NASDAQ futures are coming into the final day of October down -90 after an overnight session featuring extreme range and volume. Price dove lower during the settlement period Thursday afternoon, then continued steadily rotating lower through the night as investors reacted to several major earnings reports from Big Tech. The selling worked price down to a new weekly low, trading down to levels unseen since September 25th. Since then price has worked +200 off the lows. At 8:30am personal income and outlays data came out mixed, to slightly better than expected and as we approach cash open price is hovering in the lower quadrant of Thursday’s range.

The only other economic event today is consumer sentiment at 10am.

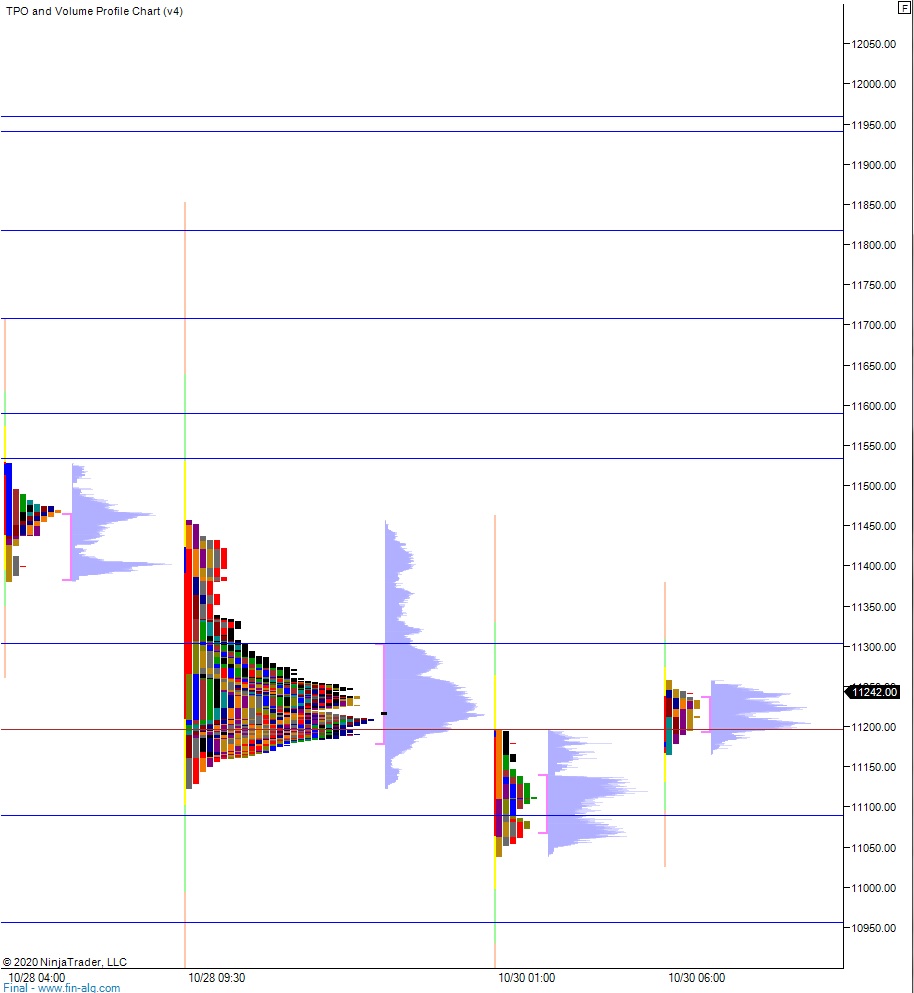

Yesterday we printed a double distribution trend up. The day began with a slight gap up and after a brief two-way auction buyers stepped in and drove price higher, rallying up into Wednesday’s midpoint before meeting any meaningful resistance. A battle ensued along Wednesday’s mid until about 1:15pm New York when buyers broke the intra-day range and drove up into the thin prices above 11,350. It was all buyers in control for the rest of the day, eventually taking out the Wednesday high by a few points before sellers re-engaged. Price was sort of fading off the highs into the close then, as noted earlier, price dove lower during settlement. We ended the session right on the mid.

Heading into today my primary expectation is for a choppy open. Look for sellers to move price down through the Thursday low 11,170.50. Look for buyers just below at the Wednesday gap 11,163.50 and for two-way trade to ensue.

Hypo 2 buyers press off the open, closing the overnight gap up to 11,322 then continue higher up through overnight high 11,339 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 11,300 setting up a run to 11,400.

Levels:

Volume profiles, gaps and measured moves: