NASDAQ futures are coming into the final week of January gap down after an overnight session featuring elevated range on extreme volume. Price worked lower overnight, erasing all the intra-day upside progress seen last Friday but sustaining trade inside the final day’s range. As we approach cash open, price is hovering near last Friday’s low.

The U.S. government has been funded for three weeks.

On the economic calendar today we have a 6-month bill and 2-year note auction at 11:30am followed by a 3-month bill and 5-year note auction at 1pm. The big tech earnings don’t start until after-market-close Tuesday (Apple).

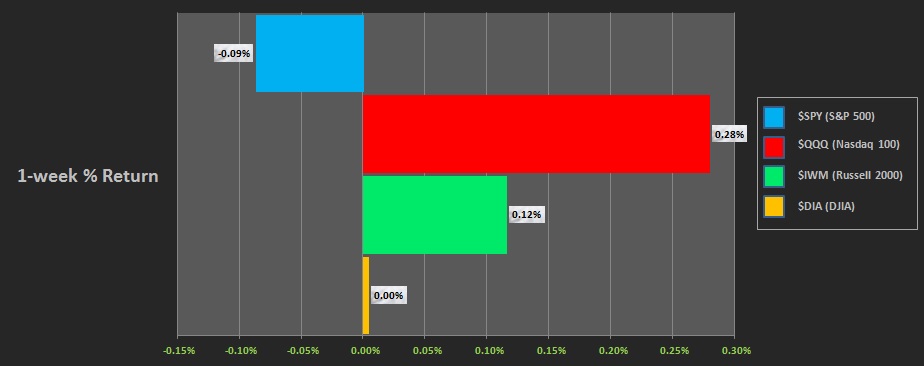

Last week started off with weakness Tuesday after a market holiday Monday (MLK). Wednesday had early strength that was faded lower. Thursday marked time before we went gap up Friday and rallied to close at high of week and essentially unchanged for the week. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation up. The day began with a gap up and two way auction. This eventually gave way to buying which drove price up into the prior Friday’s range before coming into balance.

Heading into today my primary expectation is for sellers to gap-and-go lower, trading down to 6700 before two way trade ensues.

Hypo 2 buyers work into the overnight inventory and close the gap up to 6789.75 then continue higher, up through overnight high 6797.50. Look for sellers up at 6800 and two way trade to ensue.

Hypo 3 stronger buyers trade us up to 6822.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: