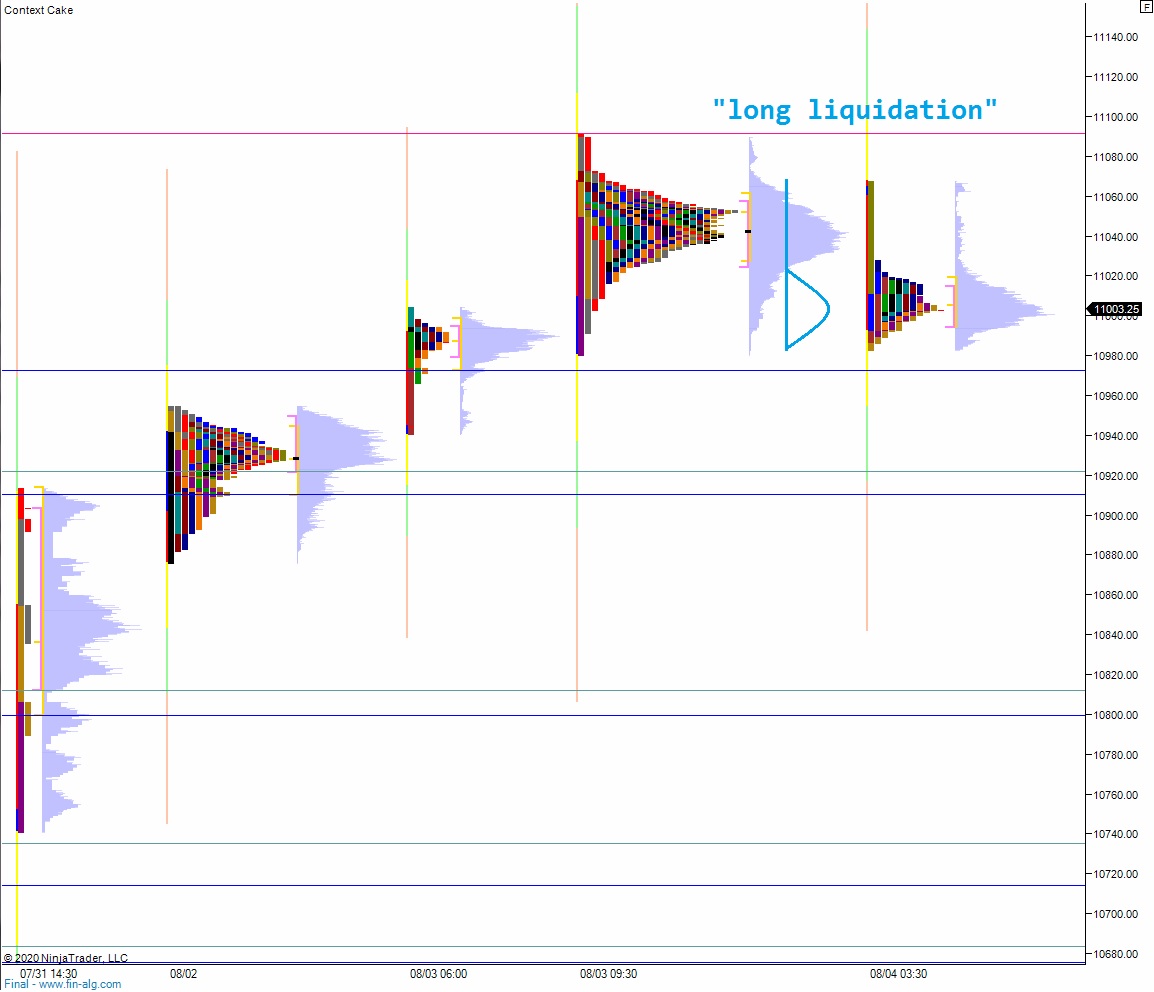

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme range and volume. Price poked higher overnight, setting a new record high before finding sellers around the key 3:30am New York hour. The rest of the session was spent rotating lower, and as we approach cash open, price is hovering around the lower quadrant of Monday’s range. The market profile structure is textbook long liquidation, forming a lowercase letter-b shape, which suggests a temporary phenomenon where sellers squeeze out longs then struggle to press lower (See the first chart below).

On the economic calendar today we have Factory orders at 10am.

Yesterday we printed a normal variation up. The day began with a gap up beyond last wee’ks range and buying drive that probed beyond all-time highs. The rest of the session was spent essentially marking time and accepting higher prices. Participants finally took the market range extension up by a few ticks around 2:30pm and we ended the day chopping along the topside of the daily midpoint.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 11,046.75. From here we continue higher, up through overnight high 11,092. Look for sellers up at 11,137 and two way trade to ensue.

Hypo 2 stronger buyers sustain trade above 11,137 setting up a move to tag 11,200.

Hypo 3 sellers press down through the Monday low 10,971.50 and find buyers right around here before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: