NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Price steadily declined overnight, slowly rotating down through the entire Wednesday range at 8:30am a slew of economic data came out. Housing starts in line with expectations, jobless claims higher than expected, Philadelphia Fed stronger than expected as were import export prices. As we approach cash open price is hovering just above the Wednesday low.

Major U.S. emoloyer Wal-Mart is -5% in premarket trade after reporting earnings.

Also on the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am, a 30-year TIPS auction at 1pm and Treasury Secretary Yellen is set to speak on CNBC’s ‘Closing Bell’ show.

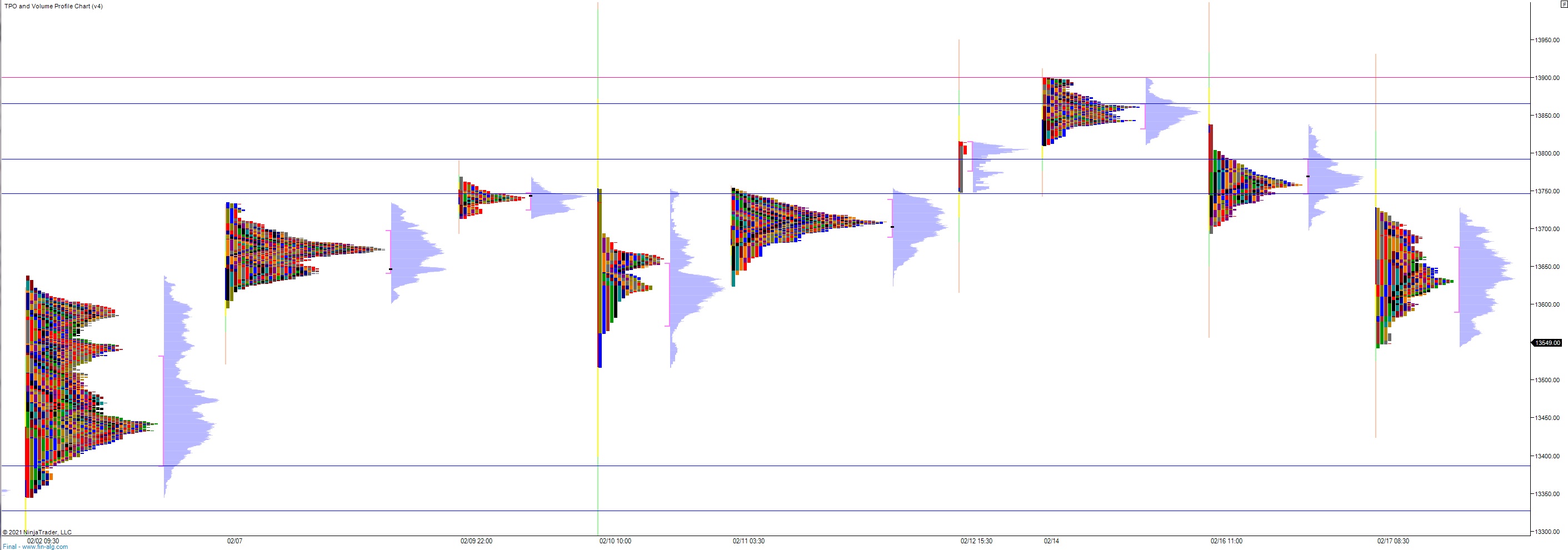

Yesterday we printed a neutral extreme up. The day began with a gap down below the Tuesday range. After an open two-way auction buyers made an attempt higher however the auction stalled well before returning to the Tuesday range. Sellers then worked price into a range extension down, trading down near last week’s low but not exceeding it. Instead we saw a strong ramp higher into the close, a ramp that effectively traversed the entire daily range and pushed neutral during settlement and closed on the high.

Neutral extreme up.

Heading into today my primary expectation is for sellers to gap-and-go lower, trading down to 13,500 before two way trade ensues.

Hypo 2 stronger sellers trade down to 13,400 before two way trade ensues.

Hypo 3 buyers work into the overnight inventory and close the gap up to 13,695.75 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: