NASDAQ futures are coming into Monday pro gap down after an overnight session featuring extreme range and volume. Price drove lower overnight, trading down into levels unseen since mid-June. The move is being attributed to the Chinese Yuan weakening, which many are calling a manipulation on China’s behalf and a potential sign that trade negotiations between USA and China are worsening. As we approach cash open, price is hovering inside the 06/17 range, well below last week’s levels.

Pro gap down.

On the economic calendar today we have ISM non-manufacturing at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

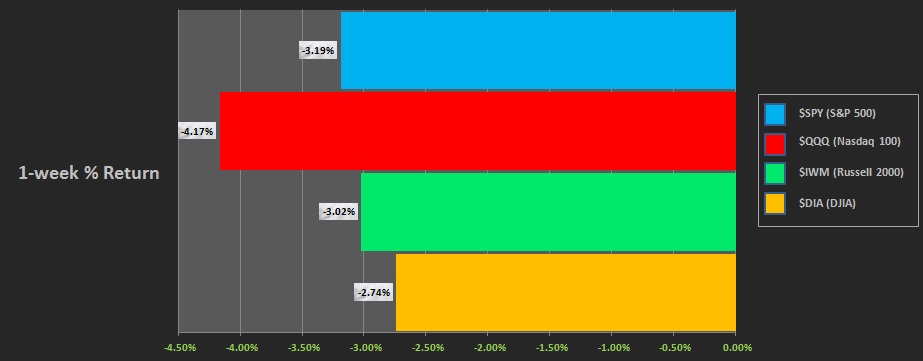

Last week kicked off with indices down slightly across the board then marking time as we awaited the Fed rate cut. Third reaction after the cut was a sell which was followed by a strong liquidation lower. Thursday, the first of August, saw buyers erased most of the Fed sell-off before a series of tweets from President Donald Trump regarding the trade negotiations sent prices back down to the Fed rate cut reaction lows. Friday was a gap down and move lower across the board, with markets coming into a choppy balance ahead of the weekend. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap down and out of Thursday’s range. Sellers rejected any notion of reclaiming the Thursday range, instead price worked lower, taking out July’s low before coming into balance inside the 06/28 range.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up to 7600. Sellers defend the century mark and we press down through overnight low 7529.25. Look for buyers down at 7506.25 and two way trade to ensue.

Hypo 2 stronger buyers sustain trade above 7600 setting up a move to target 7667.50. Sellers here attempt to defend the Friday low 7650.25 but are overrun as buyers continue working price up to a full gap fill at 7702 then up through overnight high 7709 before two way trade ensues.

Hypo 3 gap-and-go lower, sustain trade below 7500 setting up a liquidation down to 7437 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: