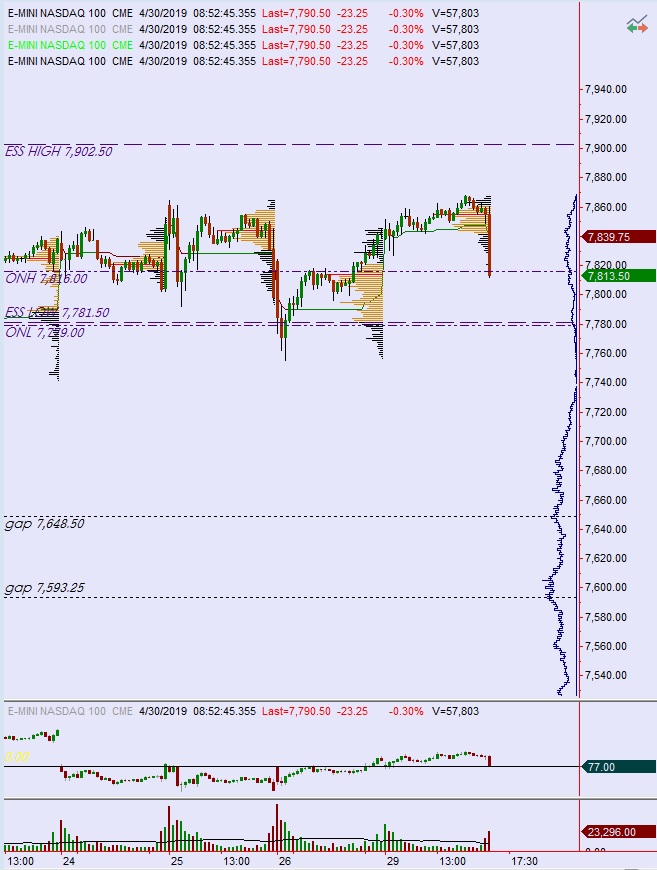

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring elevated volume on normal range. Price worked lower overnight, trading down into the lower quadrant of Friday’s range before settling into balance.

On the economic calendar today we have consumer confidence and pending home sales at 10am.

Also Apple is set to report earnings after the bell and is almost certain to put some volatility into the NASDAQ.

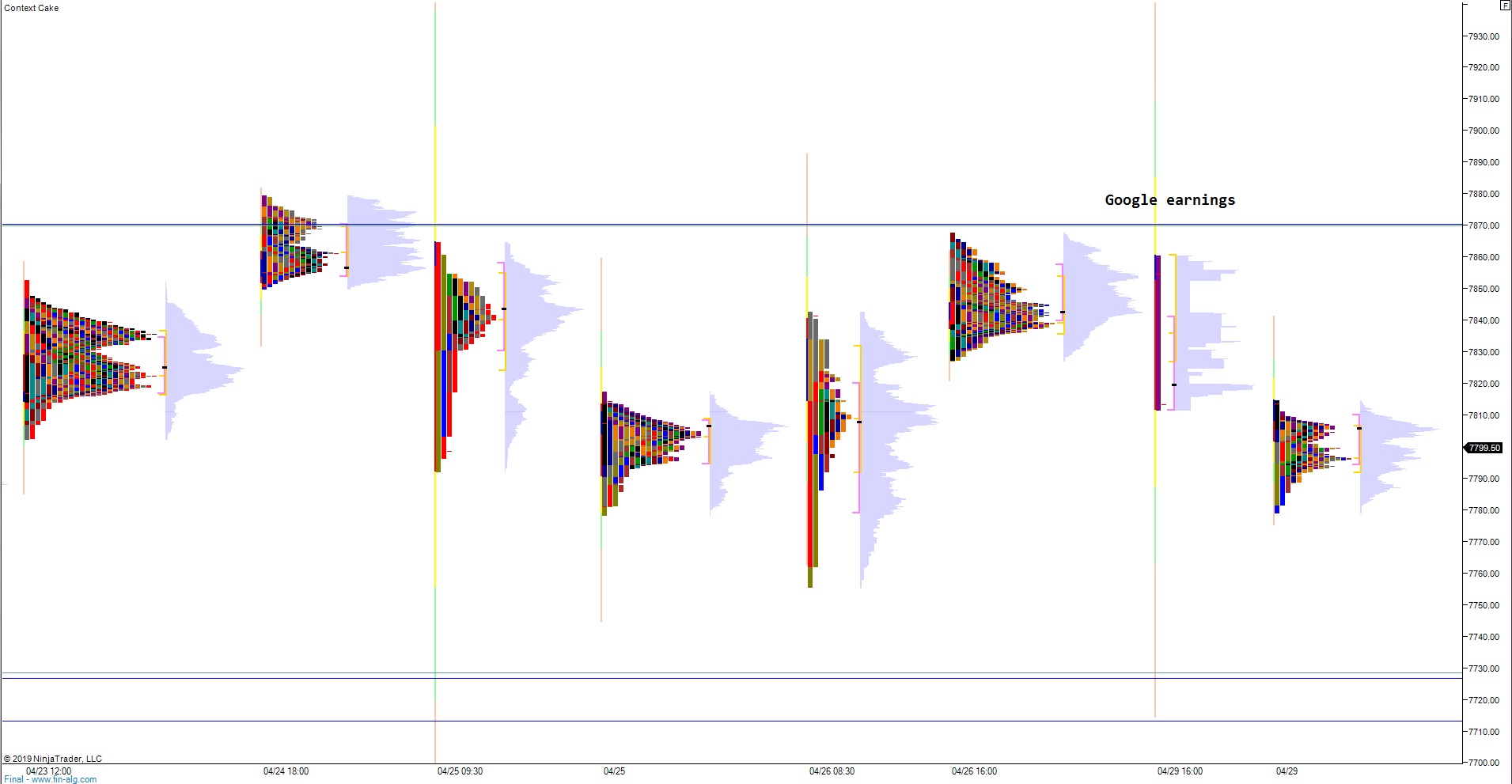

Yesterday we printed a neutral extreme down. The day began flat and with a tight two-way auction. Buyers began campaigning price higher, taking us range extension up, but were unable to make a new record high before closing bell. Then earnings from Google came out during settlement and the weaker-than-expected data resulted in sellers reversing all of the day’s gains and more, closing us at session low.

Neutral extreme.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7813.50. From here we continue higher, up through overnight high 7816. This sets up a move to tag 7833.75 before two way trade ensues.

Hypo 2 sellers gap-and-go lower, trading down through overnight low 7779 which sets up a test below last Friday’s low 7755.50. This triggers a liquidation down to 7728.50 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 7833.75 setting up a full reversal of the Google sell-off, trading us up to 7869.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: