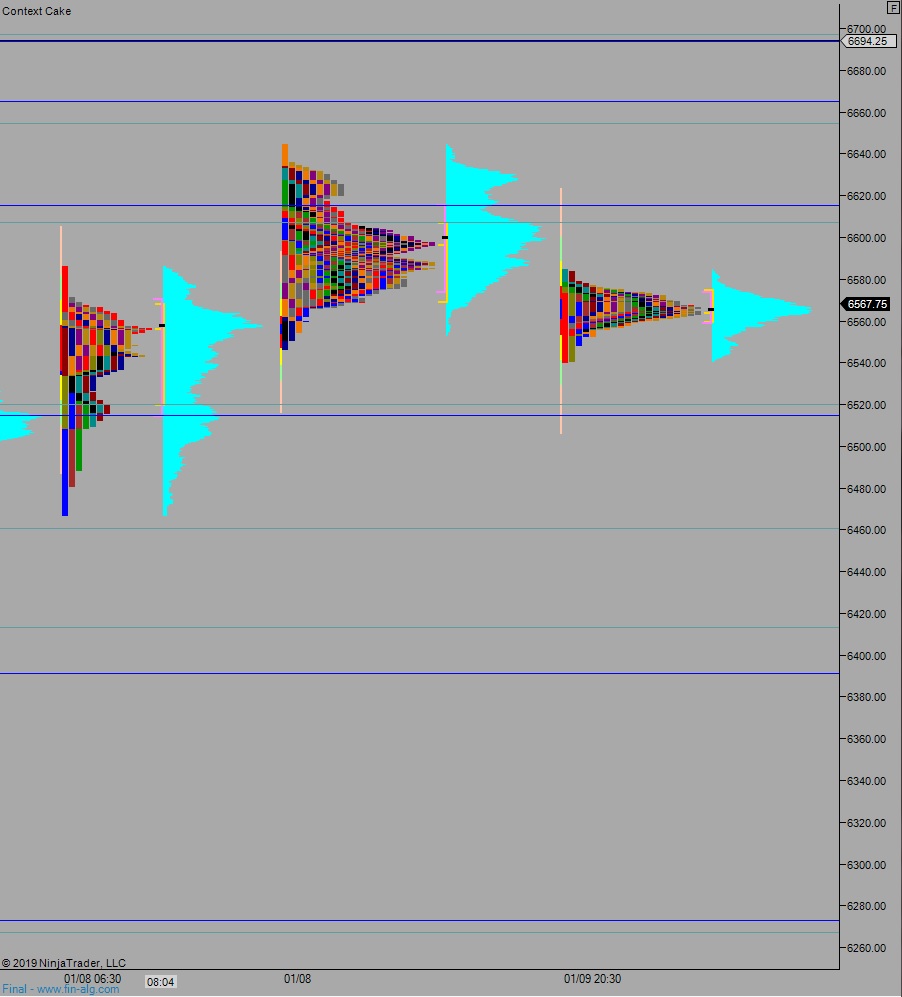

NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, uni-directionally, and briefly probed below the Wednesday cash low before settling into balance. At 8:30am initial/continuing jobless claims data came out better-than-expected. As we approach cash open, price is hovering on the low-end of Wednesday’s range.

Also on the economic calendar today we have a 4-and 8-week T-bill auction at 11:30am, Fed Chairman Powell is speaking in Washington the the economic club at 12pm, and a 30-year bond auction at 1pm.

Yesterday we printed a neutral day. The day began with a gap up and small push higher before settling into a two-way auction. Sellers managed to press us range extension down and close the overnight gap before responsive buyers stepped in (responsive relative to Wednesday’s open, initiative relative to Tuesday’s close) and worked us up through the daily range and pushed us neutral. We drifted along daily high for much of the session before reverting back to the mean near end-of-day.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6602.75. From here we continue higher, up through overnight high 6618.25. Sellers are just above overnight high and two-way trade ensues. Then look for the third reaction after Powell speaks to drive direction into the second half of the session.

Hypo 2 stronger buyers press us up to 6666 before two way trade ensues. Then look for the third reaction after Powell speaks to drive direction into the second half of the session.

Hypo 3 sellers gap-and-go lower, trading down through overnight low 6540.50 to target 6520 before two way trade ensues. Then look for the third reaction after Powell speaks to drive direction into the second half of the session.

Levels:

Volume profiles, gaps, and measured moves: