NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, taking out the Monday cash low before discovering a responsive bid about 15 points ahead of the Friday gap left behind over the weekend on Trade Wars updates over the weekend. As we approach cash open price is hovering inside Monday’s lower quadrant.

On the economic calendar today we have 4- and 52-week T-bill auctions at 11:30am followed by a 52-week T-bill auction at 1pm. Reminder: the stock market is closed tomorrow in observation of President George H.W. Bush’s death.

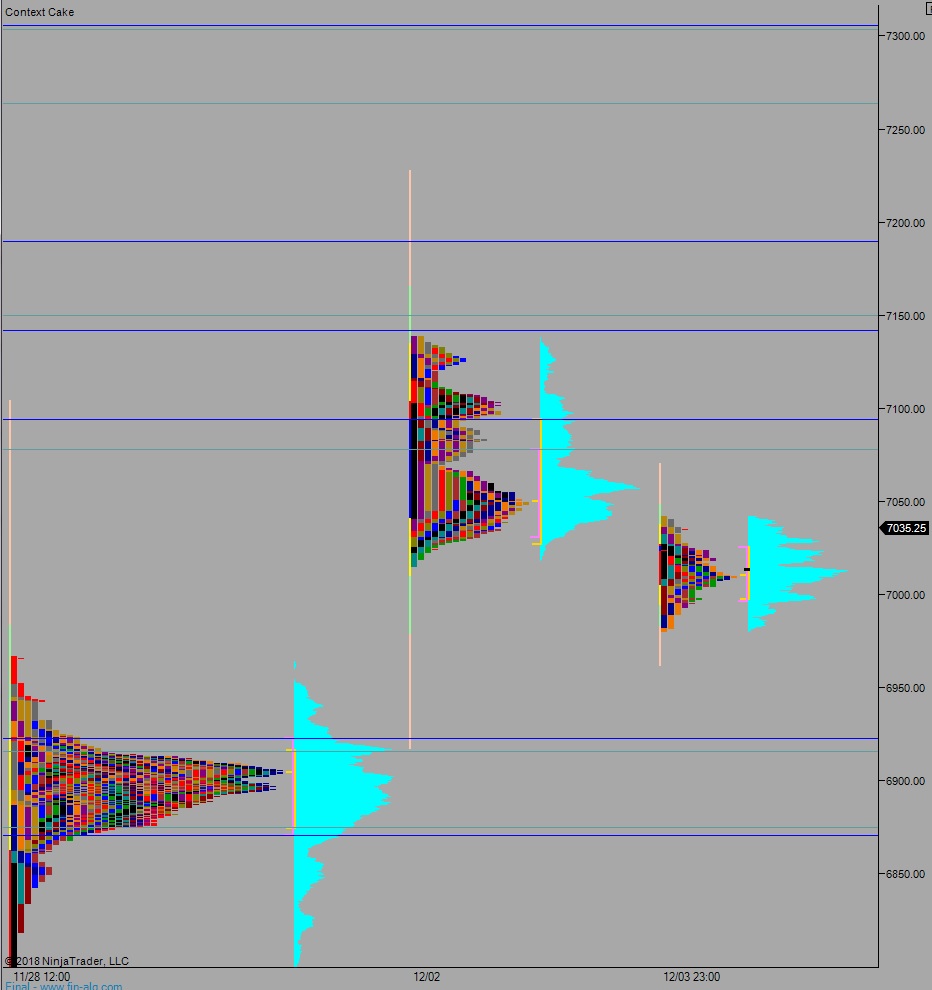

Yesterday we printed a normal variation down. The day began with a pro gap up and open two-way auction. The chop eventually led to a range extension lower. Responsive buyers (responsive relative to Monday open, initiative relative to Friday close) prevented price from probing very far into the weekend gap, and we ended the day back up at session midpoint.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7059. From here we continue higher, up through overnight high 7068. Look for sellers up at 7077.75 and two way trade to ensue.

Hypo 2 stronger buyers trade us up to 7114 before two way trade ensues.

Hypo 3 gap-and-go lower trading down through overnight low 6980.25 setting up a weekend gap fill down to 6965.75. Look for buyers at the composite VPOC 66950 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: