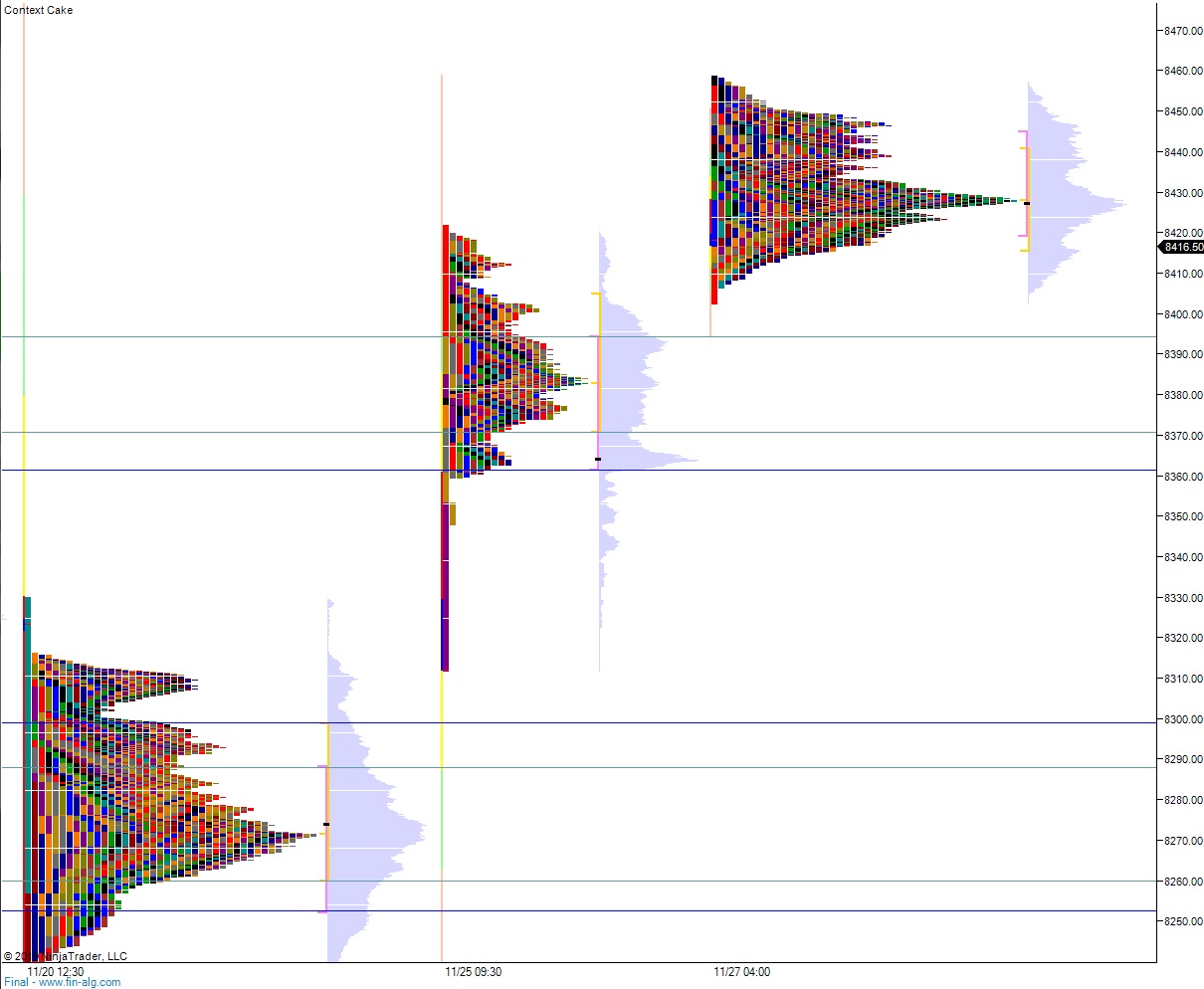

NASDAQ futures are coming into the week flat after an overnight session featuring extreme volume on elevated range. Price was balanced overnight, rotating a few points beyond last week’s high before slowly moving down back near the Friday low. As we approach cash open, we are off the low by about 10 points and flat verses last week’s close.

On the economic calendar today we have ISM employment/manufacturing at 10am followed by both 13- and 26-week T-bill auctions at 11:30am.

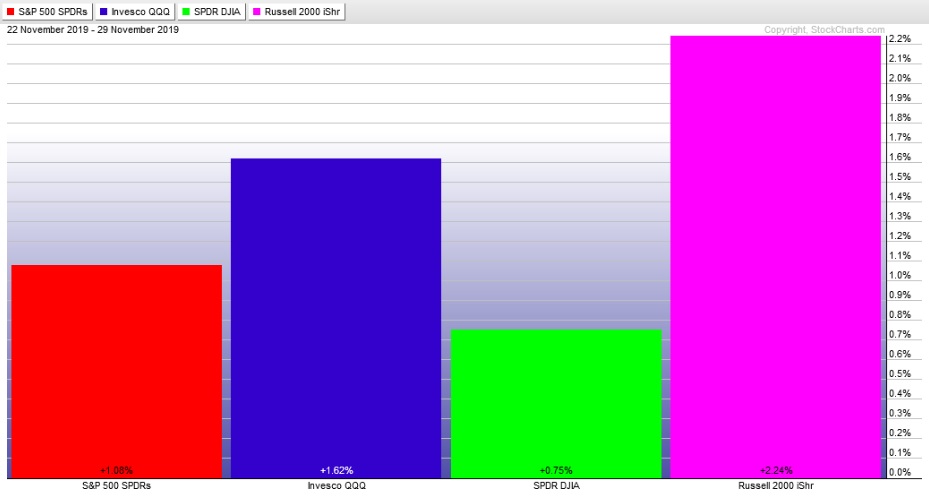

Last week we rallied. We came into the week gap up and drove higher. The rally extended through Wednesday. Thursday markets were closed in observation of Thanksgiving. Friday was a half day and price slowly rotated lower. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation down. The day began with a gap down, down near the Wednesday midpoint. Buyers made a slight move higher, but were unable to fill the gap. Instead sellers pressed range extension down through noon. As the market came to a halt around 1:15pm New York, a slight ramp occurred, sending price back up to the midpoint.

Heading into today my primary expectation is for buyers to work higher, closing the Wednesday gap 8453.75 and trading up through overnight high 8457.25 before two way trade ensues.

Hypo 2 sellers press down to 8400 before buyers step in and two way trade ensues.

Hypo 3 stronger buyers trade up to 8479.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: