NASDAQ futures are coming into Monday pro gap up after an overnight session featuring extreme range and volume. Price shot higher on presumed progress in the tariff discussions, or trade wars between China and the US. As we approach cash open price is trading at price levels unseen since November 9th.

On the economic calendar today we have construction spending at 10am, ISM manufacturing/employment at 10am, and a 3- and 6-month T-bill auction at 11:30am. Reminder, US markets will be closed Wednesday December 5th in observation of the death of George H.W. Bush, 41st President of the United States.

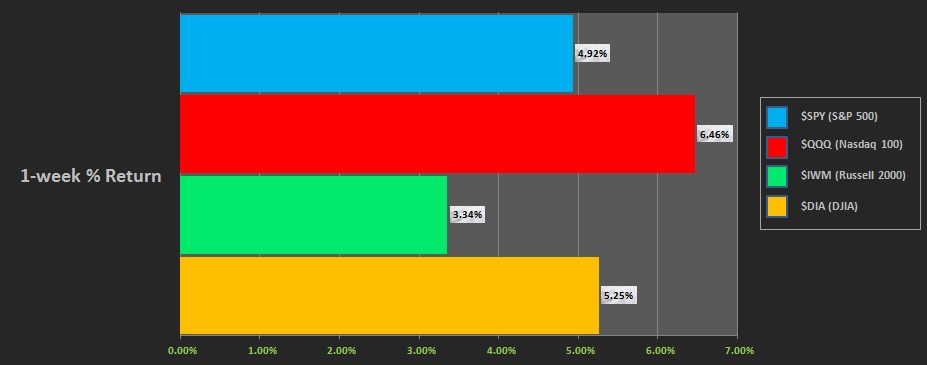

Last week began with a gap up and buyers asserting price higher. Price continued to work higher all week long, even trending higher Wednesday. The week ended near high-of-week. The last week performance of each major index is shown below:

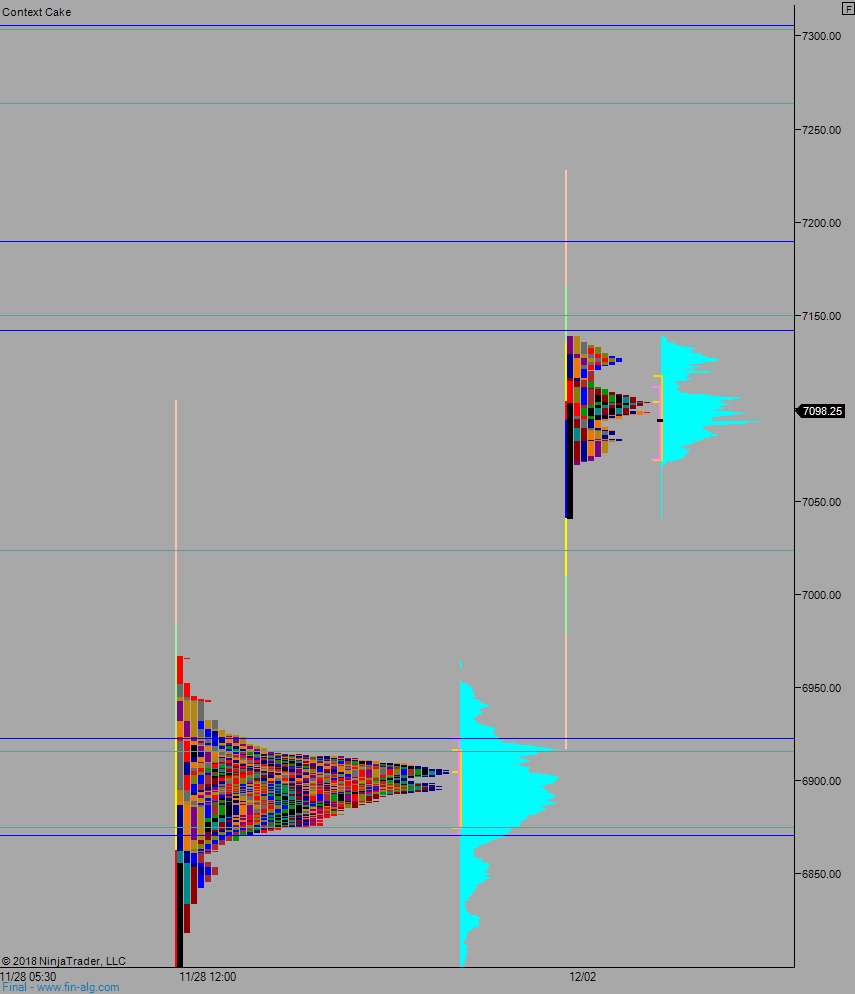

On Friday the NASDAQ printed a normal variation up. The day began with a slight gap down and sellers attempting lower. Responsive buyers stepped in just below Thursday’s midpoint and shortly after 10:30am we were range extension up. Price then chopped along the daily midpoint for much of the session before rallying to a new weekly high in the afternoon, pressing up through the composite high volume node at 6950.

Heading into today my primary expectation is for a choppy open. We are coming into the first trading day in December way out of balance and there is an uncommon, nearly unplanned market holiday mid-week. Look for the higher time frame to be engaging the market early on. Eventually look for sellers to press into the overnight inventory and trade down through overnight low 7040. Look for buyers down at 7023.75 and two way trade to ensue.

Hypo 2 buyers gap-and-go higher, trading up through overnight high 7139, setting up a move to target 7150 before two way trade ensues.

Hypo 3 stronger sellers work a full gap fill down to 6965.75. Expect some chop at the composite VPOC 6950, then look for buyers down at 6922.75 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: