NASDAQ futures are coming into Friday gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, holding inside the lower quadrant of Thursday’s range until non-farm payroll data came out. This economic data drove price down below the Thursday range and as we approach cash open prices are hovering below Thursday’s low.

There are no other major economic events today.

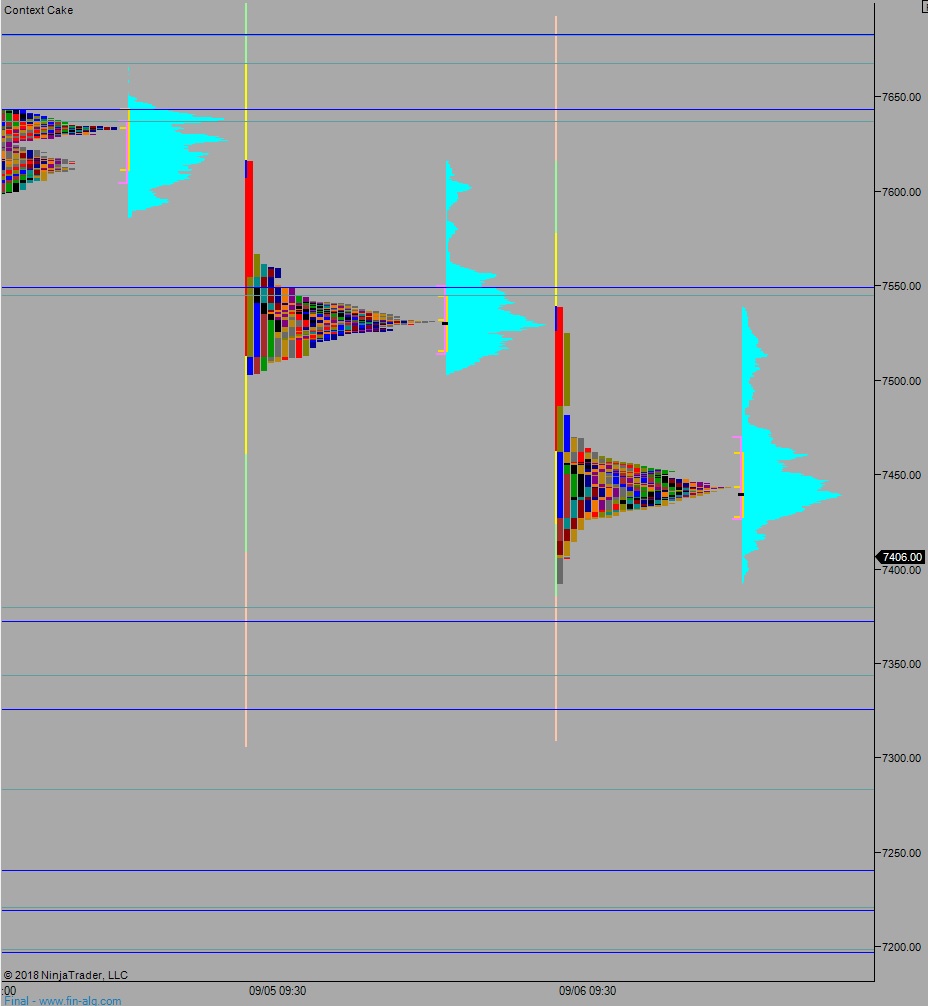

Yesterday we printed a double distribution trend down. The day began with a slight gap down, basically flat, and with a wide open auction. Then initiative sellers stepped in and continued to drive price lower trading down to the 08/23 open gap before two way trade ensued. Near the end of the session we ramped back to the daily midpoint.

Heading into today my primary expectation is for sellers to reject a move back into Thursday’s low 7407.75 setting up a move down through overnight low 7393. Look for buyers down at 7379.50 and two way trade to ensue.

Hypo 2 stronger sellers trade us down to 7343 before two way trade ensues.

Hypo 3 buyers work up into Thursday’s low 7407.75 setting up a move to close the overnight gap 7456.50 then continue up through overnight high 7470.25 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves:

If you enjoy the content at iBankCoin, please follow us on Twitter