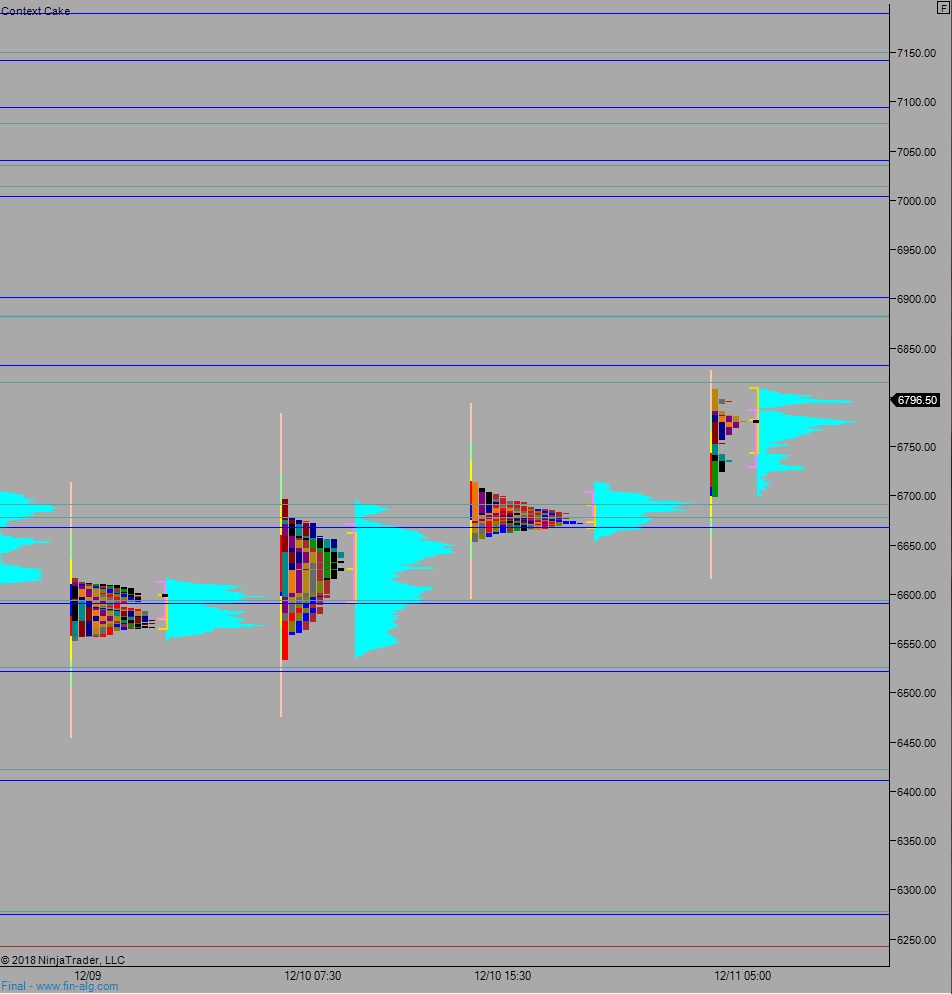

NASDAQ futures are coming into Tuesday gap up after an overnight session featuring extreme range and volume. Price was balanced in the upper quadrant of Monday’s cash range for much of the session before a 100-point unidirectional wave higher pressed prices higher around 5am. As we approach cash open price is hovering near globex high, which is near last Friday’s opening print.

On the economic calendar today we have a 3-year Note auction at 1pm. There are no other events.

Yesterday we printed a neutral extreme up. The day began with a slight gap down after a 30 point gap up was erased just before opening bell. Price spiked higher early on but was met with equal selling force just beyond overnight high. Sellers then began campaigning lower, taking price down through Friday’s low. However, an excess low formed before we could resolve the open gap down at 6530.50 and from then onward we began to campaign higher, steadily, pushing neutral by mid-afternoon, and closing at session high.

Neutral extreme up.

Heading into today my primary expectation is for sellers to work into the overnight inventory and trade us down to 6722. Buyers reject an attempt back into Monday’s high 6714.50 and we work higher, eventually taking out overnight high 6808.75. Look for sellers up at 6832.50 and two way trade to ensue.

Hypo 2 buyers gap-and-go higher, sustaining trade above 6850 to set up a move to target 6882.25. Stretch targets are 6900 then the composite VPOC at 6950.

Hypo 3 sellers work a full gap fill down to 6699 then continue lower, down through overnight low 6655, setting up a move to target 6600 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: