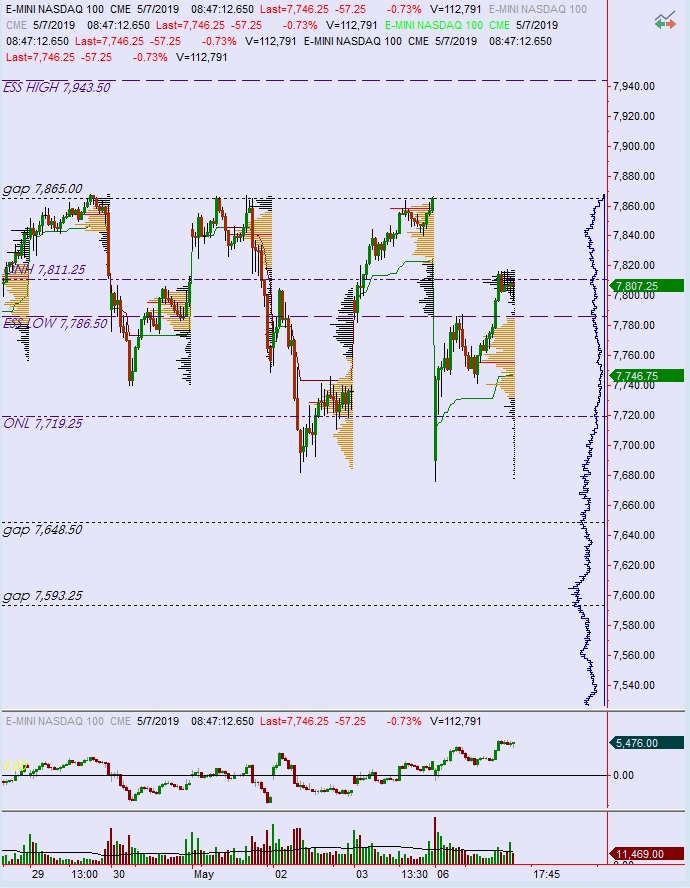

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme range and volume. Price was choppy overnight, real choppy (90 point range, circumnavigated thrice) bouncing along inside of the Monday range. As we approach cash open, price is hovering just below Monday’s midpoint.

On the economic calendar today we have a 3-year note auction at 1pm followed by consumer credit at 3pm.

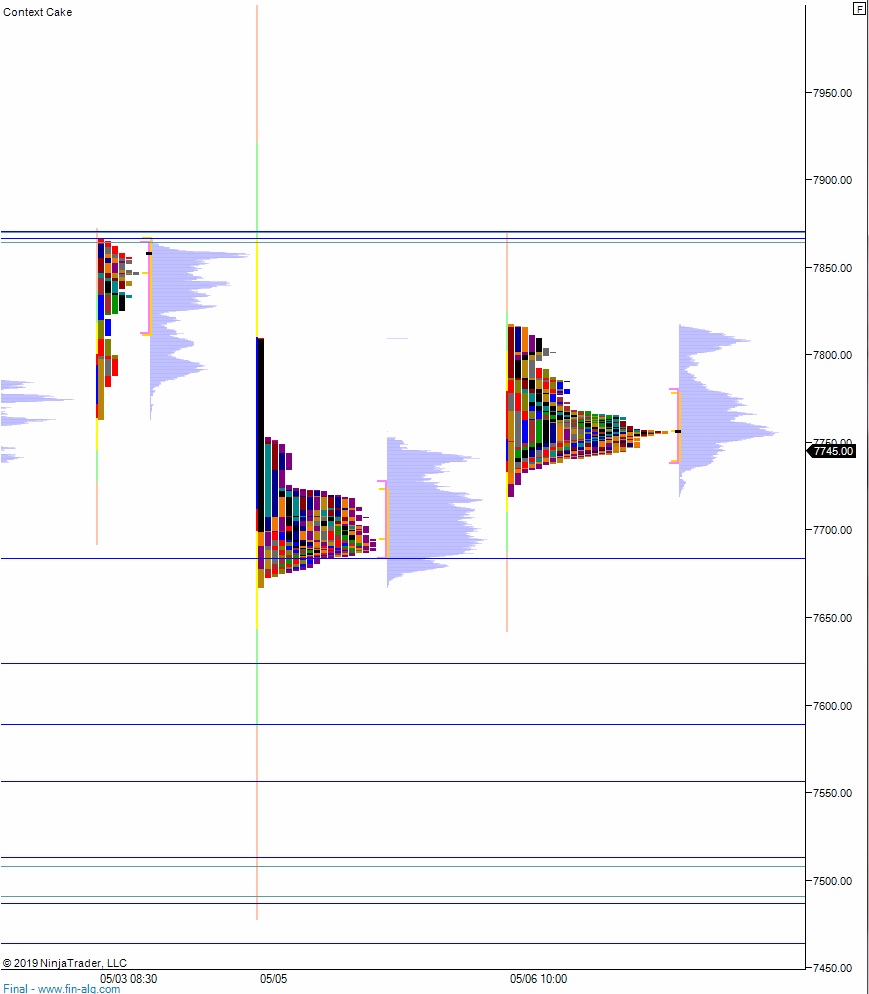

Yesterday we printed a double distribution trend up. The day began with a gap down that was driven by news from the ‘Trade Wars’ battlefront. A quick poke below last Thursday’s low during the opening two-way auction discovered a strong responsive bid and sparked a drive higher. The drive puttered out right at the weekly lower ATR band 7786.50 and retraced a bit before buyers became initiative (initiative relative to Monday’s open, responsive relative to Friday’s close) and put together a second drive higher, trading up beyond 7800 before ultimately settling into the century mark by end of day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and trade up to 7786.50 before we tighten up and chop for the rest of the day.

Hypo 2 sellers gap-and-go lower, trading down through overnight low 7719.25 to set up a move to target 7700. Look for buyers down at 7683.75 and two way trade to ensue.

Hypo 3 stronger buyers work a full gap fill up to 7807.25 setting up a move to close the weekly gap up at 7865 before balance ensues.

Levels:

Volume profiles, gaps, and measured moves: