NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price drove lower overnight, trading in a near unidirectional manner for the entire Globex session, starting shortly after closing bell Tuesday when Microsoft reported earnings. The selling accelerated overnight however. European markets were weak. The German DAX is currently pricing its 7th biggest down day of the year. At 8:30am U.S. goods trades deficit came out better than expected but did little to stem the wave of selling hitting early markets. As we approach cash open price is hovering above Monday’s low.

Also on the economic calendar today we have crude oil inventories at 10:30am, a 2-year note auction at 11:30am and a 5-year note auction at 1pm.

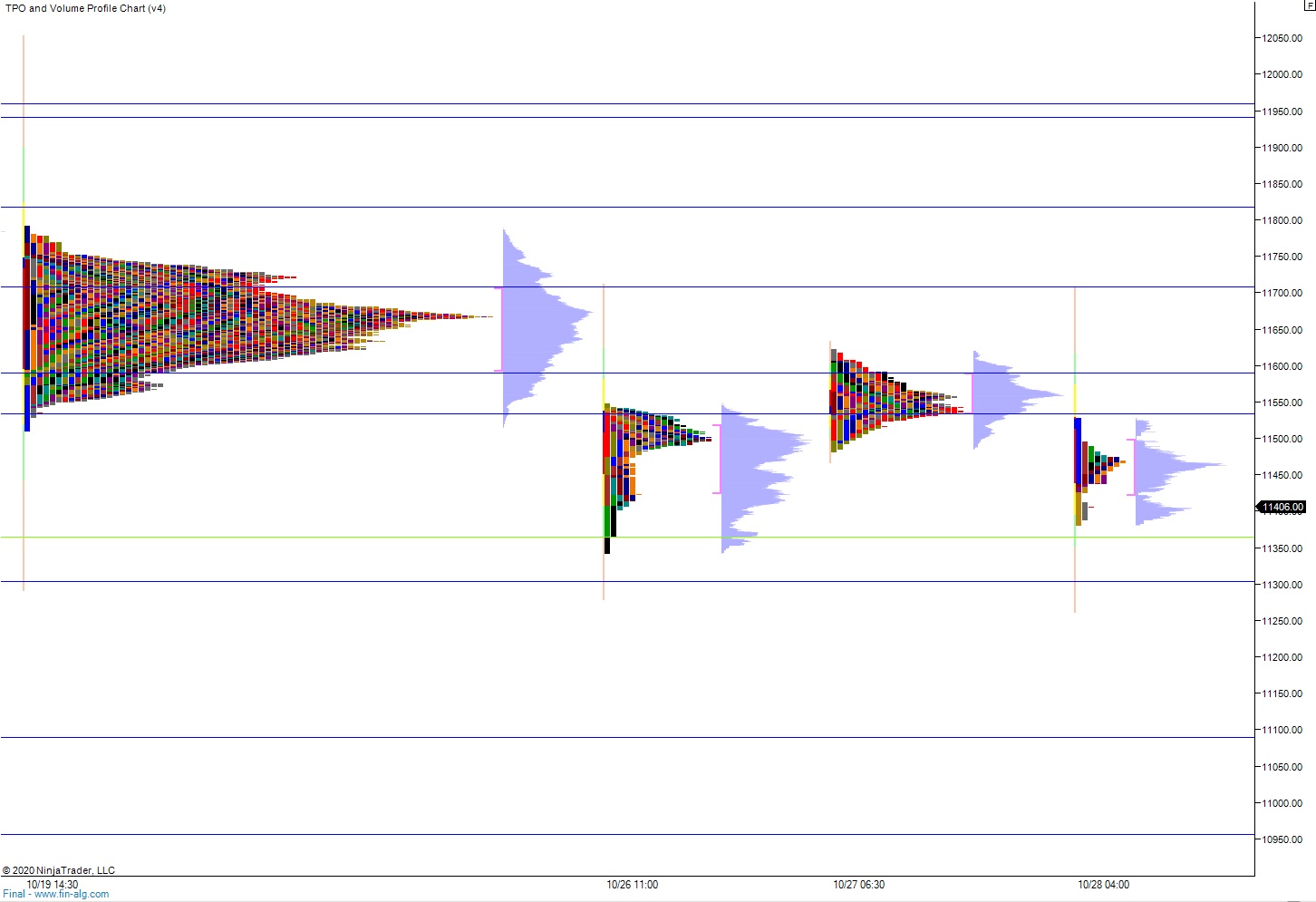

Yesterday we printed a normal variation up. The day began with a gap up that was quickly resolved during the open two-way auction. A second attempt lower was thwarted right before 10:30am, a few ticks below the Monday closing print. Low of day was in from there. Price was range extension up by mid-morning and after several hours of chop above the daily midpoint buyers ramped into the bell.

Normal variation up. Inside day.

Heading into today my primary expectation is for sellers to gap and go lower, trading down through overnight low 11,390.75 on their way to tagging 11,302 before two way trade ensues.

Hypo 2 half gap fill. Buyers work up to Tuesday low but cannot reclaim the 11,486 level. Choppy action along the lows.

Hypo 3 buyers work a full gap fill up to 11,593 then take out overnight high 11,604 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: