NASDAQ futures are coming into Wednesday gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, in part due to strong earnings from Apple after the close Tuesday.

Apple Q1 EPS $4.99 Vs $4.18 Last Year

Shares of the most valuable public company in the world are up just shy of +2% in pre-market trade.

As we approach cash open, the NASDAQ is currently trading up beyond Tuesday’s range, inside the lower quadrant of last Friday’s trend down.

On the economic calendar toady we have pending home sales at 10am, crude oil inventories at 10:30am and then an FOMC rate decision at 2pm. The consensus is for no change to the Fed’s benchmark borrowing rate, however investors will be keen on any word use and tone from the Fed Chairman when he delivers a press conference at 2:30pm.

Also be aware that the second and fifth largest companies report earnings after the bell today, Microsoft and Facebook. Both are potential index movers. Tesla also reports after the bell.

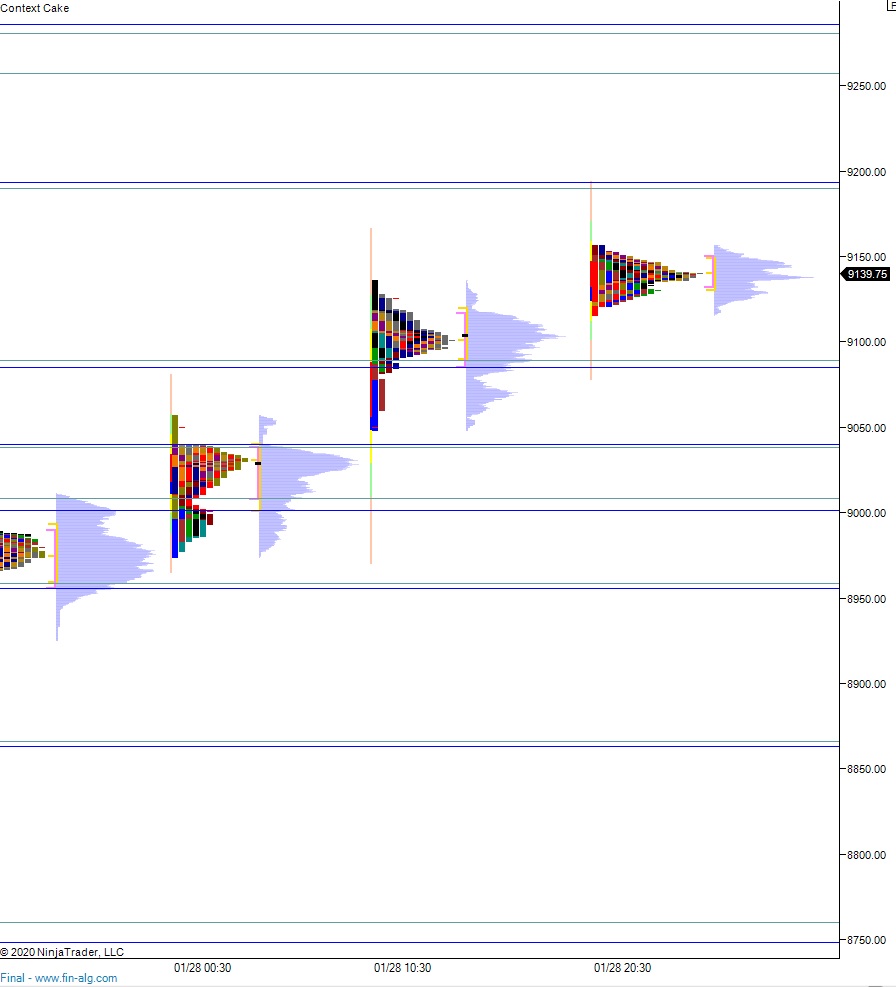

Yesterday we printed a double distribution trend up. The day began with a gap up near the Monday high, and after a two-way auction buyers stepped in and drove price higher. Price went slowly trend up all day before coming into a tight balance near the end of the session, just below last Friday’s range.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 9103.75. Then we continue lower, down through overnight low 9091.75. Look for buyers down at 9089.25 then chop. Then look for the third reaction after the Fed presser to provide direction into the close.

Hypo 2 stronger sellers trade down to 9040. Then look for the third reaction after the Fed presser to provide direction into the close.

Hypo 3 buyers gap and go higher, trading up through overnight high 9157 setting up a move to target 9192 before two way trade ensues. Then look for the third reaction after the Fed presser to provide direction into the close.

Levels:

Volume profiles, gaps, and measured moves: