NASDAQ futures are coming into Monday gap up after an overnight session featuring extreme range and volume. Price first worked lower Sunday evening, trading down near the Friday midpoint before catching a bid around 7:30pm New York. The rest of the Globex session was spent campaigning higher, eventually taking out the Friday high around 10pm. At 8:30am durable goods orders came out stronger than expected. As we approach cash open, price is hovering above Friday’s high.

Also on the economic calendar today we have 6-month and 2-year note auctions at 11:30am followed by 3-month and 5-year note auctions at 1pm.

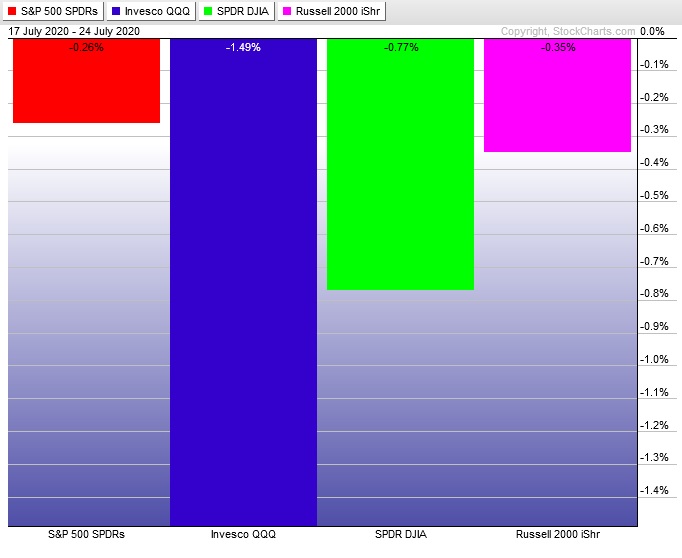

Last week we kicked off with a slight gap up across all major indices and eventually printed trend up across the board Monday. While the S&P and Dow were able to consolidate sideways for most of the week, the NASDAQ started to fade Thursday and by Friday it had given back all of Monday’s gains and more. The Russell demonstrated divergent strength into the second half of the week, suggesting investor risk appetite is running high. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation up. The day began with a gap down out of range. Sellers drove lower off the open, briefly trading down below the 4th of July levels. Within the first 15 minutes of trade a sharp excess lower formed. We spent the rest of the morning trading higher, eventually flirting with the Thursday low but buyers were unable to reclaim the range. Instead sellers pressed back down to the daily midpoint. Buyers held the mid and we spent the rest of the session chopping above it.

Heading into today my primary expectation is for buyers to gap and go higher, trading up through overnight high. Look for sellers up at 10,609.75 and two way trade ensues.

Hypo 2 stronger buyers run up to 10,637.50 before two way trade ensues.

Hypo 3 sellers work into the overnight inventory and close the gap down to 10,457.75. From here we continue lower, taking out overnight low 10,401. Look for buyers right here at 10,400 and two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: