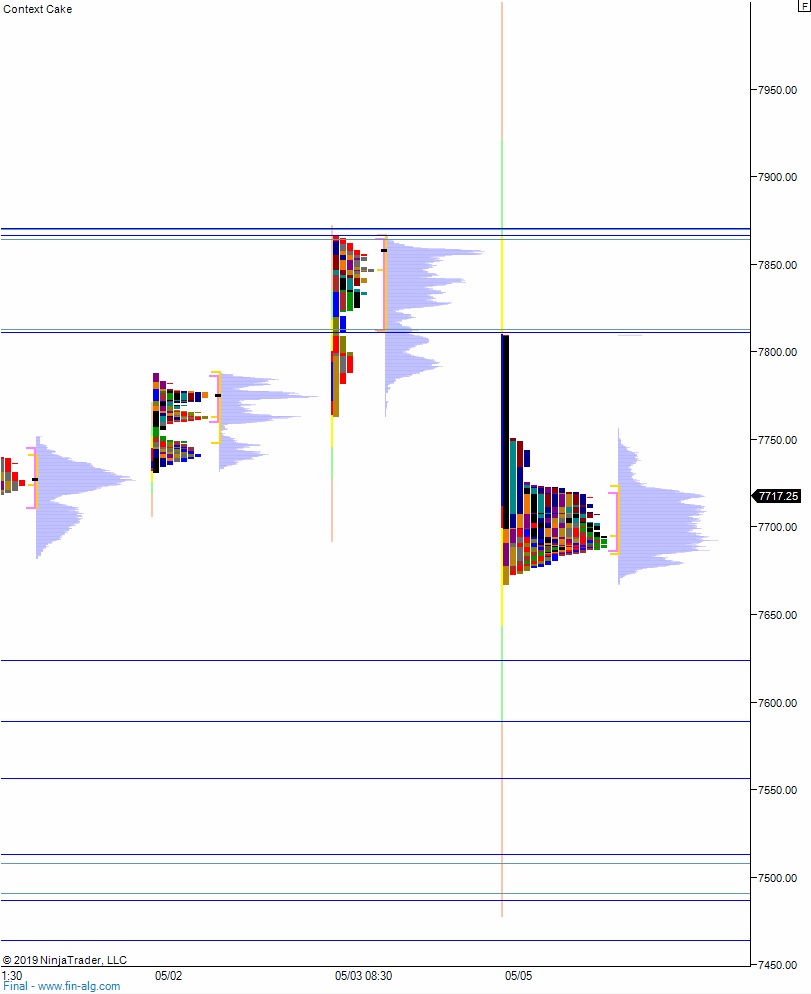

NASDAQ futures are coming into Monday pro gap down after an overnight session featuring extreme range and volume. Globex gapped down into the Sunday evening open and proceeded to liquidate down to a new two-week low before coming into balance. The move is news driven, after the White House went on offense in the ongoing tariff talks with China. As we approach cash open, price is hovering inside of last Thursday’s range.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am.

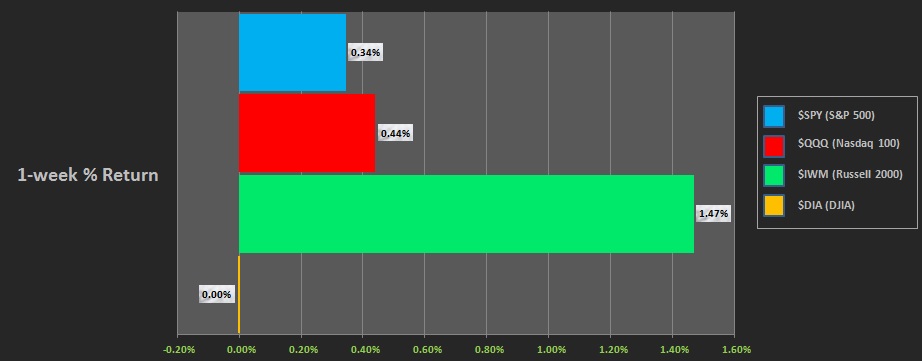

Last week was choppy early on, ultimately giving way to sellers Wednesday afternoon and continuing into Thursday morning before finding a strong responsive bid. Buyers then took the markets trend up into all of Friday, closing the week out at the highs. The Russell 200o demonstrated divergent strength throughout the week. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a trend up. The day began with a gap up to near the top of Thursday’s range. Buyers stepped in early on and we began trending higher, with the behavior extending through the entire session and us closing the week out a few points off of all-time highs.

Heading into today my primary expectation is for buyers to work into the overnight inventory and tag 7800. From here we continue higher, up through overnight high 7813.50 before two way trade ensues.

Hypo 2 stronger buyers work a full gap fill up to 7865 before two way trade ensues.

Hypo 3 sellers gap-and-go lower, trading down through overnight low 7667.50 to tag the open gap at 7648.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: