NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price was balanced overnight, chopping sideways beneath the Monday midpoint. As we approach cash open, price is hovering below the Monday 6536.25 midpoint. At 8:30am housing starts/building permits data came out better than expected.

There are no other economic events today.

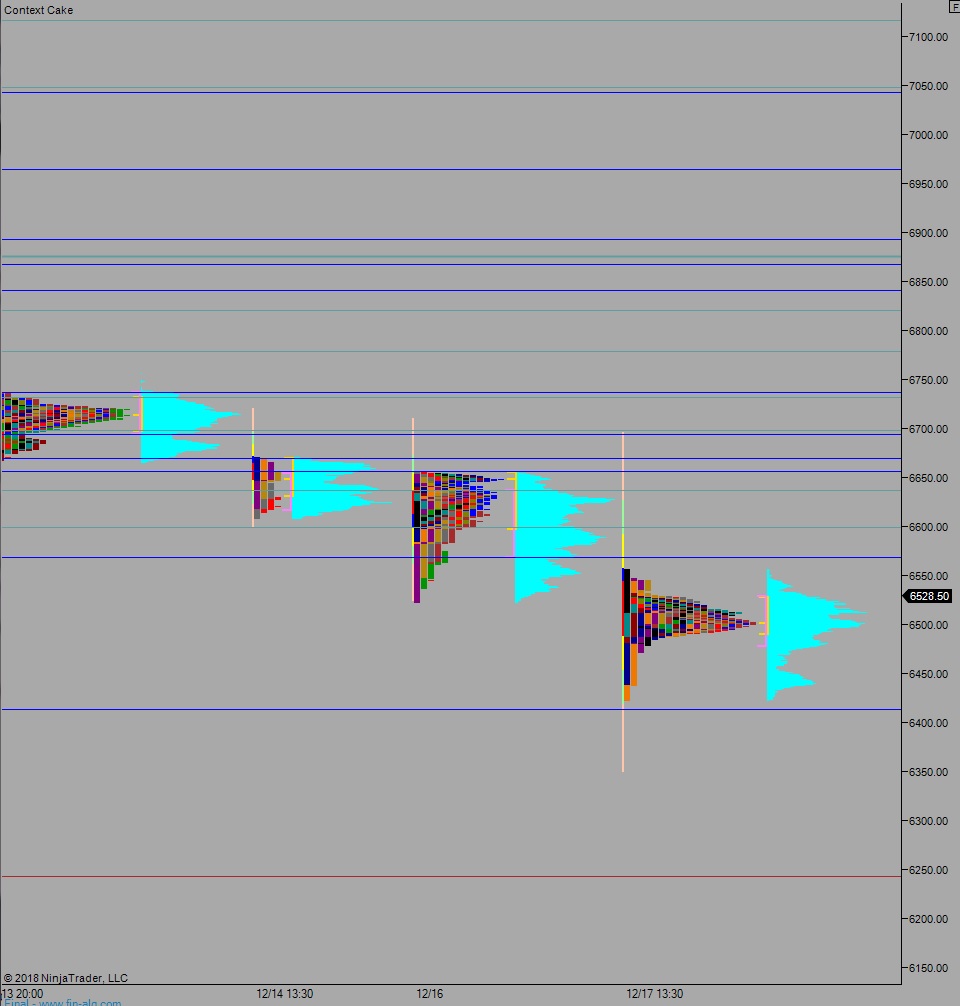

Yesterday we printed a neutral extreme down/double distribution trend down. The day began with a gap down and drive lower which managed to find a strong responsive bid at the 11/23 open gap at 6350.50. Responsive buyers reversed the drive down, closed the overnight gap and pressed us range extension up right into the lunch hour. Then sellers came in and reversed all the intra-day gains. Then they pushed the market range extension down, putting us into a neutral print. Selling accelerated at this point, taking us down to the weekly ATR band at 6454.50. Near the end-of-session a slight responsive bid stepped in.

Neutral extreme due to double range extension and closing in lower quadrant, double distribution trend down because the daily VPOC kept shifting lower. These labels are broad brush strokes as every day is unique.

Heading into today my primary expectation is fro sellers to work into the overnight inventory and close the gap down to 6488.50. Sellers continue lower, down to 6413 before two way trade ensues.

Hypo 2 buyers take out overnight high early on 6548, setting up a move to target 6567 before two way trade ensues.

Hypo 3 stronger buyers trade us up to 6600 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: