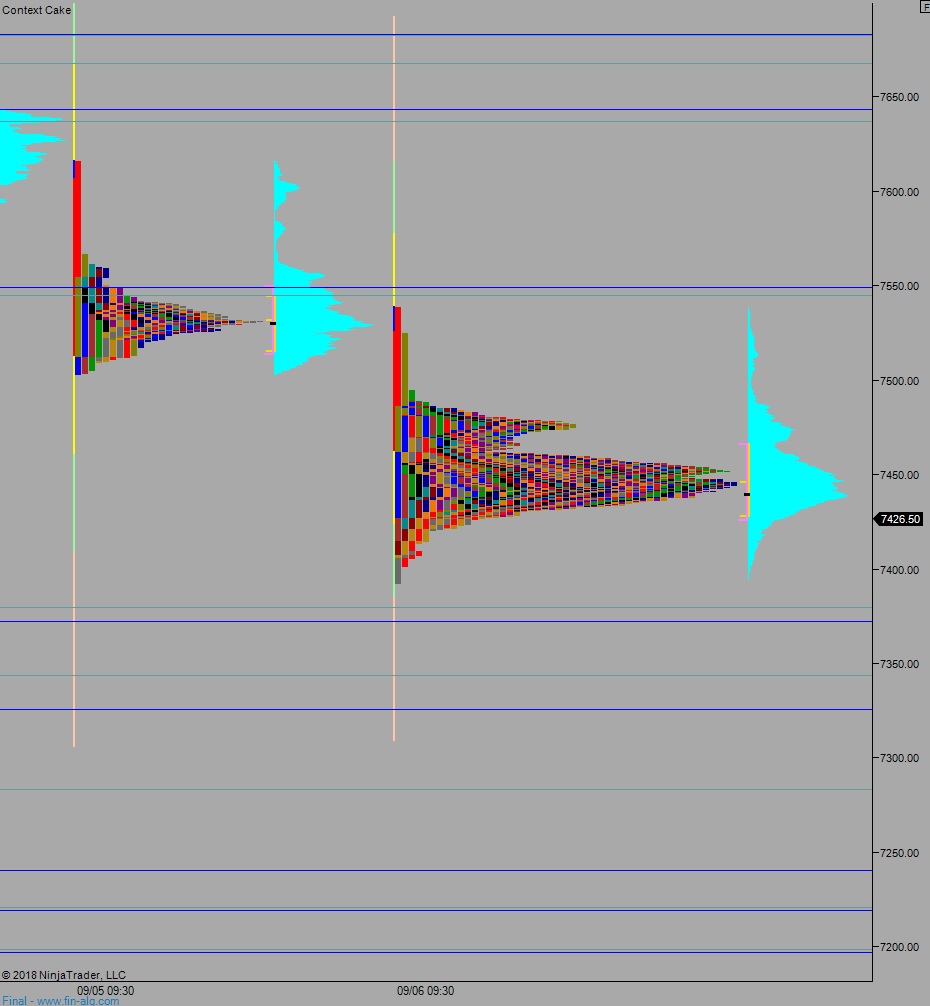

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring extreme range and volume. Price worked higher overnight, briefly exceeding the Monday high before sharply reversing lower. As we approach cash open price is hovering inside the lower quadrant on Monday’s range.

On the economic calendar today we have a 4- and 52-week T-bill auction at 11:30am followed by a 3-year note auction at 1pm.

Yesterday we printed a normal day, which is anything but normal. They only occur about 5% of the time. The day began with nearly a 40 point gap up which sellers quickly erased. The selling during the first hour of trade was dynamic and created a wide range that we never exceeded for the rest of the session. Instead we slowly worked back higher, eventually ramping up a bit off the daily midpoint near the end of the session. It was also an inside day, with the entire daily range being contained inside of last Friday’s range.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 7460.75. From here we continue higher, up through overnight high 7486.75. Look for sellers up at 7500 and two way trade to ensue.

Hypo 2 sellers gap-and-go lower, down through overnight low 7421.75 setting up a move to target 7400. Look for buyers down at 7379.75 and two way trade to ensue.

Hypo 3 stronger sellers sustain trade below 7379.75 setting up a move to target 7364.

Levels:

Volume profiles, gaps, and measured moves: