NASDAQ futures are coming into Wednesday gap down after an overnight session featuring elevated range on extreme volume. Price worked lower overnight, working down through overnight low by midnight and sustaining trade below it. As we approach cash open, price is a few points below the Tuesday low.

On the economic calendar today we have crude oil inventories at 10:30am followed by FOMC minutes at 2pm.

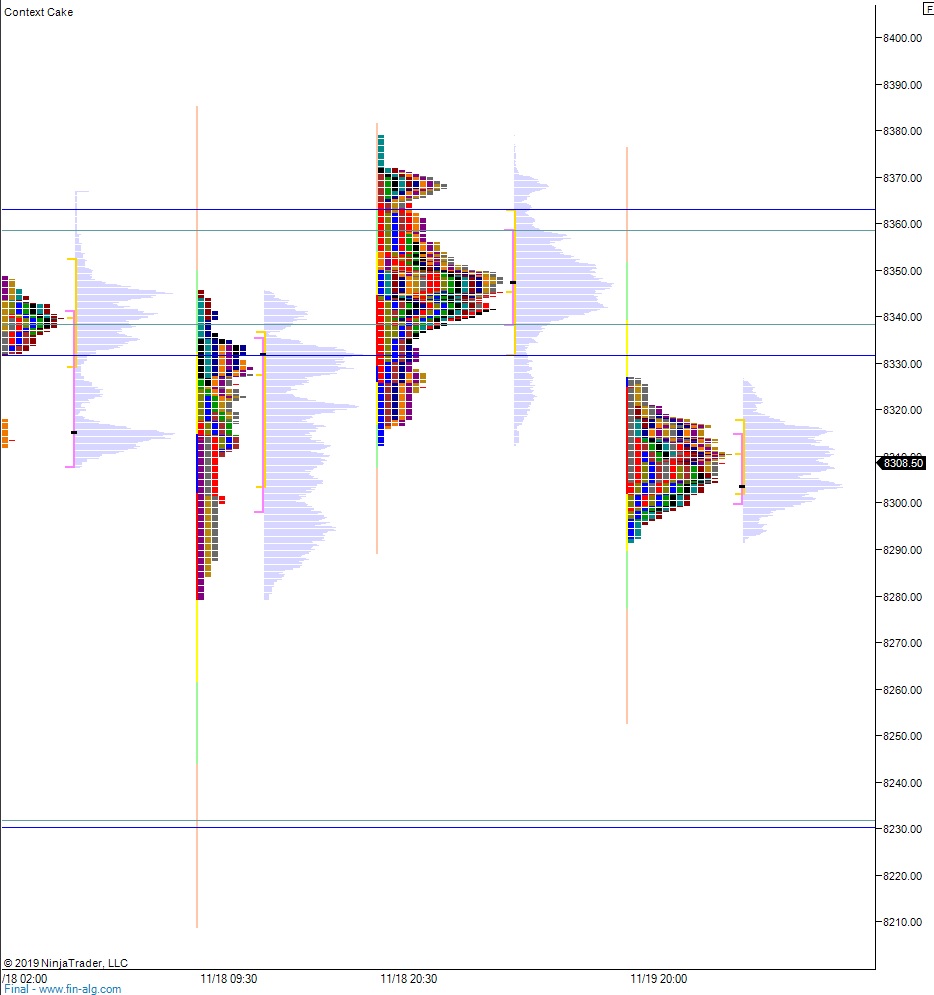

Yesterday we printed a normal variation down. The day began with a gap up to new all-time highs. High was set during globex. Before buyers could work up through globex high, sellers were active, driving lower on the open to close the overnight gap. Sellers continued lower, tagging the Monday midpoint before rotating back up through the daily midpoint and chopping above it into the close.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 8338.50. From here we continue higher, up through overnight high 8343.25 before two way trade ensues.

Hypo 2 buyers pres sup to 8358.75 before two way trade ensues.

Hypo 3 sellers gap-and-go down, taking out overnight low 8291.50 which sets up the gap fill down to 8265.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: