NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme range and volume. Price was balanced for most of the overnight session chopping along the Tuesday midpoint before rate cuts from other country’s central banks briefly spiked price higher–poking above the Tuesday high. The buy spike was erased through much of the early AM hours here in America before the selling accelerated around the time President Donald Trump sent out a series of tweet criticizing Federal Reserve policy:

“Three more Central Banks cut rates.” Our problem is not China – We are stronger than ever, money is pouring into the U.S. while China is losing companies by the thousands to other countries, and their currency is under siege – Our problem is a Federal Reserve that is too…..

— Donald J. Trump (@realDonaldTrump) August 7, 2019

As we approach cash open, price is hovering just below Wednesday’s low.

On the economic calendar today we have crude oil inventories at 10:30am, a 10-year note auction at 1pm and consumer credit at 3pm.

Yesterday we printed a neutral day. The day began with a gap up into the upper quadrant of Monday range. Buyers made a drive higher off the open but were unable to take out the Monday high before sellers stepped in and worked us into a range extension down. Said selling formed an excess low just before New York lunch and up above Monday’s lower quadrant. This led to a rally back up through the daily high and briefly above Monday’s high before we closed the session back near the low end of the upper quad.

Neutral.

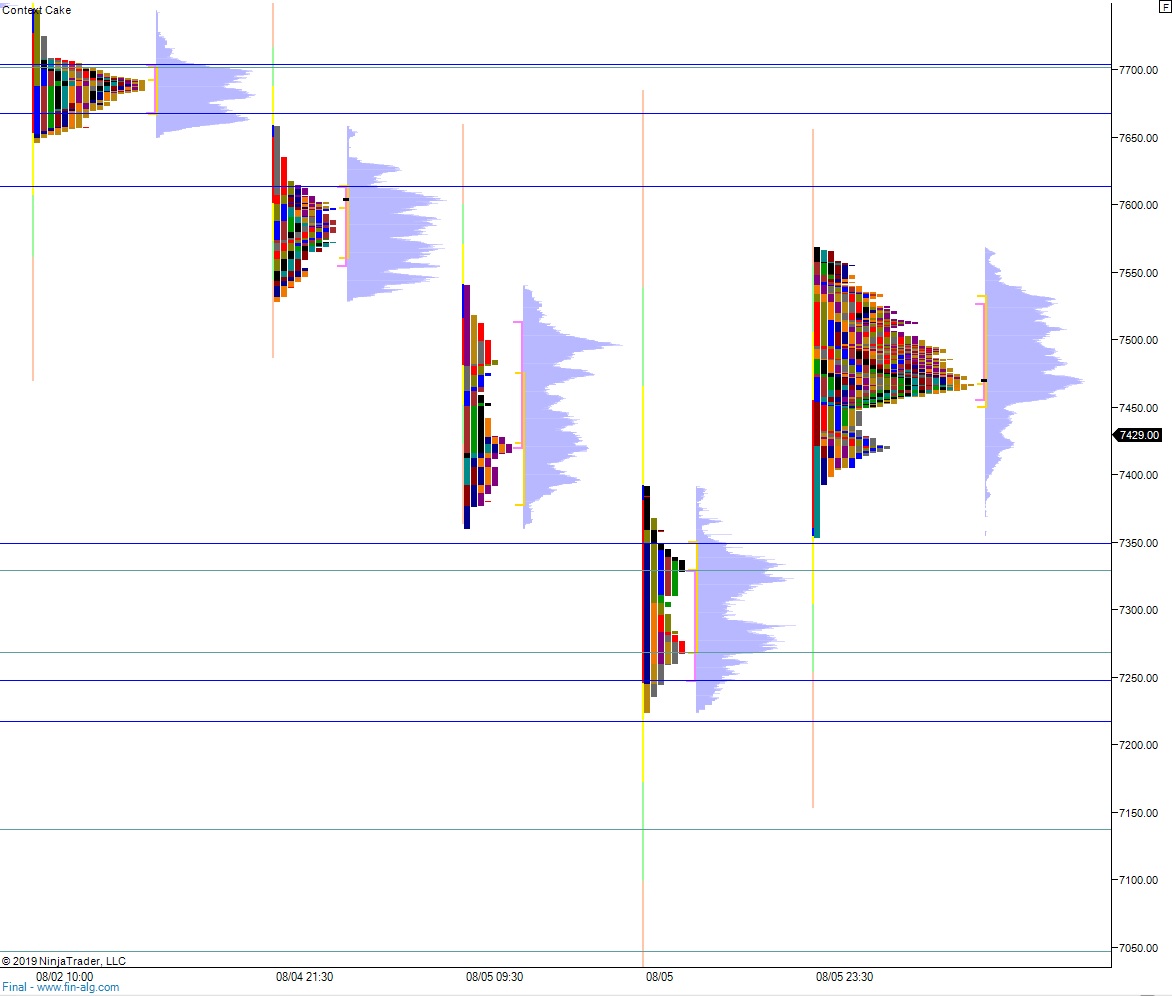

Heading into today my primary expectation is for sellers to press down to the 7400 century mark before discovering responsive buyers. Said buyers work price back up to 7450 before two way trade ensues.

Hypo 2 buyers work into the overnight inventory and close the gap up to 7514.50 setting up a move to take out overnight high 7569. Look for sellers up at 7588.75 and two way trade to ensue.

Hypo 3 strong sellers press down to 7350 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: