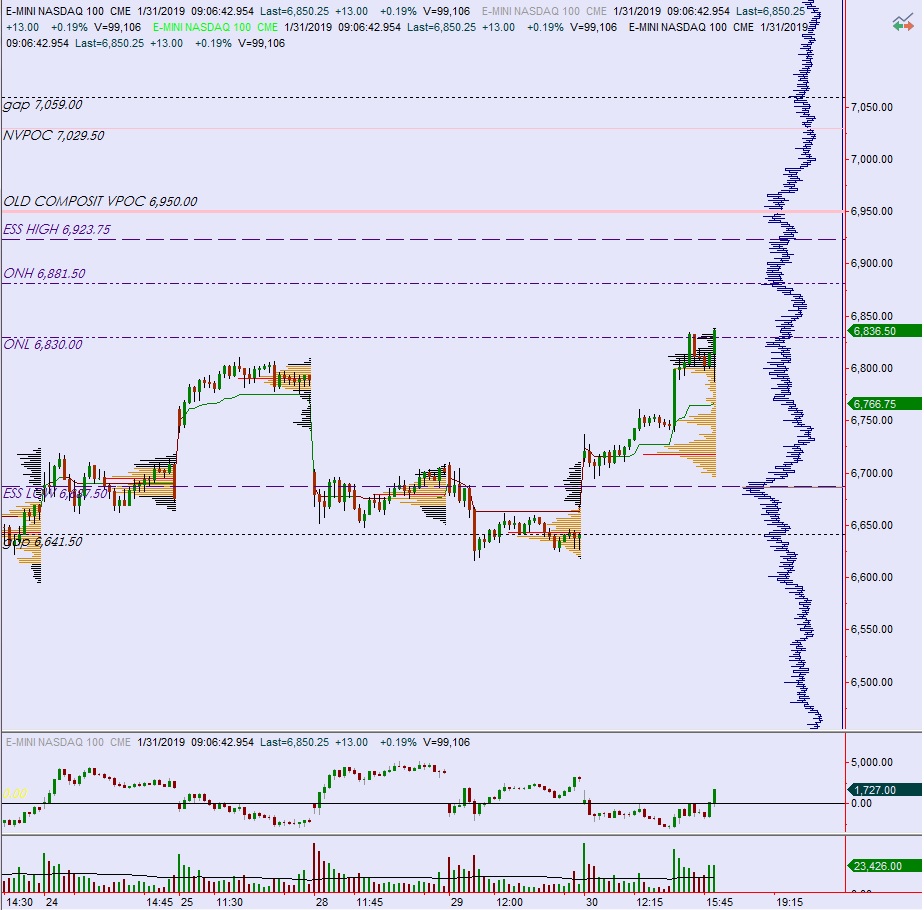

NASDAQ futures are coming into Thursday with a slight gap up after an overnight session featuring elevated range on extreme volume. Price worked higher overnight, trading up into price levels unseen since December 4th before setting into balance. Recall that December 4th was a conviction selling day, with the market liquidating lower for most of the session. However, of interest on that day, the VPOC never shifted out of it’s upper quadrant. The naked VPOC remains up at 7029.50. At 8:30am initial/continuing jobless claims data came out worse than expected.

Also on the economic calendar today we have a 4- and 8-week T-bill auction at 9am.

Investors are also likely to start looking ahead to the closing bell today as we await earnings from Amazon.

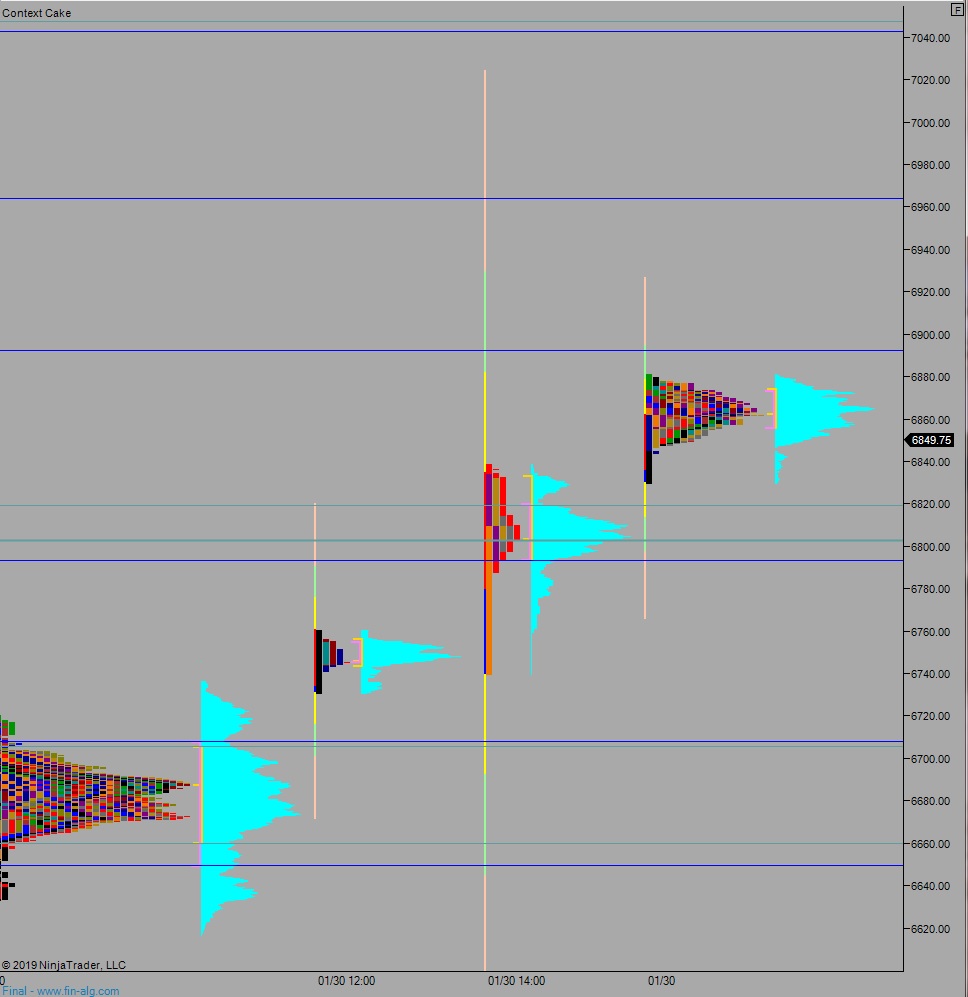

Yesterday we printed a double distribution trend up. The day began with a gap up and choppy two-way action. By late morning, the NASDAQ had gone range extension up and was flagging at the higher prices heading into the FOMC rate decision. The Feds left their benchmark borrowing rate unchanged and third reaction analysis yielded a buy signal. We rallied into the close, ending the day near session high.

Double distribution trend up.

After the close, we heard earnings from Facebook, Microsoft, and Tesla. Microsoft’s were a slight miss, the others were satisfactory.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6836.50. From here we continue lower, down through overnight low 6830. Look for buyers down at 6819.75 and two way trade to ensue.

Hypo 2 buyers gap-and-go higher, trading up through overnight high 6881.50. Look for sellers up at 6892 and two way trade to ensue.

Hypo 3 stronger buyers tag 6900 and sustain trade above it, setting up a move to target 6923.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: