NASDAQ futures are coming into Thursday gap up after an overnight session featuring extreme volume on elevated range. Price worked higher overnight after continuing to slide lower for a bit following Wednesday’s afternoon sell-off. Price dropped to a new 7-day low before catching a bid near last Monday’s (4/22) high. As we approach cash open, price is hovering in the lower quad of Wednesday’s range. At 8:30am initial/continuing jobless claims data came out weaker than expected.

Also on the economic calendar today we have durable goods and factory orders at 8:30am followed by both 4- and 8-week T-bill auctions at 11:30am.

All of the important tech earnings are complete for the week.

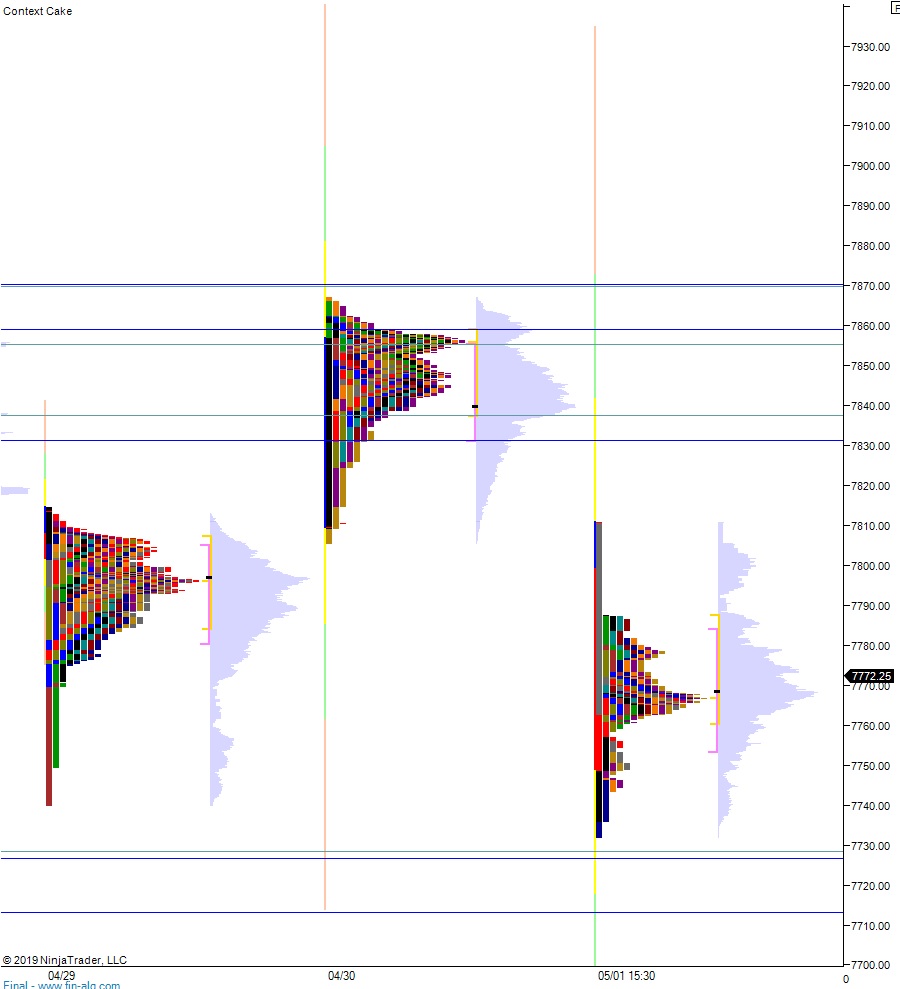

Yesterday we printed a neutral extreme down. The day began with a gap up into the Monday midpoint. Sellers were unable to fill the overnight gap during the opening two-way auction. Instead price began working higher, pushing range extension up in the late morning but buyers were unable to test beyond the Monday high. Instead we came into a balance formation and awaited the FOMC rate decision. First reaction after the announcement was up, it took out the daily high by a few ticks but again could not test beyond the Monday high. Instead we had a failed auction. Reaction two and three to the FOMC rate decision were down and this triggered a liquidation that probed down near Tuesday’s low. We ended the day near low-of-session.

Neutral extreme down.

Heading into today my primary expectation is for buyers gap-and-go higher, trading up to 7800 before two way trade ensues.

Hypo 2 stronger buyers sustain trade above 7800 setting up a move to target 7831.25 before two way trade ensues.

Hypo 3 sellers press down through overnight low 7732 which resolves the 4/22 gap at 7734.75 (we tagged this level during globex but not during cash) and continues lower to 7728.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: