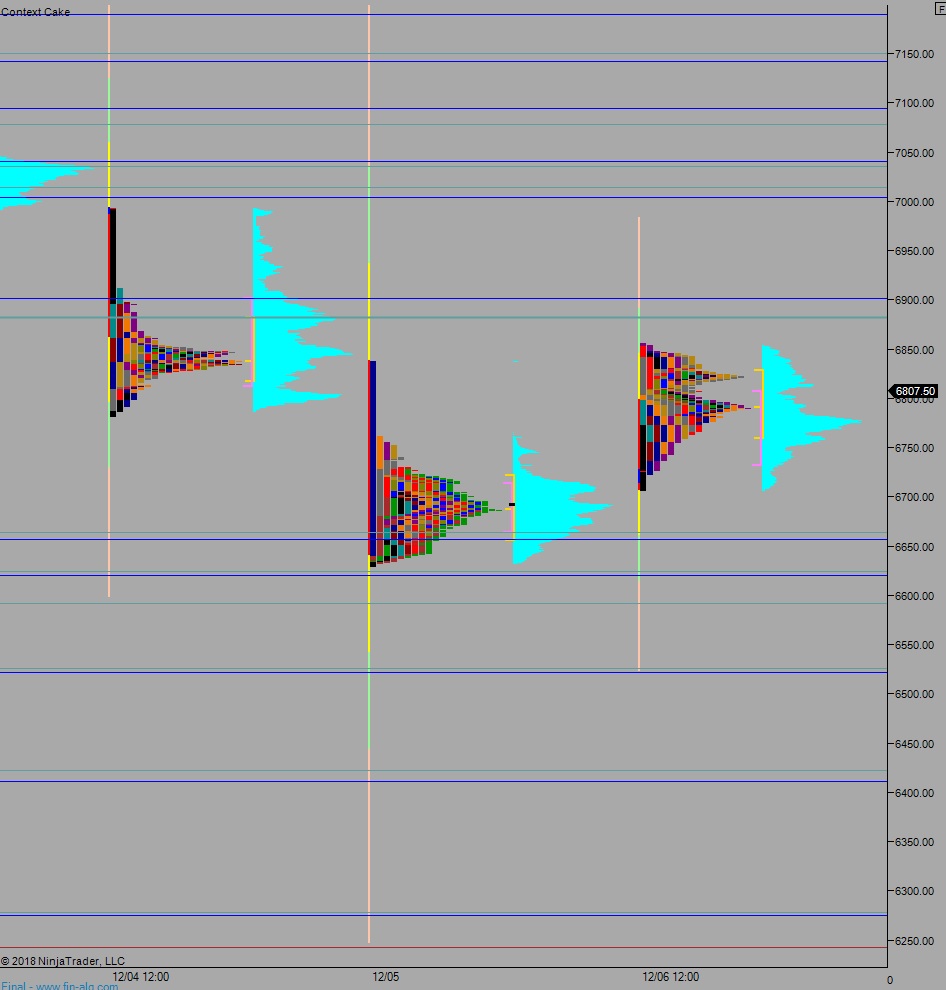

NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight after briefly probing up beyond Thursday high. Selling overnight was contained to the upper quadrant of Thursday’s range and as we approach cash open price is hovering up near Thursday’s high. At 8:30am non-farm payroll data came out worse than expected.

Also on the economic calendar today we have University of Michigan’s primary December reading of sentiment at 10am followed by consumer credit at 3pm.

Yesterday we printed a neutral extreme up. The day began with a pro gap down after the Wednesday market holiday and the Tuesday trend down. The first hour of trade was choppy and formed a wide initial balance. We very briefly broke the IB to the downside just before New York lunch, right as the European markets were closing, and instantly discovered a strong responsive bid. This was a failed auction to the downside and it led to a strong rally that traversed the entire daily range to go neutral before continuing higher to close the overnight gap. We ended near session high.

Neutral extreme.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 6826.50. From here we continue higher, up through overnight high 6856.50 setting up a move to target 6900 before two way trade ensues.

Hypo 2 sellers press down through overnight low 6764.50 setting up a move to target 6700 before two way trade ensues.

Hypo 3 stronger buyers trade us up to composite VPOC at 6950 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: