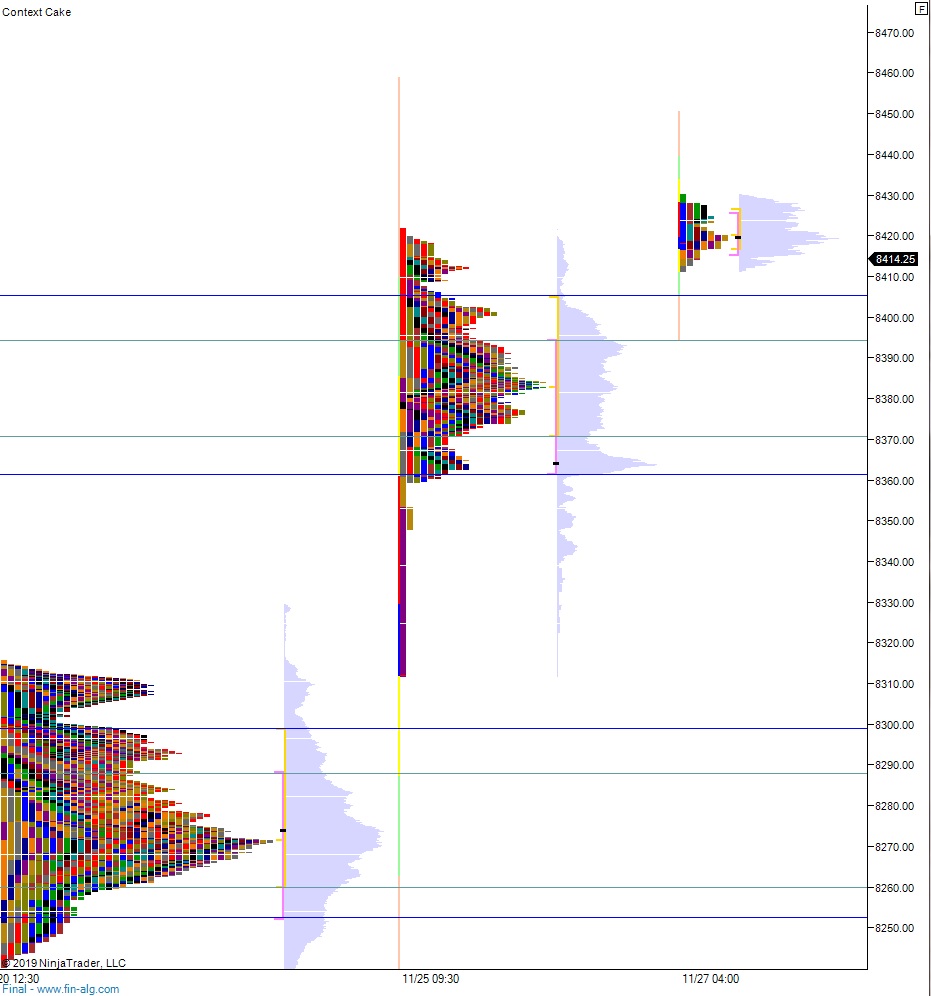

NASDAQ futures are coming into the last full trading session of the month with a slight gap up after an overnight session featuring normal range on elevated volume. Price worked higher overnight, tagging a new all-time high. As we approach cash open, price is hovering near the high, above the Tuesday range.

There are several economic events today, all of low impact. Chicago purchasing manager 9:45am, PCE core and pending home sales and 4- and 8-week T-bill auctions at 10am, crude oil inventories at 10:30am, 7-year note auction at 11:30am and Fed Beige Book at 2pm.

Yesterday we printed a normal variation up. The day began with a slight gap up that was resolved during an open two-way auction. Buyers eventually stepped in and worked the market range extension up. The afternoon was spent rotating back to the daily midpoint before a late-session ramp returned price to the day’s high. The overnight stat was never taken out.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 8430.25 on their way to 8450 before two way trade ensues.

Hypo 2 sellers press down through overnight low 8390.50 before two way trade ensues.

Hypo 3 tight chop from 8405.25 to 8430.25.

Levels:

Volume profiles, gaps and measures moves:

CRAM