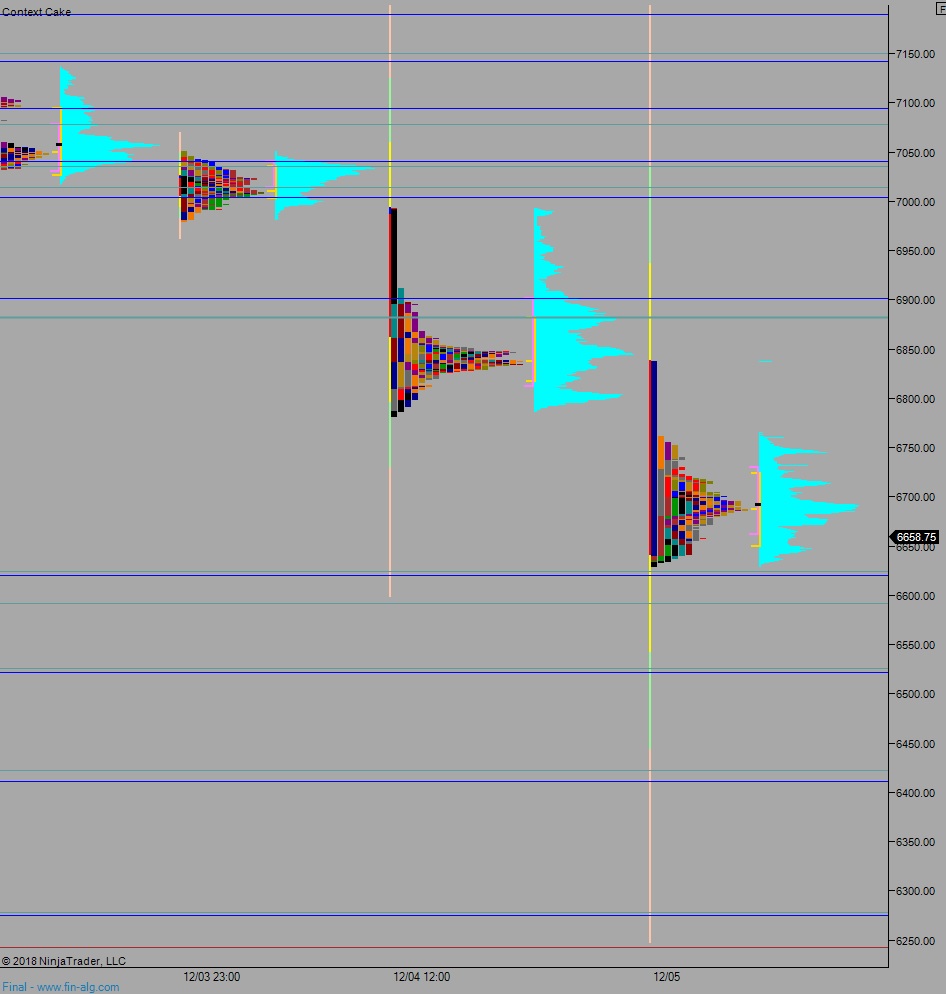

NASDAQ futures are coming into Thursday pro gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, initially spiking about 200 points lower at the open of globex at 6pm, before recovering 100 of the points within five minutes. After chopping sideways for many hours, the futures began working lower again around 10pm. As we approach cash open prices are hovering near the globex lows, at levels unseen since last Tuesday. At 8:15 ADP employment data came out below expectations. At 8:30am trade balance data came out below expectations. At 8:30am initial/continuing jobless claims data came out mixed.

Also on the economic agenda today we have ISM non-manufacturing/service composite at 10am, factory/durable goods orders at 10am, crude oil inventories at 11am, and both a 4- and 8-week T-bill auction at 11:30am.

Traders also need to keep an eye on the mounting tensions between China and USA as trade wars and tariff commentary continue to affect NASDAQ prices.

Yesterday the NASDAQ was closed in observation of President George H.W. Bush’s death. On Tuesday the NASDAQ printed a trend down. The day began with a gap down and tight open auction/chop. Sellers pressed down through the low, which aligned with the Monday low. This triggered a quick liquidation that erased the gap up we had to begin the week. Sellers continued lower, trading down into last Wednesday’s conviction buying. We ended the session at the lows.

Heading into today my primary expectation is for a choppy open. The higher timeframe will be active as we are way out of balance. Look for a gap-and-go lower. Look for sellers to trade down through overnight low 6630.25 setting up a move to target 6600 before two way trade ensues.

Hypo 2 stronger sellers trade down to close the gap at 6530.50. Look for buyers down at 6526.50 and two way trade to ensue.

Hypo 3 buyers work into the overnight inventory and trade up through overnight high 6842 setting up a move to target 6882.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: