NASDAQ futures are coming into Thursday with a gap up after an overnight session featuring elevated volume on extreme range. Price was balanced overnight, staying about +50 points higher and marking time initially selling off a bit after the bell when investors heard earnings from Tesla and Microsoft. That selling was erased during the evening. Then around 2am price spiked higher, taking out the Wednesday high for a bit. Since about 2:45am price has been on a steady rotation lower. At 8:30am jobless claims data came out mixed. As we approach cash open, price is hovering above Wednesday’s midpoint.

On the economic calendar today we have 4- and 8-week T-bill auctions at 11:30am followed by a 10-year TIPS auction at 1pm.

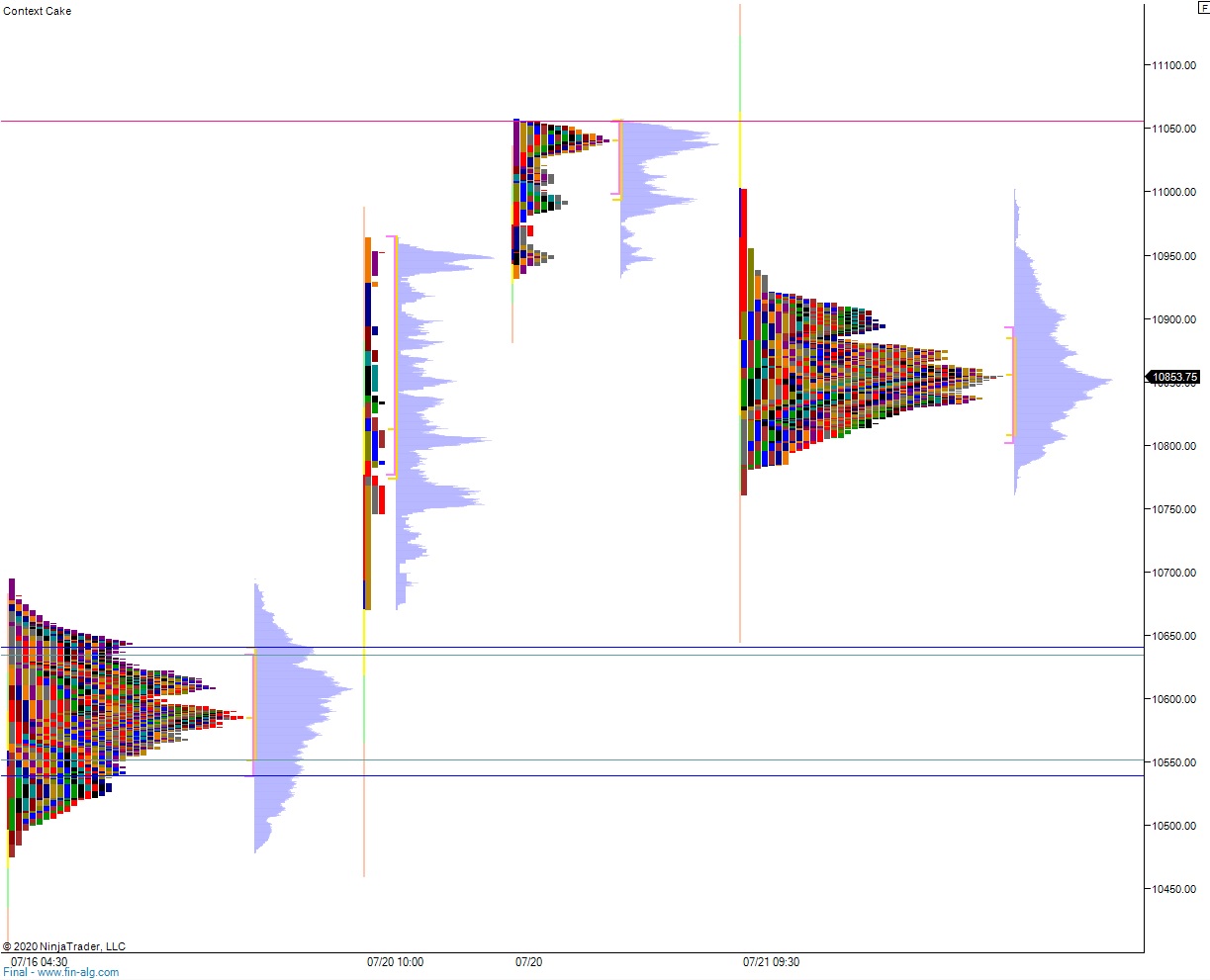

Yesterday we printed a normal variation down. The day began with a slight gap down. Buyers resolved the overnight gap during an open two-way auction in raneg. Said buyers managed to tag the Tuesday VPOC before sellers stepped in and worled price range extension down, taking out the Tuesday low along the way. Just a few point below Tuesday low responsive buyers stepped in and formed an excess low. The rest of the day was spent crossing back and forth over the daily midpoint. We ended the day with some selling during the settlement period.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up through overnight high 10,938.50. This sets up a tag of 11,000 before two way trade ensues.

Hypo 2 sellers press down through overnight low 10,795.25. Buyers defend 10,778 and two way trade ensues.

Hypo 3 stronger sellers sustain trade below 10,778 setting up a run down to 10,700.

Levels:

Volume profiles, gaps and measured moves: