NASDAQ futures are coming into Wednesday with a slight gap down after an overnight session featuring extreme range and volume. Price worked higher overnight, spending much of the Globex session working higher then balancing along Tuesday’s midpoint. Then around 6am New York sellers stepped in and reversed the evening gains. As we approach cash open, price is hovering in the lower quadrant of Tuesday’s range.

On the economic calendar today we have a 2-year floating rate note auction at 11:30am, 5-year note auction at 1pm and the Fed Beige Book at 2pm.

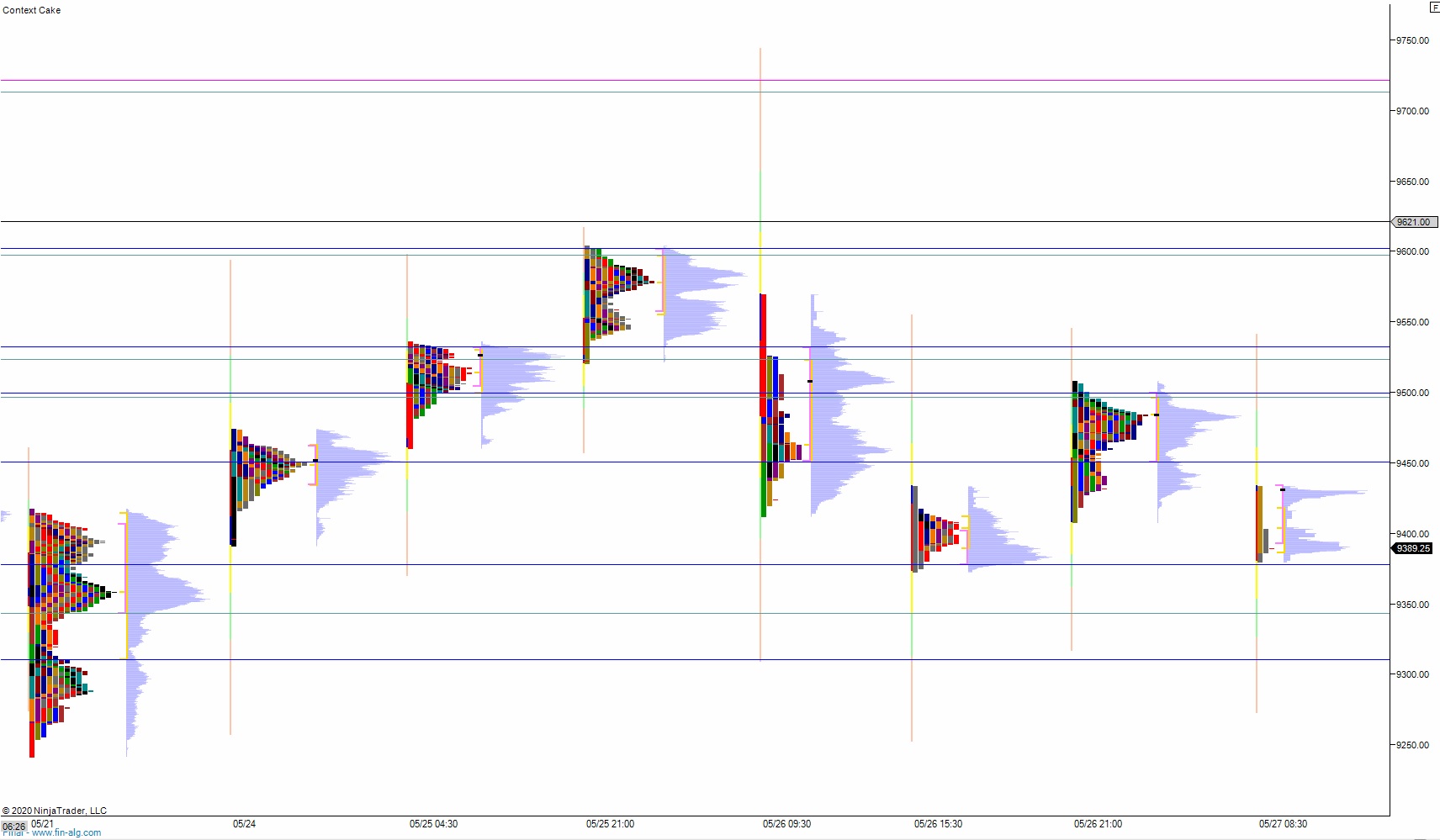

Yesterday we printed a double distribution trend down. The day began with a gap up to a new cash swing high. The actual swing high was set around 3am though, during globex. The market continues attempting to mark swing high outside of cash hours which statistically is uncommon. From the open we had a selling drive lower, working back down near last Friday’s range before finding a responsive bid. Said buyers nearly worked back to the daily midpoint before a second wave of selling came in. We ended the day near session low.

Heading into today my primary expectation is for sellers to press down through overnight low 9375, setting up a move to tag 9343.75 before two way trade ensues.

Hypo 2 buyers work higher, trading up to 9450.50 before two way trade ensues.

Hypo 3 stronger buyers trade up through overnight high 9508 and sustain trade above it, setting up a run to 9523.25.

Levels:

Volume profiles, gaps and measures moves:

Thank you very much Mr. Santos, it was an awesome day