NASDAQ futures are coming into the last Tuesday in July with a slight gap down after an overnight session featuring extreme range and volume. Price popped higher after the bell Monday, pressing up near the upper quadrant of last Thusday’s range. Recall that last Thursday was a conviction sell day. That Globex rally lasted until about 9:15pm New York. The rest of the session was spent steadily rotating lower. As we approach cash open, price is hovering about +30 points above Monday’s midpoint.

On the economic calendar today we have consumer confidence at 10am followed by 2- and 7-year note auctions at 1pm.

Yesterday we printed a neutral extreme up. The day began with a gap up then an open test drive up. Buyers rejected an attempt right at opening bell by sellers to reclaim last Friday’s range. This set up a drive that lasted about 30 minutes. From there sellers stepped in, first taking price back to the midpoint, then after a bit of a battle pressing range extension down. During RE down buyers were unable to close the Friday gap. Instead buyers once again rejected a move into the Friday range. This time it kicked off a steady campaign higher, eventually pressing neutral and closing at session high.

Neutral extreme up.

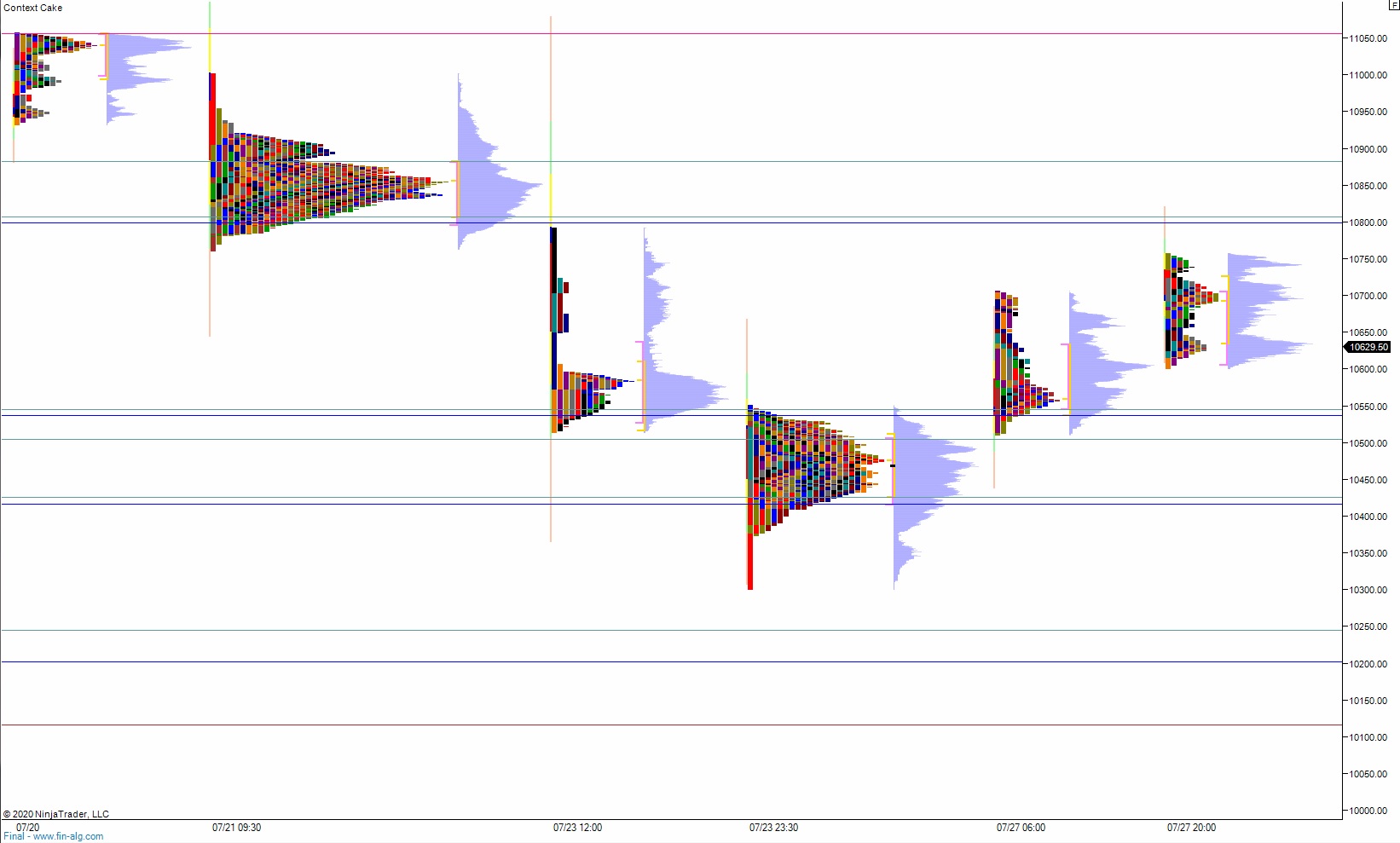

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 10,675.50. From here we continue higher, tagging 10,700 before two way trade ensues.

Hypo 2 stronger buyers sustain trade above 10,707.25 setting up a run up through overnight high 10,758.50. Look for sellers up at 10,795.75 and two way trade to ensue.

Hypo 3 sellers drive down through overnight low 10,601 off the open, setting up a tag of 10,546 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: