NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme volume on elevated range. Price worked up beyond the Tuesday high overnight before falling back into the daily range around 7:30am New York. As we approach cash open price is hovering in the upper quadrant of Tuesday range.

On the economic calendar today we have crude oil inventories at 10:30am, a 10-year note auction at 1pm, and the Fed’s beige book at 2pm.

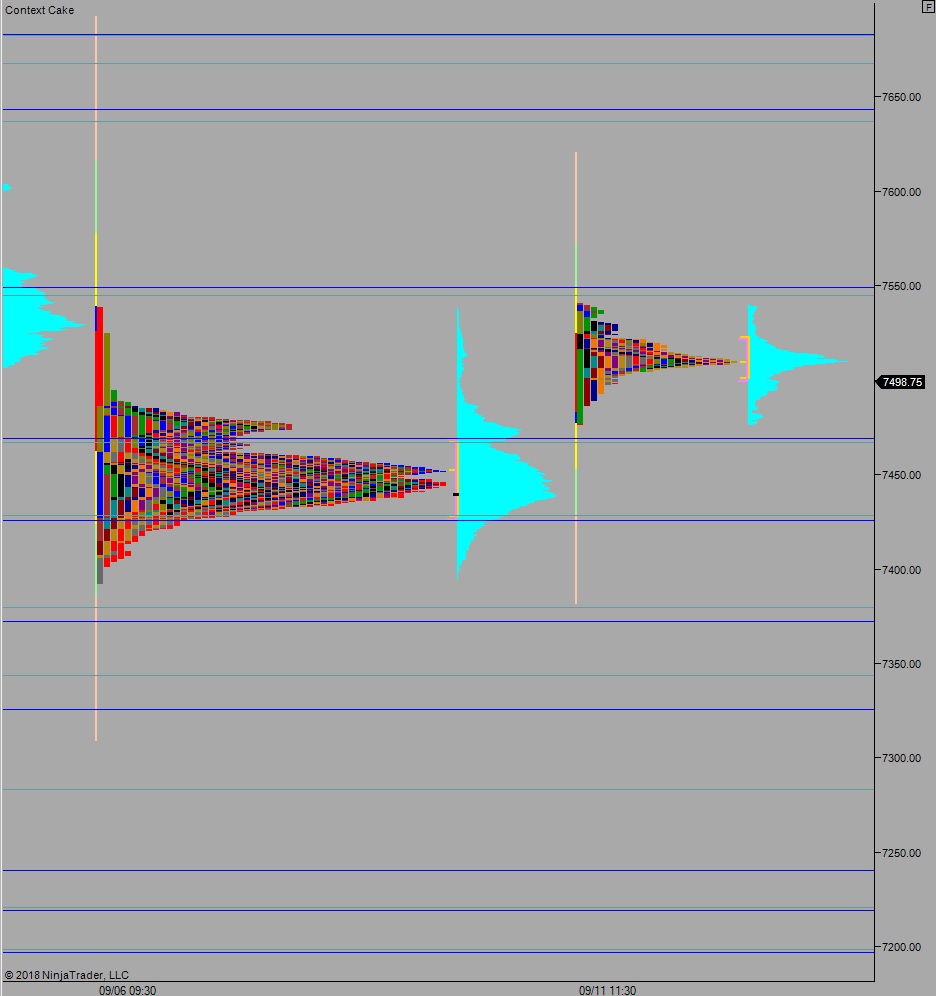

Yesterday we printed a double distribution trend up. The day began gap down and sellers probing lower but failing to take out last Friday’s low. This set up the gap fill upward then a continued drive higher from the bulls up to the weekly ATR band and just beyond it before discovering responsive sellers. Said sellers made a small rotation lower which stalled right along last Friday’s high setting up an afternoon ramp back up near the highs before two way trade ensued.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7511.75. Buyers continue higher, up through Tuesday high 7524.75 but stall ahead of the overnight high 7541 before two way trade ensues.

Hypo 2 sellers gap-and-go lower, trade down to 7469.25 before two way trade ensues.

Hypo 3 stronger buyers trade up through overnight high 7541 setting up a move to target 7544.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: