NASDAQ futures are coming into Wednesday gap up after an overnight session featuring extreme range and volume. Price worked down through the Tuesday low briefly overnight before rallying up near the cash session’s highs. Eventually price balanced out above the Tuesday midpoint. AS we approach cash open, price is attempting to break down-and-away from that overnight balance, and is floating just above the Tuesday mid.

On the economic calendar today we have Fed Chairman Jay Powell taking part in a listening event over in Kansas at 10:30am along with crude oil inventories at the same time. At 1pm there is a 10-year note auction then at 2pm the FOMC minutes.

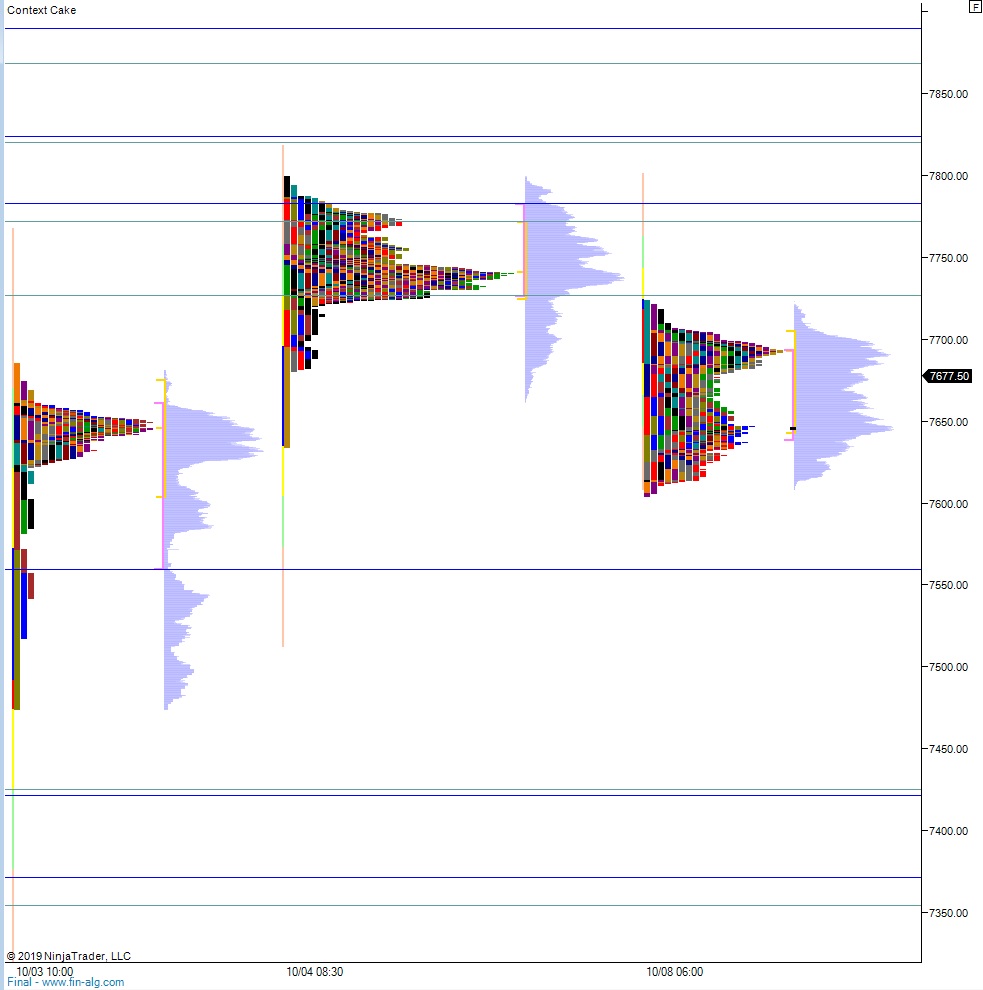

Yesterday we printed a neutral extreme down. The day began with a gap down and drive lower, trading down into the upper quadrant of last Thursday’s trend up before coming into balance and rallying higher. The rally took price up near the Monday low before sellers again stepped in and worked price lower, eventually pushing us to a new low-of-day and into a neutral print. Closing on the lowers sealed the deal as a neutral extreme down.

Heading into today my primary expectation is for sellers to poke down into the tape, trading down to 7666 before finding buyers who work price up through overnight high 7719. Price continues higher, closing the open Monday gap at 7739.25 before two way trade ensues.

Hypo 2 sellers work a full gap fill down to 7622 then continue lower, down through overnight low 7604. Look for buyers down at 7600 and two way trade to ensue.

Hypo 3 stronger sellers press price down to 7560 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: