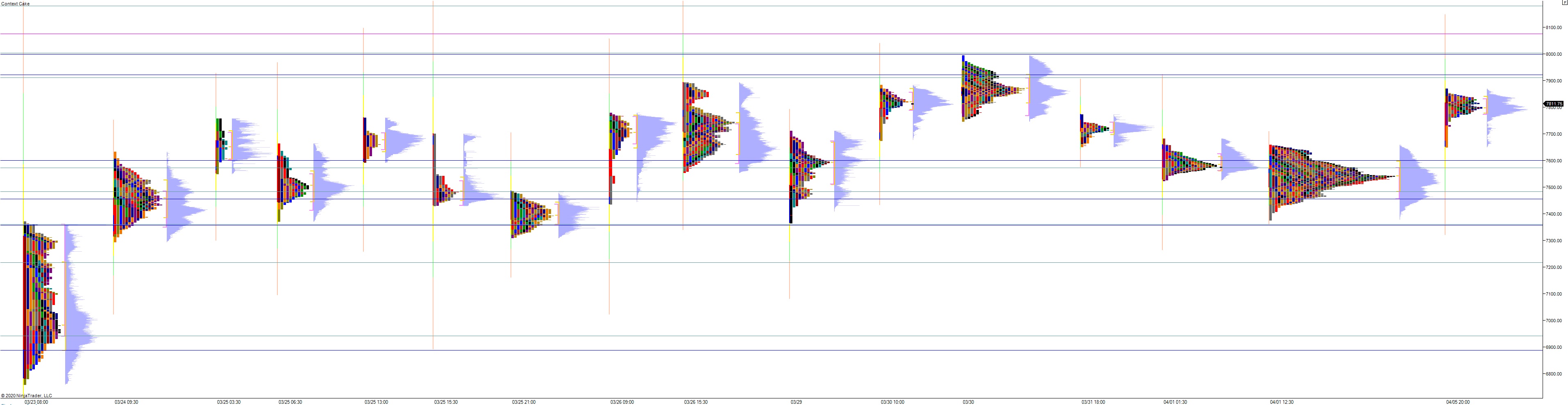

NASDAQ futures are coming into the week pro gap up after an overnight session featuring extreme range and volume. Price drove higher from Globex open (6pm eastern) until about 8pm, working up to the 7800 century mark which aligns with the lower quadrant of last Tuesday’s range. After a bit of flagging/consolidation a second leg higher took price up near last Tuesday’s midpoint before we settled into balance. As we approach cash open, price is hovering along the 7800 century mark.

On the economic calendar today we have 13- and 26-week T-bill auctions at 11:30am followed by a 3-year note auction at 1pm.

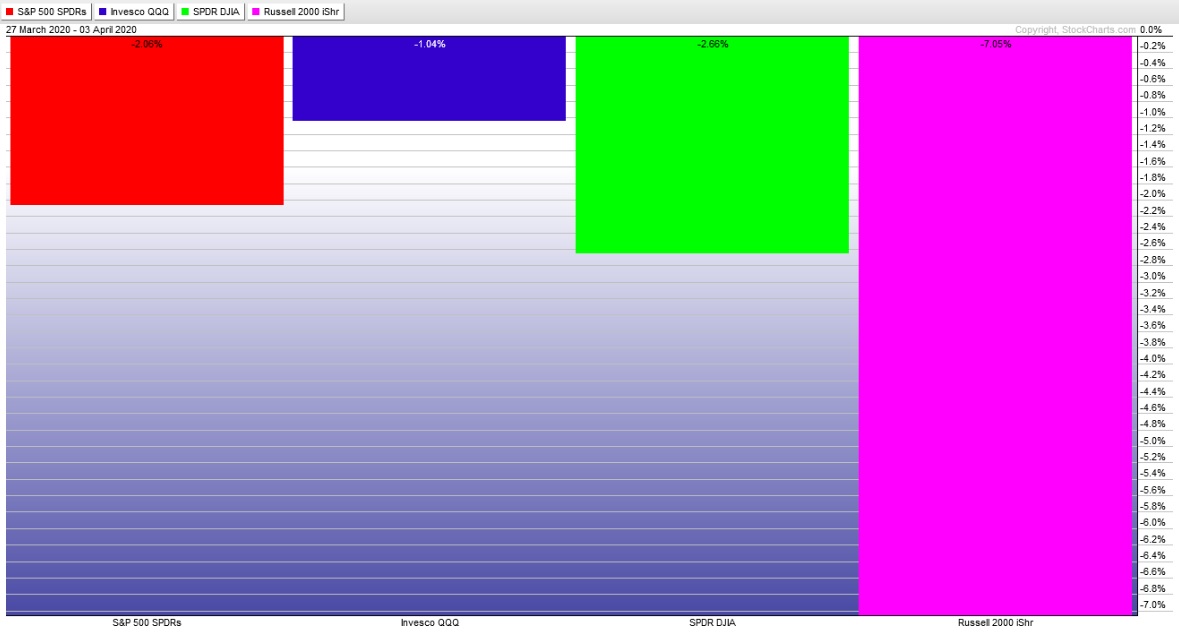

Last week began with a smaller up gap, then a buying campaign that ran higher through early Tuesday. From mid-Tuesday on sellers controlled the tape. Wednesday morning saw prices gap down to a new weekly low then Wednesday formed a wide range as most of the day was spent discovering lower prices. For most indices, the rest of the week was spent trading inside the Wednesday range, balancing. The Russell was slightly divergent to the downside. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down. The day began with a gap down in range that buyers quickly resolved on the open. Said buyers took price a few ticks beyond the Thursday high but were unable to break balance. Instead responsive sellers worked price back down through value, rotating down near the range lows (but not exceeding them). Then late in the day a ramp took price back up to value. This action all took place after much worse-than-expected Nonfarm payroll data. This resilience of the tape to weak economic data told a story.

Heading into today my primary expectation is for sellers to work into the overnight inventory and tag the 7700 composite VPOC. Buyers show up here and work price up through overnight high 7870 setting up a run to 7908.50 before two way trade ensues.

Hypo 2 stronger sellers work down to 7600 before two way trade ensues.

Hypo 3 even stronger sellers work a full gap fill down to 7518.25. Look for buyers down at 7484.75 and two way trade to ensue.

Levels:

Volume profiles, gaps and measured moves: