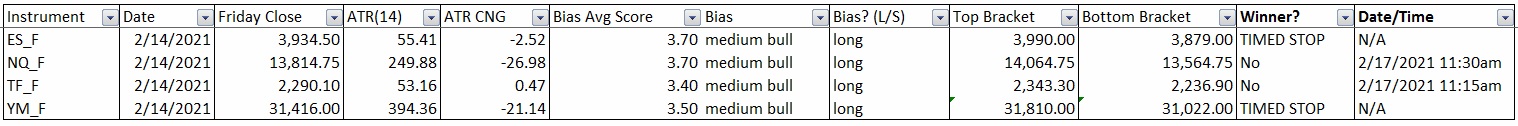

Here are last week’s bias trade results:

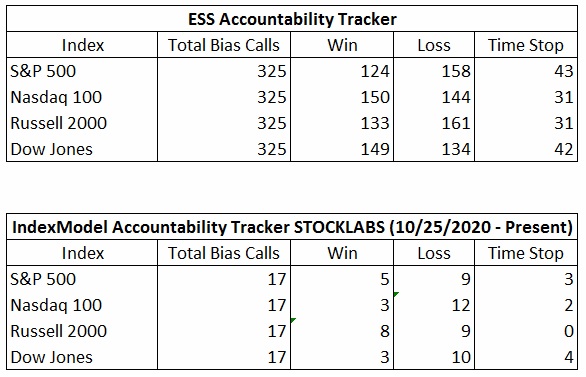

Bias Book Performance [11/17/2014-Present]:

Contextual sub-indices remain discovery up

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Same as last week — transports continued their discovery up phase.

bullish

See below:

Semiconductors continue to discover higher prices. NVIDIA earning out Wednesday after the bell could serve to pivot this entire index.

bullish

See below:

V. INDEX MODEL

Bias model is neutral for a thirteenth consecutive week. No bias.

VI. Stocklabs Hybrid Overbought.

On Friday, February 5th Exodus flagged hybrid (and technical) overbought on the 12-month algo. This is a bullish cycle that runs through Friday, February 19th end-of-day. Here is the performance thus far:

VII. QUOTE OF THE WEEK:

“The confidence of people is worth more than money.” – Carter G. Woodson

Trade simple, guard your emotional capital

If you enjoy the content at iBankCoin, please follow us on Twitter