Gotta boogie so I shall keep this brief—we’re headed into a new year lads. The 2021st Julian year. January can be noisy AF, with every dicknose or bobbed woman willing to go on teevee and say “why” given air time to make up some fairy tail reason for the price action seen in the financial markets.

It is all bull shit.

This chatter will be amplified to eleven because the dang coined bits are going bananas.

I remain cautiously bullish heading into the new year and my reasoning is presented below in the strategy session. I also give you two charts you can monitor for the next five days (on your own) that will tell you more than any human, beast or spirit about why the market is behaving the way it is.

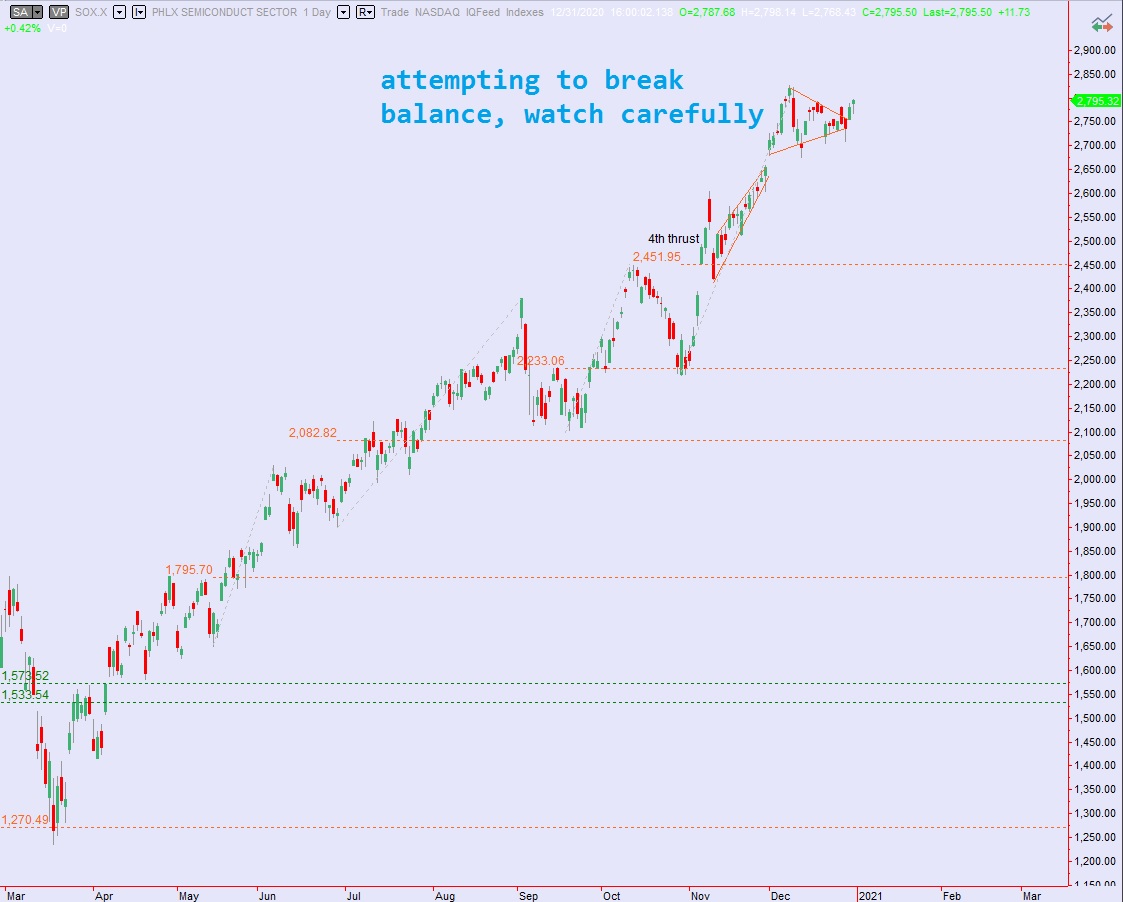

If you simply keep daily charts of the PHLX semiconductor index and the NASDAQ transportation index on your screens, your lenses into the world of speculative finance, you will be well on your way to understanding the market. Especially in the upcoming weeks. (see my notes regarding these two chart in Section IV of the Strategy Session).

Be also aware of FOMC minutes Wednesday afternoon, MU earnings Thursday AMC and Non-farm payroll Friday morning.

I have so much heckin’ more work to do. I work harder than the priests on Sunday. Because Sunday is the easiest day to out work the christians. And let there be no mistake—I am competing against all ideologies except for the simple premise of being a good neighbor and the most consistently profitable speculator to ever share their homework publicly.

With that, I bid you a happy new year and look forward to a strong cocked year of hustle and flow.

Raul Santos, January 3rd 2021

And now, the 319th edition of Strategy Session. Enjoy

Stocklabs Strategy Session: 01/04/21 – 01/08/21

I. Executive Summary

Raul’s bias score 3.53, medium bull. Buyers continue to hold price steady along the highs though Wednesday morning. Then watch for third reaction to the FOMC minutes Wednesday afternoon to dictate direction into Friday morning. Then look for third reaction to the nonfarm payroll data Friday morning to dictate direction into the weekend.

II. RECAP OF THE ACTION

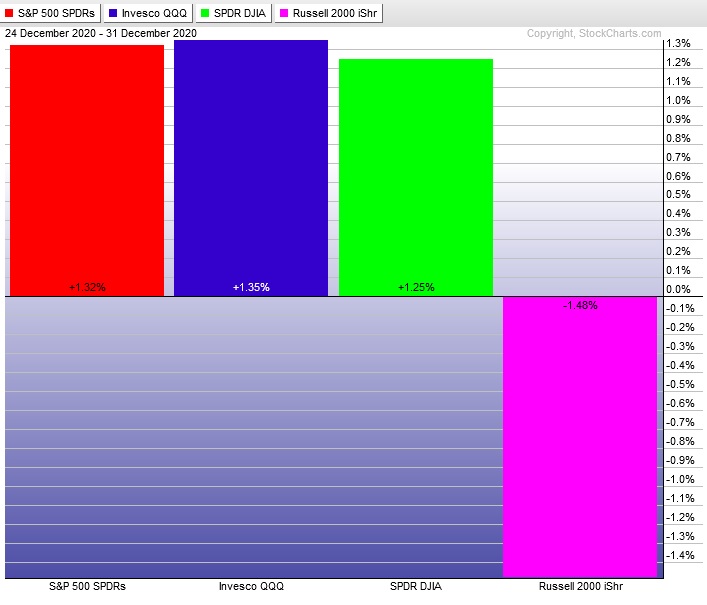

Gap up Monday then the rest of the shortened week spent marking time. Strong ramp Thursday afternoon into year-end. Closed Friday in observation of New Year’s day. The Russell 2000 bearish divergent after being bullish divergent the week prior.

The last week performance of each major index is shown below:

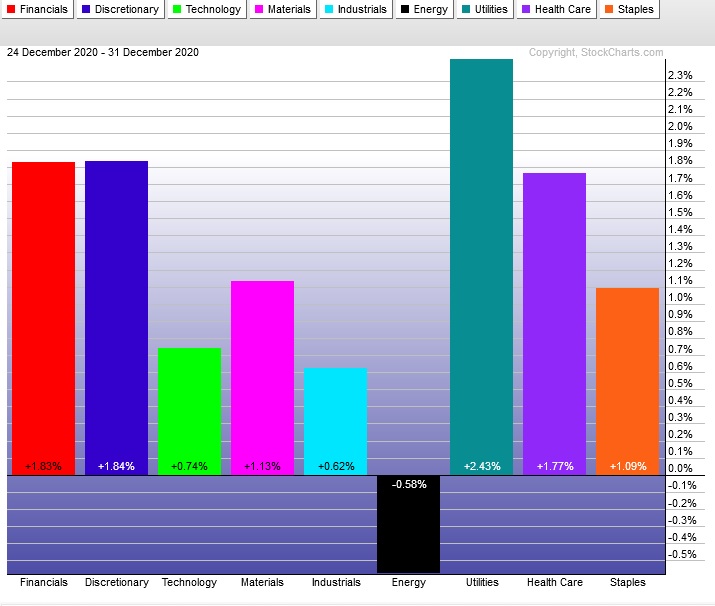

Rotational Report:

Sketchy leadership from Utilities.

caution bulls

For the week, the performance of each sector can be seen below:

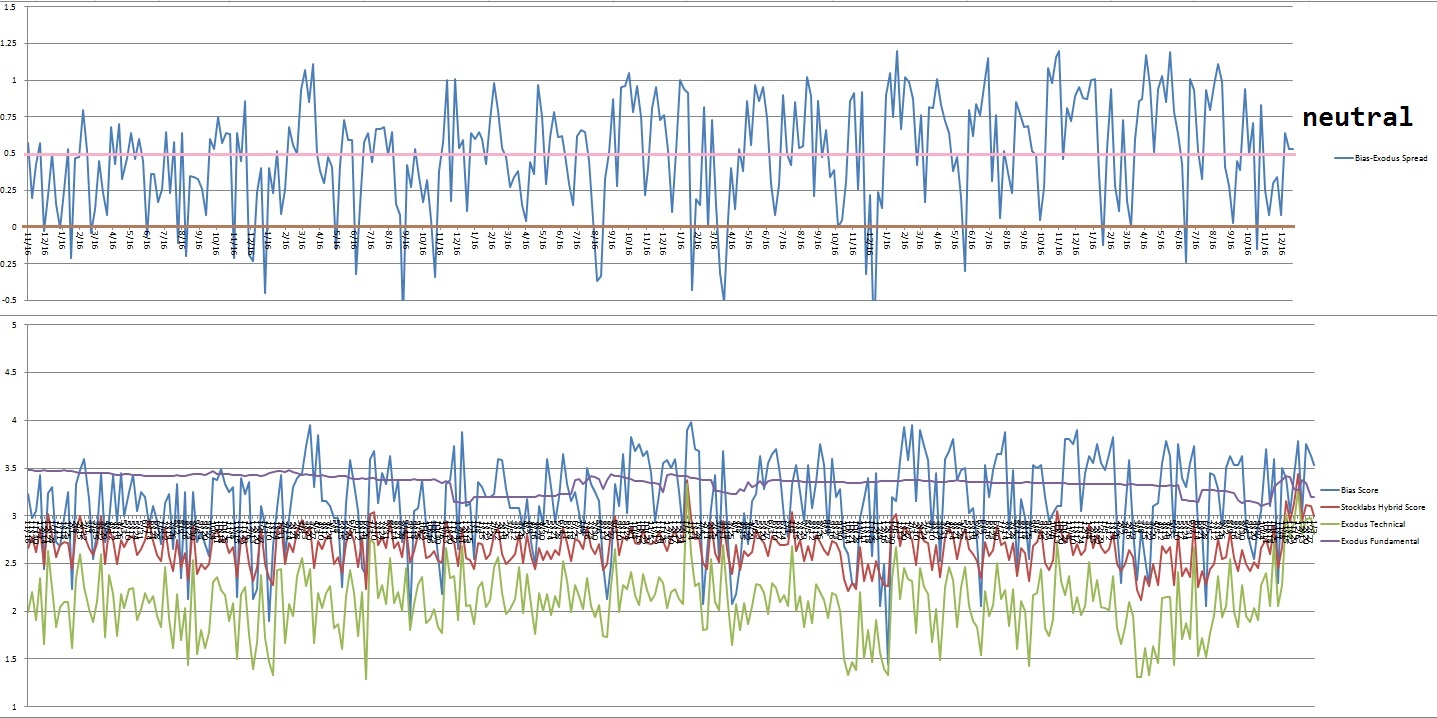

Concentrated Money Flows:

Industry flows still muted. No heavy money flows underway.

neutral

Here are this week’s results:

III. Stocklabs ACADEMY

User profiles

Many of the tools inside of Stocklabs are highly customizable. Some users are more advanced than others and one way to begin to understand how they use the software is to check out their profile. You can access a user’s profile by click the icon next to their name anywhere in the software. This will open a window with their recent commentary, their bio, portfolios, screens, watch lists and much more.

The follow feature allows you to receive update notifications any time that user makes a change.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Buyers continue to hold price steady along the highs though Wednesday morning. Then watch for third reaction to the FOMC minutes Wednesday afternoon to dictate direction into Friday morning. Then look for third reaction to the nonfarm payroll data Friday morning to dictate direction into the weekend.

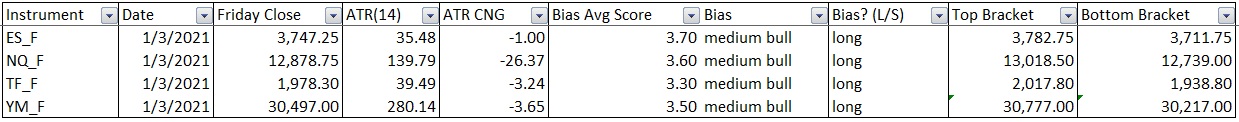

Bias Book:

Here are the bias trades and price levels for this week:

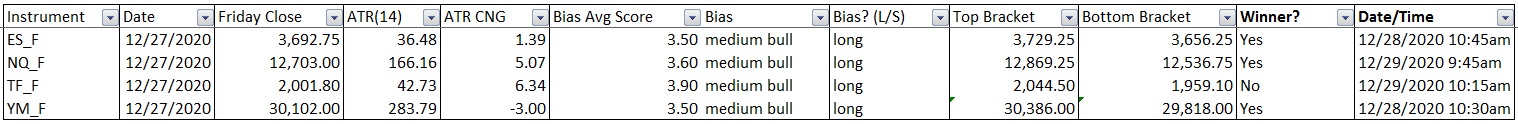

Here are last week’s bias trade results:

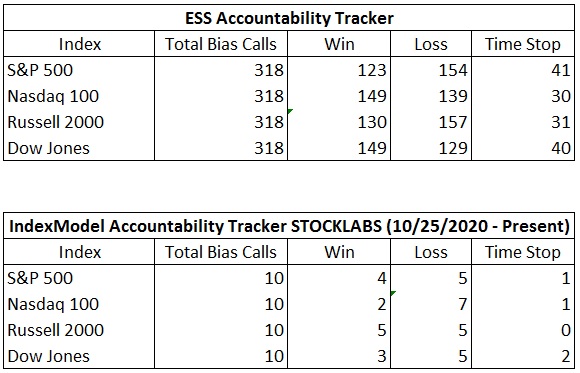

Bias Book Performance [11/17/2014-Present]:

Semiconductors attempt breakout, yes…Transports could still fail

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports continue to have the picture of a failed auction. The set-up is not confirmed until we print a strong daily red candle. Will that happen? We don’t know. But this key contextual sub-index could tell a story over the coming days. Monitor closely.

See below:

Semiconductors also could tell a story. This index is attempting to break balance and continue higher. Atop an extended rally. We need to monitor this attempt and gauge it. The success or failure of the consolidation breakout could lead the whole market.

Earnings out of key chip maker Micron Technologies Thursday after the bell might be the information needed to confirm the breakout (failed breakout) on the SOX.

See below:

V. INDEX MODEL

Bias model is neutral for a seventh consecutive week. No bias.

VI. QUOTE OF THE WEEK:

“The worst thing that can happen is death and that’s not the worst thing in the world either.” – John Stockdale

Trade simple, did you die?

If you enjoy the content at iBankCoin, please follow us on Twitter