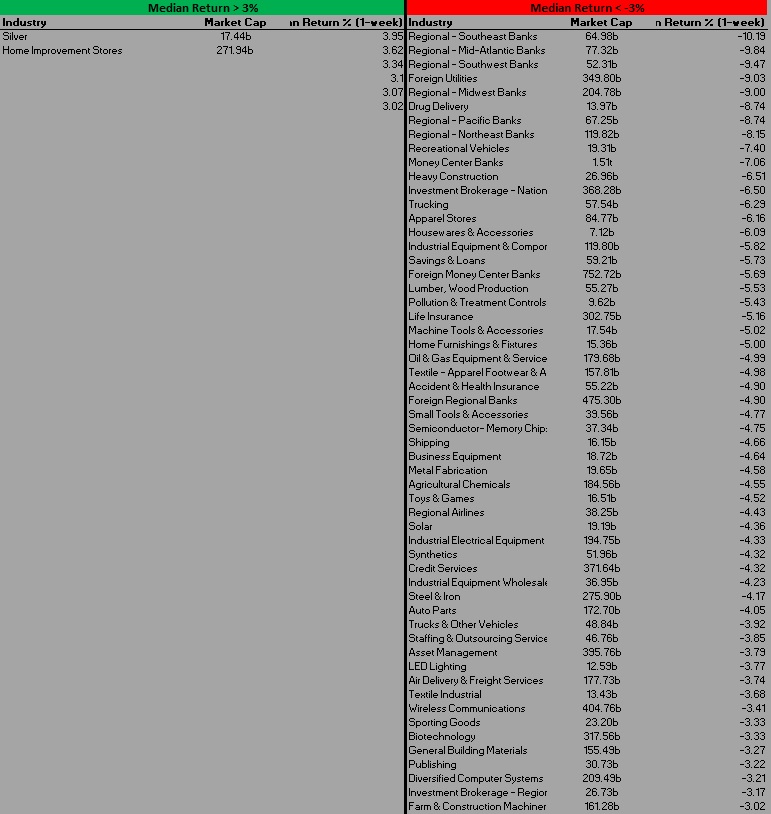

What popped out during my Sunday research was how most of last week’s selling pressure was focused on industry groups that are sensitive to interest rates—industries that would, in traditional finance theory, stand to turn more profits if interest rates went up. The below graph displays last week’s returns from the best and worst performing industries:

When you take into consideration the unexpectedly dovish statement from the Federal Reserve last Wednesday, which suggested they have no intention of lifting interest rates for the rest of 2019, the selling pressure seen above appears logical. The money is flowing away from potential loser industries, but is it completely leaving the equity markets?

I doubt it.

All the real hitters know that the rally we’ve enjoyed since 2016 has been driven by big tech. Big tech is all that matters and listen.

Soon there will be no regional banks. What? Did you think the tech invasion would just stop at the gates of finance? Bankers lack the means to build a mote sophisticated enough to keep out all the AI goblins crawling out of Silicon Valley. Those coastal elites have their minds set on bankrupting your local spendthrift with some gamified phone app that lives in a cloud. And that’s okay.

All I want is to be helpful to folks who want to draw money out of the stock market via investments and trades. When you speculate, there are only a few important actualities you need to accept about the present.

First, this is Jeff Bezos’s world we’re just living in it. The man literally reneged on a promise to the capitalists of New York (the capital of capitalism) to distract everyone away from some unsavory penis pictures The National Enquirer managed to get their hands on.

Next, nothing is sacred in the battle to control the way we think as a society. Projects like bitcoin reveal how national governments are losing a grip and they don’t like it.

The Federal Reserve and the Internal Revenue Service are the first and second most powerful government agencies in the world.

And finally, ‘we were here first’ is an irrelevant argument made by old generations desperately clinging to an expectation for order in a completely random and indifferent universe.

If you’re reading this blog you have, all of you have one reason to continue coming back to read me hammer the same few principles week after week, and that is for the explicit intent of watching how a hardened speculator prepares to extract fiat US Federal Reserve notes from the global financial markets. Ruthlessly. Impersonally, like a robot. This isn’t some knitting circle where we gossip about the latest news bit bullshit. Believe me, if a news thingy happens that really truly matters, someone in real life will tell you.

I show up 2-5 hours every Sunday and do research. I write super boring trading reports that most of you will never bother to understand. Then I plug my brain into the machines and fight like a ravenous dog for US Federal Reserve notes. If along the way we can interact for the sake of improving our craft let’s do it.

The models lads, which are built on the foundation stones of raw market data, they’re neutral. This is the last week of Q1. If you have managed to harvest gains over these last three months, I saute you. For those of you who didn’t, maybe now is a good time to meditate on what has real value in this world. Then get some more of that. I am in no rush to declare a strong directional forecast for the next five days. Therefore I will be taking it real easy and only scalping the highest probability setups, like the manna regularly offered by the stock market gods in the form of an open gap in range.

All very logical you see?

ciao ciao kiss kiss

RAUL SANTOS, March 24th 2019

Exodus members, the 227th edition of Strategy Session is live. You need to see the notes on semiconductors and transports, be sure to check out Section IV.

If you enjoy the content at iBankCoin, please follow us on Twitter