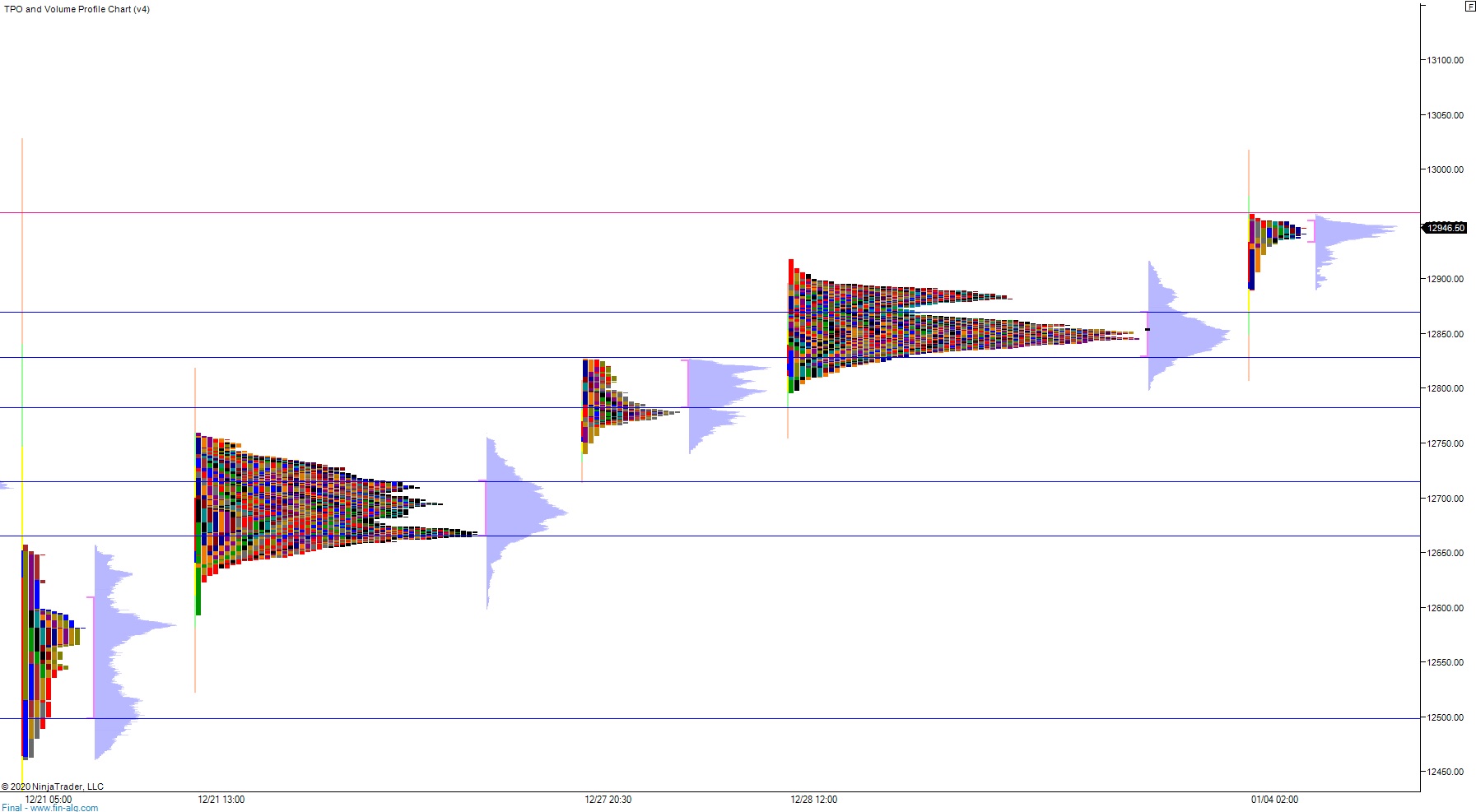

NASDAQ futures are coming into the week pro gap up after an overnight session featuring extreme range and volume. price was balanced overnight, balancing inside of the prior two days’ ranges until about 2am New York when price began to campaign higher. As we approach cash open, price is hovering at all-time highs, right around 12,500.

On the economic calendar today we have construction spending at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

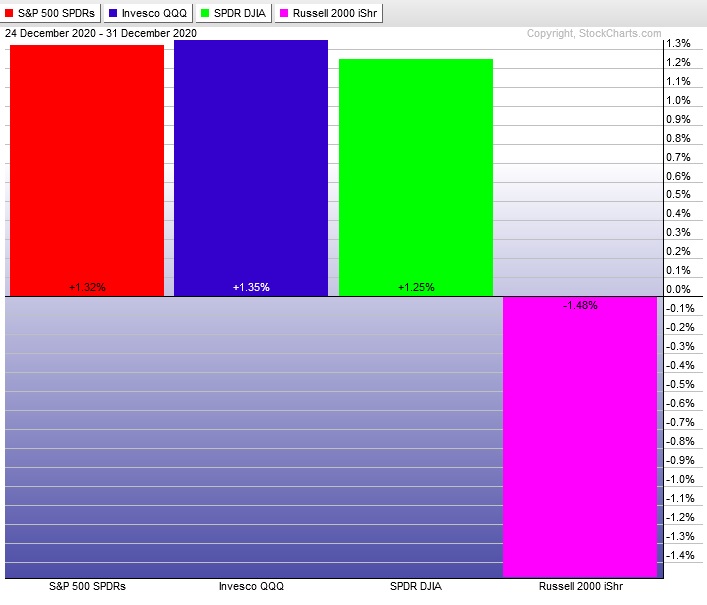

Last week was gap up Monday then the rest of the shortened week was spent marking time. Price ramped aggressively higher late Thursday afternoon into year-end. Markets were closed Friday in observation of New Year’s Day. The Russell 2000 was bearish divergent after being bullish divergent the week prior. The last week performance of each major index is shown below:

On Thursday (markets were closed Friday) the NASDAQ printed a neutral extreme up. The day began with a slight gap up that was quickly resolved during an open two-way auction. Price held a tight range for the first few hours before sellers stepped in and drove price lower. Said sellers managed to take out the Tuesday/Wednesday lows before discovering a responsive bid. Then we marked time for a few hours, chopping along the bottom side of the daily midpoint before buyers reclaimed the mid around 2:30pm. A bit more chop just below the daily high before a strong ramp into the settlement period pressed us into a neutral print. We ended the day near the high.

Neutral extreme up.

Heading into today my primary expectation is for buyers to gap and go higher, tagging 13,000 before two way trade ensues.

Hypo 2 sellers work into the overnight inventory and close the gap down to 12,878.75 before two way trade ensues.

Hypo 3 stronger sellers trade down through overnight low 12,825.25 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: