NASDAQ futures are coming into Tuesday gap down after an overnight session featuring elevated range on extreme volume. Price was balanced for much of the globex session, eventually moving lower around 6am New York but staying inside last Friday’s range. As we approach cash open, price is hovering near last Friday’s low. During the pre-market, Walmart earnings came out stronger than expected and WMT stock is trading higher.

Also on the economic calendar today we have the NAHB housing market index at 10am followed by a 3- and 6-month T-bill auction at 11:30am.

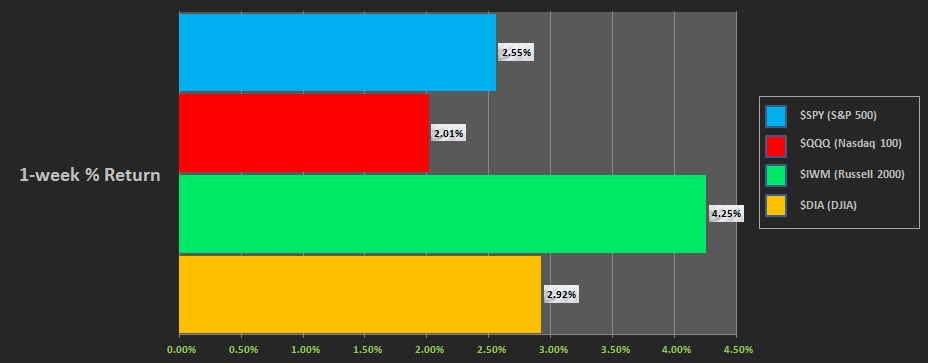

Last week markets worked higher. Monday was flat-ish, Tuesday saw a strong trend higher. Wednesday-Friday flagged sideways, accepting the higher prices. The last week performance of each major index is shown below:

On Friday, the NASDAQ printed a normal variation down. The day began with a gap up to new 3-month highs, prices unseen since early December. Sellers stepped in and drove down into the gap, pushing down into Thursday’s range but failing to close the overnight gap before responsive buyers stepped in. Said buyers eventually worked price back up through the Friday midpoint before end-of-session.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7063.75. From here we continue higher, up through overnight high 7086.50. Then look for sellers up at 7100 and two way trade to ensue.

Hypo 2 sellers gap-and-go lower, trading down to close the gap at 7020.25 before two way trade ensues.

Hypo 3 stronger sellers trade down to 7000 before two way trade ensues.

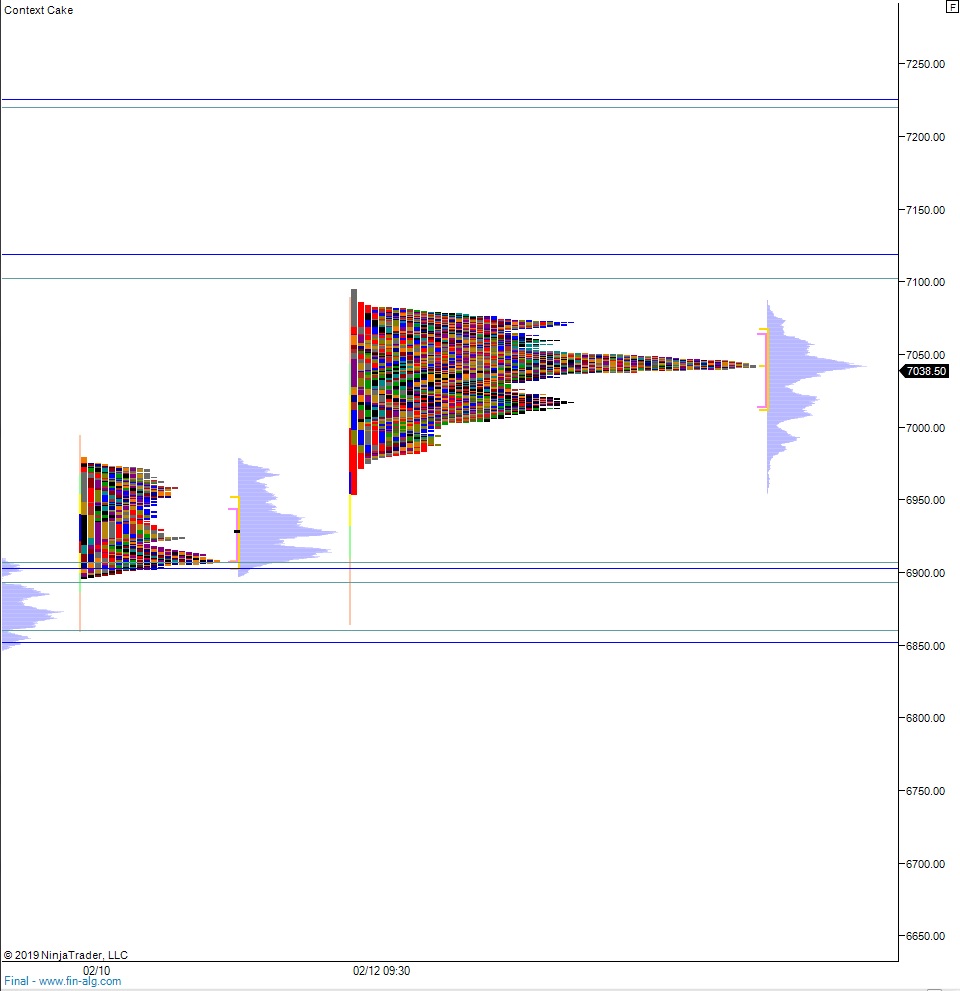

Levels:

Volume profiles, gaps, and measured moves: